Table of Contents

Introduction

At the beginning of their trading career, everyone has a lot of queries in their mind. Many people are interested in starting trading in the stock market, but they don’t know where to invest. Commodity trading is one of the best options for investors to start their trading career. Presently, everyone can do commodity trading to create good profits. As commodity trading is different from equity trading, many retail investors are interested in commodity trading because it is very safe when compared to equity trading.

In this article, we are going to discuss what is commodity trading? Basics of commodity trading, How to invest in the Indian commodity market, Where to invest in the commodity market, List of commodities traded in India, Commodities tips, Types of Commodity traders in India, How to start commodity trading. For latest updates in commodities trading, follow this post as we will regularly update the content. Let’s get started.

What is Commodity Trading

Buying and selling any stocks is known as ‘TRADING.’ In Commodity trading, retail clients will buy and sell the stocks via the stock exchange. A commodity is a raw material that is used in everyday life. A commodity can be in the form of food, Grains, Wheat, corn, soybeans, Crude Oil, gold, silver, copper, Natural gas, etc. Commodities can be transferred from one location to another physically. It is the best way to diversify your stocks. Traders can start buying commodities through the derivative market and can trade in futures and options.

What is a commodity futures contract?

A commodity futures contract means the agreement between two parties to buy or sell the specific commodity at a particular price and date in futures. Commodity futures is a standard contract initiated by a commodity future exchange. It generally comprises of sizes like 1,000 barrels, 5,000 bushels, 5,000 ounces, etc

A commodity futures contract will not consider the current day market price because it is delivered at the contracted price. Commodity futures is one of the best places for traders and investors. However, commodity futures contracts are very risky for new traders in the market. Many investors in the market lose their invested amount in the commodity futures.

How commodity future contract works

When you plan to buy futures, you don’t have to pay the whole amount because the stockbrokers will provide you with the margin.

For example, You bought a silver futures contract at Rs. 120,000 per 500 gm.

The margin for silver fixed by commodity exchange is 6%. So you have to pay Rs. 7200.

It is always better to select the low margin broker because you can purchase a large amount of silver by paying a very small amount.

The next day, the silver price increased to Rs. 125000 per 500 gm. In this case, Rs 5000 (Rs 125000 – Rs 120000) will be credited to your account. The same scenario happens if the silver price decreases.

How are the contracts settled?

All the commodity exchanges will settle the contracts in 2 ways

- Cash and

- Delivery Mechanism

If you want to settle your future contracts via cash means, you have to mention that you don’t plan to deliver the item when placing the order.

If you want to settle your future contracts via delivery, you should have the warehouse receipts. The settlement option may change several times because a person wants till the last day of the contract expiry.

Commodity Trading Basics

Commodities investing is the best way to earn good profits. But, No one should invest all their hard-earned money in a single stock because investing in a single stock can have high risk. Diversification is very important in commodity trading.

Identify your risk capacity:

Before you start commodity trading, firstly, you need to know how must risk you can bear. Never invest all your capital in a single commodity. It is better to diversify your portfolio because it can help you to reduce your losses. Before you start trading in commodity, you must have a clear idea of what is your risk level.

Put stop loss:

Sometimes commodity trading is correlated with high risks because there may be many factors to influence the price. So everyone should always put stop-loss while trading. If you neglect it, then you may end up with a huge loss. If you put a stop loss, your commodity will be sold once it reaches that price level. It is the best strategy to reduce losses.

Keep emotions under control:

Don’t be panic in any situation and never try to take revenge. Everyone should put their emotions aside while making investment decisions because it may lead to the loss of all your money.

Reviewing is very crucial:

Before buying any commodity, reviewing your strategies is very important because sometimes you may forget to change the previous settings.

Seasonality:

One of the most important factors in commodity trading in India is seasonality because some products will have high demand based on seasons. You must have a clear idea of products you are willing to buy.

Take help of Technical analysis:

Technical analysis plays a significant role in determining the market trend because it can help you to make the correct decision. Trend specifies the future price movement of a commodity.

