Table of Contents

What is Nifty and Sensex – Index

If you are new to Stock Market and confused hearing these terms – don’t worry! . This article will explain you about What is Nifty , What is Bank nifty , What is Sensex and How to buy Nifty shares , Bank nifty and Sensex.

Nifty , Sensex and Niftybank are Index or Indices . Its used to represent performance of top companies of India which eventually reflects how stock markets are performing . NIFTY is major index of National Stock Exchange of India which represents the top 50 companies of India from different sectors. Sensex is and index which represents performance of top 30 companies of India. Bank nifty is an index which represents performance of top Banks of India .

When companies do good and economy do good, people buy shares because share prices are directly linked to companies performance in general. When you hear NIFTY going up , it means the constituent companies , majority of them are doing good. When you say Nifty is going down in last 1 year , it means companies and to and extent , economy is not doing good.

.It is calculated on the basis of the free-float market cap method. For example, if Tata motors have a total share of 1 lakh in share market and each share costs 200 rupees then the total market cap will be 1 lakh*200 = 2 crores. The shares which are not used to buy or sell daily are known as free-float market cap.

Also Read : How to select Best stocks for Investment

How is Index like Nifty and Bank nifty Calculated

Nifty’s calculation is based on free-float market capitalization of a share . To make a calculation in Nifty, you must select a base year and base value. Nifty calculation is done taking into consideration of 50 stocks that are actively traded on NSE and belong to 12 sectors. To calculate market capitalization, you need to multiply total shares of that company in market with market price per share.

Market capitalization = shares outstanding * market price per share.

To calculate the free-float market cap, you need to multiply with shares outstanding with price and investable weight factor.

Free float market cap = shares outstanding * price * investable weight factor.

To calculate Index value, you need to divide the current market value and base market value and multiply it with the base index value.

Index value = (current market value/base market value) * base index value.

Nifty and bank nifty share prices goes up or falls down depending upon the sum of 50 stock. If the stocks go up, its price and market cap will be increased by which even nifty’s value will be increased.

How does Nifty and Sensex Go up and down

As we have already said , Nifty is calculated using free float market capitalization of stocks. Since Nifty consists of 50 stocks, as the price changes of these stocks , Nifty value will change.

Since stock trading happens daily in stock market , Nifty keeps on goin up and down daily depending on its constituent shares movement. However , over longer term like 1 year , if most Nifty companies do well , their demand will be up and share price of Nifty will increase. so will Nifty price increase.

So we can say that generally , when expectation of economy and company doing good increases, demands for stocks increases and Index increases. However if stocks and companies don’t do well, demand decreases and index decreases and shares are sold by investors at lower prices.

How to Buy Nifty and Banknifty shares

We cannot buy nifty and bank nifty individually, as its just a number . Index like Nifty , Sensex and Banknifty depends on what is market price of constituent stocks and as the price of constituent stocks changes, Index changes.

However there are some alternative ways to Invest and Trade in Nifty , banknifty and other Index. Few of the wats to invest in Nifty and other Indices are

- Invest Through Index Mutual Funds

- Invest through Exchange traded Funds or ETF’s

- Trade through index futures and options, like Nifty futures, Nifty Options , Bank nifty Futures , Bank nifty Options

Invest through Index Mutual Funds

Index Mutual funds are passive Mutual funds which invests the money into stocks exactly in the same ratio as Index . Example Nifty Mutual fund will have 50 companies in its portfolio in the same ratio as its in Nifty Index. It tries to mimic the performance of Index and hence its called Index mutual funds.

Index mutual funds are passive funds, meaning that fund manager doesn’t need to actively buy sell shares. Only when some new stocks are added or removed from index, fund manager needs to do the same thing. Such funds have low management costs and just gives returns like Sensex and Nifty

Invest through Exchange traded Funds or ETF’s

Exchange traded funds are just like mutual funds, just that unlike mutual funds, they are traded on exchange .You can buy and sell them just like stocks. Hence there may be sometimes mispricing of ETF based on demand and supply.

Some of the Most popular ETF’s are NIFTYBEES (Nifty ETF) , BANKBEES (Bank Nifty ETF) etc . Most fund houses will have an ETF on their name , like Kotak ETF , SBI ETF etc.

Trade in Nifty Futures , Nifty Options , Bank nifty Options

SInce 90% of people trade in stock markets , people created a products called index futures and Index options. Index futures are derivatives, which means that their value is derived from value of underlying index.

Futures can be bought and sold in fixed number of quantities called lot size. As Index moves up and down , its future moves up and down . Futures have a fixed validity and is called expiry date. So if you want to trade in Index like Nifty , you can buy or sell Nifty Futures. The nifty futures trades on discount in case of any unfavorable or sudden news compared to nifty as it anticipates that the price may go down more. For example, if nifty is at 11600 and nifty futures will be at 11640, because of sudden news if nifty falls to 11500 then nifty futures will fall to 11490

Index options are another type of complex financial instruments whose value depends on underlying index and changes as index price moves .

There is a risk associated with the people who are buying and selling Index Options . They charge a premium which is directly proportional to the risk involved. The premium must be high when the expiry time is more. There can be exceptions when market price to go in a certain direction. . This helps to understand about Nifty, Bank Nifty, and how to calculate and buy them.

