Table of Contents

What is a Dark Cloud Cover?

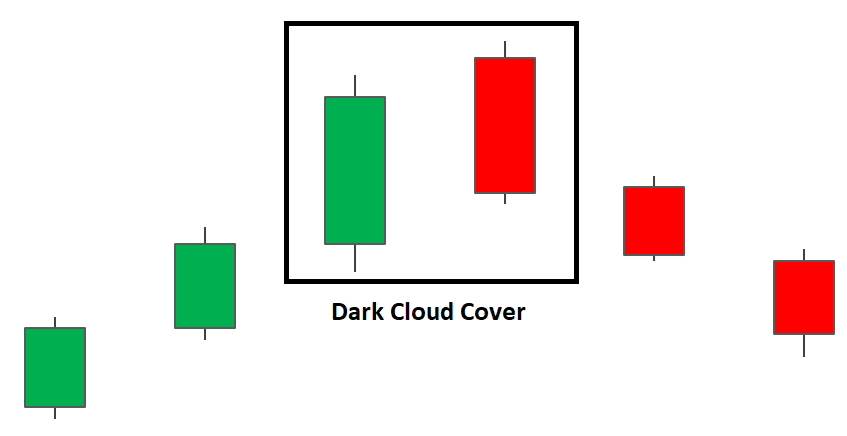

Dark Cloud Cover is a bearish reversal candlestick pattern that is developed at the end of an uptrend. It is composed of two candlesticks. The first candlestick is a bullish candlestick and the second one is a bearish candlestick.

You can find this candlestick pattern significant as it signals the reversal of uptrend into a downtrend. If the volume is high when the formation of this candle, there will be more chance of the reversal to take place as shown in the image below.

If the prices increase, the pattern becomes more significant for the reversal to the downside. If the price action is odd then the pattern is less significant as the price remains irregular after this pattern.

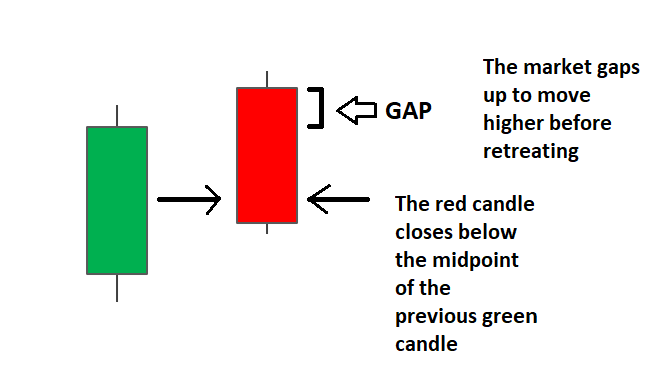

It starts with a bullish candle in an uptrend, followed by a gap up the next day. The candlestick of the next day turns to be a bearish candle. The close of this bearish candle is below the midpoint of the previous day candle.

The bullish and bearish candlesticks in this candlestick pattern have large bodies with very little or no shadows as shown in the image above. The formation of this pattern is confirmed by the formation of a bearish candle at the end of this pattern.

How to use Dark Cloud Cover

You must look at a few points before trading with the dark cloud cover pattern

- The trend should be an uptrend, as the dark cloud cover pattern is a bearish reversal pattern.

- The length of the candlestick performs a vital role in deciding the efficiency with which the reversal will take place.

- The gap up between the bullish and bearish candlesticks indicates how powerful the trend reversal will be.

- The bearish candlestick should close more than the midpoint of the previous bullish candlestick.

- Both the bullish and the bearish candlestick pattern should have larger bodies with a small shadow.

How to trade using Dark Cloud Cover?

Entry levels, targets and stop loss can be clearly recognised when taking a look at the chart below. The entry can be placed at the open of the next candle after the Dark Cloud Cover pattern has developed. Remember we don’t trade candlestick pattern without important support and resistance levels. If you want to understand what is Support and Resistance in trading , Read article here

Stoploss can be placed above the recent high and the initial target level can be set at key levels or recent areas of support/resistance.

Importance of Dark Cloud Cover in Trading

The traders find this pattern important as it signals the reversal of uptrend into a downtrend. One should look at the daily charts for this pattern as this pattern is less important in the lesser time-frame charts.

This pattern happens near the resistance level. If the volume is high during the formation of this candle, there are more chances of the reversal to take place.

Don’t forget to confirm the signals given by this pattern with other technical indicators. You can also use technical indicators to filter out the stocks for trading the stocks.

Recommended Brokers

| No 1 STOCKBROKER IN INDIA Zerodha Free equity & mutual fund investments | Flat ₹20 intraday and F&O trades | Rating ★★★★★ | APPLY NOW |

| GET FREE DEMAT ACCOUNT Upstox Fix brokerage of Rs. 20 per trade | Rating ★★★★ | APPLY NOW |

| GET FREE DEMAT ACCOUNT Angel Broking 0 Brokerage on Equity Delivery | Rs 20 per order for Intraday and F&O trades | Rating ★★★★★ | APPLY NOW |

Simply love this series on candlesticks, very helpful .