Follow Market:

As the indian commodity market is highly volatile, it is very important to follow the market regularly. Sometimes, a piece of sudden news can have a major change in the global and local market.

Margin – By using margins, you can trade high volume with a low amount. Usually, the margin ranges from 5 – 10% of the contract value.

Futures contracts

Futures derivatives are commonly used in the commodity market. Here sellers make a futures contract with buyers at a specific price. If the market is down, the sellers have margin profits; in the same way, if the market is moving up, the buyers have good profits. If the trade manages by commodity exchanges, it s cis considered as a future derivative contract t, or if the trade happens between two parties without exchange, then it is considered as over the counter exchange trading.

Options contracts

According to the SEBI rules and regulations, option contracts can be used when buying the top commodities. Option contract is the agreement between two parties(buyer and seller) that gives the buyer the right to buy or sell the commodity before the specified date.

Commodity exchanges in India

To start trading in commodities, we need a platform. There are many commodity Stock exchanges in India. Here are the list

- MCX – Multi Commodity Exchange

- NCDEX – National Commodity and Derivatives Exchange

- NMCE – National Multi Commodity Exchange

- ICEX – Indian Commodity Exchange

- ACE – Ace derivatives Exchange

- UCX – Universal Commodity Exchange

List of commodities traded in India

The commodities market in India has been divided into five sectors namely – Agriculture, Metals and Materials, Precious metals and materials, Energy. These sectors are again classified into various constituents. Here is the list of

| Commodity sectors | Constituents |

| Agriculture | Grains: Rice, Basmati rice, wheat, maize, jeera. Oil and oilseeds: Castor seeds, soy seeds, castor oil, refined soy oil, soymeal, crude palm oil, groundnut oil, mustard seed, cottonseed, etc. Spices: Pepper, red chilli, jeera, turmeric and cardamom. Pulses: Chana, urad, yellow peas |

| Metals and Materials | Base metals: Aluminum, copper, nickel, zinc, tin. Bulk commodities: Iron ore, coking coal, bauxite, steel. Others: Soda ash, chemicals, rare earth metals. |

| Precious Metals and Materials | Gold, silver, platinum and palladium. |

| Energy | Crude oil, natural gas, Brent crude, thermal coal, alternate energy. |

| Services | Oil services, mining services and others. |

Commodities Which can be Traded on Stock Exchange are

| Sr No | Commodities |

| 1 | ALUMINIUM |

| 2 | CARDAMOM |

| 3 | CASTORSEED |

| 4 | COPPER |

| 5 | COTTON |

| 6 | CPO |

| 7 | CRUDEOIL |

| 8 | GOLD |

| 9 | GOLDGUINEA |

| 10 | GOLDM |

| 11 | GOLDPETAL |

| 12 | KAPAS |

| 13 | LEAD |

| 14 | MCXBULLDEX |

| 15 | MCXMETLDEX |

| 16 | MENTHAOIL |

| 17 | NATURALGAS |

| 18 | NICKEL |

| 19 | PEPPER |

| 20 | RUBBER |

| 21 | SILVER |

| 22 | SILVERM |

| 23 | SILVERMIC |

| 24 | ZINC |

Types of Commodity Market Traders

There are two types of commodity traders based on their operations.

Hedgers

Hedger investors aim to decrease their risks, so they are entering into a futures contract. If there are any changes in the price, it won’t affect the contracts. Here investors take the delivery position when the future contract expires.

Speculators

Here investors main goal is to get large profits from the price movement, and they are termed as a speculator.

How to Trade in Commodity Market

Step 1:

To do commodity trading India, you need to have a demat account and trading account. There are currently many stockbrokers in India who can provide depositary services. Here are the list of best broker in india.

- Zerodha Demat Account

- Upstox Demat Account

- Angel Broking Demat Account

- Stoxkart Demat Account

- Choice Broking Demat Account

If you have not opened the demat account till now, click on the below links to find the complete account opening process.