Top Stocks in Nifty

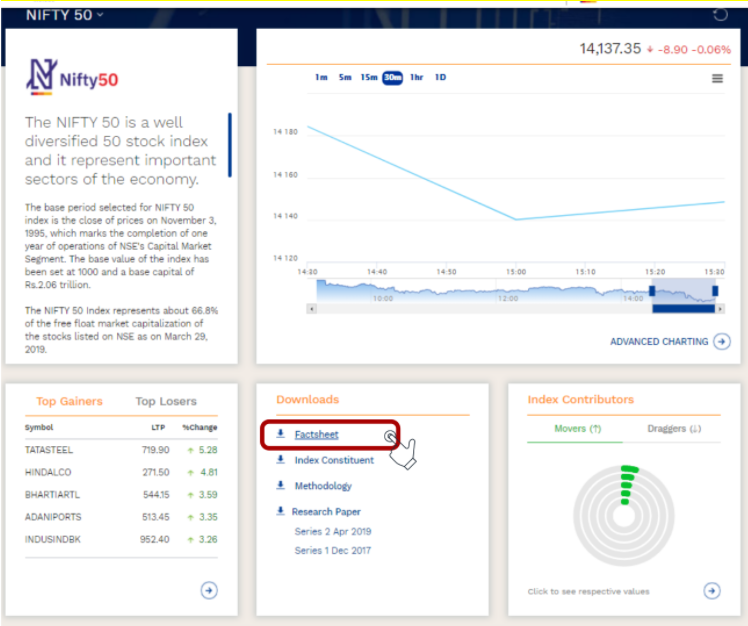

Nifty includes various types of stocks. Many people who want to invest in Nifty will distribute the stocks according to the company capitalization and weightage. Investors can find all the details of Nifty listed companies using NSE India website.

Here is the list of top Nifty Constituents.

| Company Name | Weightage(%) |

| Reliance Industries Ltd. | 10.66 |

| HDFC Bank Ltd. | 10.37 |

| Housing Development Finance Corporation | 7.61 |

| Infosys Ltd. | 7.64 |

| ICICI Bank Ltd. | 6.12 |

| Tata Consultancy Services Ltd. | 4.99 |

| ITC Ltd. | 3.03 |

| Kotak Mahindra Bank Ltd | 4.85 |

| Hindustan Unilever Ltd. | 3.55 |

| Larsen & Toubro Ltd. | 2.61 |

Top stocks in Bank nifty

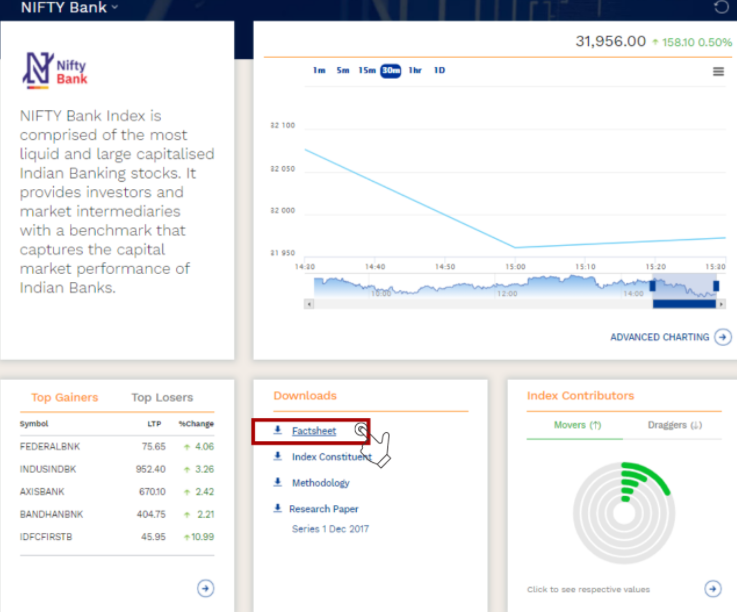

Bank Nifty is also a sectoral index, and it describes the Banking sector(Private and nifty PSU banks). Like the Bank Nifty, we have many other sectoral indices like Nifty Financial Services, Nifty private bank, Nifty Media, Nifty FMCG, Nifty IT, and Nifty pharma, Nifty Auto, Nifty Healthcare Index etc. Investors use these indices to know what is occurring in the market, and according to that, they will start investing. Investors can find all the details of Bank Nifty listed companies using NSE India website.

Here is the list of top nifty bank constituents.

| Company Name | Weight(%) |

| HDFC Bank Ltd. | 26.08 |

| ICICI Bank Ltd. | 20.05 |

| Kotak Mahindra Bank Ltd | 15.88 |

| Axis Bank Ltd | 15.35 |

| State Bank Of India | 10.54 |

| IndusInd Bank Ltd. | 5.07 |

| Bandhan Bank Ltd. | 2.72 |

| Federal Bank Ltd. | 1.33 |

| RBL Bank Ltd. | 1.03 |

| Bank of Baroda | 0.78 |

FAQs

What is the difference between Nifty and Sensex?

The nifty comes from National and Fifty and Sensex comes from Sensitive and Index. Nifty 50 consists of the top 50 organizations that are actively traded on the National Stock Exchange. In contrast, Sensex consists of the top 30 organizations that are actively traded on the Bombay Stock Exchange. Nifty is an index that covers 24 sectors, whereas Sensex covers 13 sectors.

What is the difference between NSE and BSE?

NSE and BSE are both stock exchanges. NSE is national stock exchange and BSE is Bombay stock exchange. Nse is newer exchange while BSE is old exchange. In India, NSE has more liquidity and major share trading of stocks happen n NSE only.

Recommended Brokers

| No 1 STOCKBROKER IN INDIA Zerodha Free equity & mutual fund investments | Flat ₹20 intraday and F&O trades | Rating ★★★★★ | APPLY NOW |

| GET FREE DEMAT ACCOUNT Upstox Fix brokerage of Rs. 20 per trade | Rating ★★★★ | APPLY NOW |

| GET FREE DEMAT ACCOUNT Angel Broking 0 Brokerage on Equity Delivery | Rs 20 per order for Intraday and F&O trades | Rating ★★★★★ | APPLY NOW |

Leave a Reply