Step 2

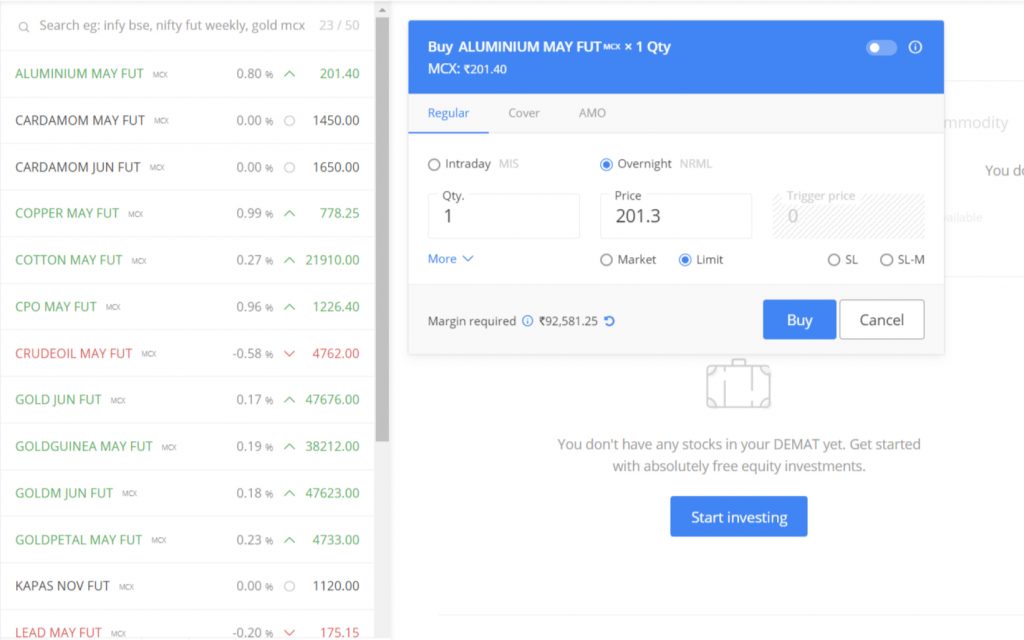

You must have a margin balance in your commodity trading account. The margin amount changes from a regular trade to an MIS. There is a difference between regular trades and MIS. For regular trades, the stocks can be traded for the long term, whereas in MIS, the stocks will square off their positions on the same day.

Step 3

Select the commodity such as gold, silver, natural gas, crude oil, etc.

Step 4

After selecting commodities, you can start buying if you assume if the price is moving up and start selling if the price is moving down. Here you can start buying a share in 2 ways

- Market Order – Here, you start purchasing the shares at the current price

- Limit Order – Here, you can fix the price you want to buy the shares

Step 5

Enter the lot size you want to trade. When you are trading CFD, the lot value changes depending on the commodity you wish to trade. After you gave the lot size, It is advisable to put the stop-loss to avoid huge losses.

Step 6

Here you need to observe the market movement every minute. It is better to identify that your losses should not exceed your deposits.

Tips for Commodity Trading

- Never follow the stock market trading approach in commodity trading

- Diversify your amount in multiple commodities

- Never trade with the stocks when you are not convinced

- Use technical analysis to have a better idea on commodity

- Find the difference between cyclic and noncyclic commodities

- Fix the target price and book the profit for your trade

- Follow the market trend

FAQs

What are commodity trading timings?

Commodity exchange will work from Monday to Friday and Saturday, and Sunday is a holiday. The timings for commodity exchange is 10:00 am to 11:55 pm. You can watch all the price movements during the trading hours.

Which are the best trading app in India for commodity trading?

Here are the list of best trading app India for commodity trading

Edelweiss Mobile Commodities App

Moneycontrol App

IIFL Markets.

Reliance Commodities Trading App.

Investing.com.

Angel Broking App.

Leave a Reply