Vijay Kedia is an ace investor in the India stocks market. He is known to identify quality stocks at a very early stage which turns out to be multi-baggers. Let’s take a look at his investment strategy, which he calls SMILE methodology. In this article, we will learn How Vijay Kedia selects multi-bagger stocks.

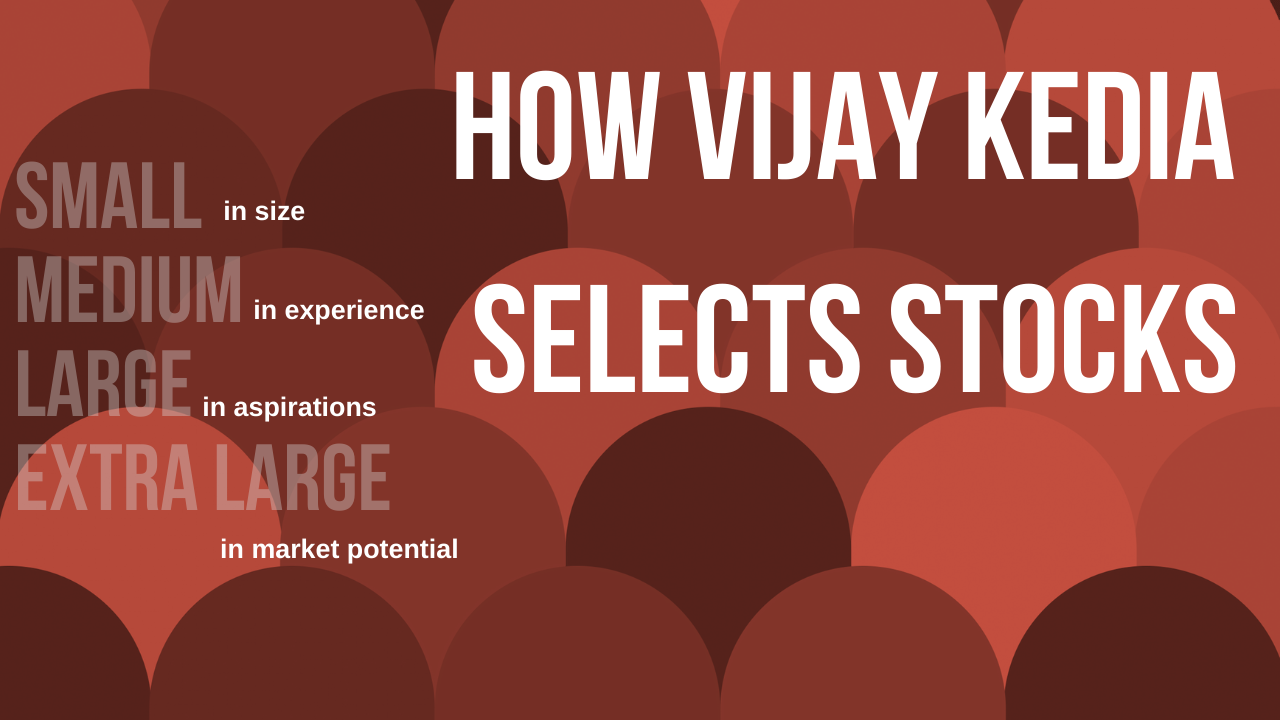

Vijay Kedia selects multi-bagger stocks by using a simple principle which is “SMILE” while choosing the shares for his portfolio. Here we will discuss each of the concepts of SMILE

Table of Contents

S means small in size

But here we should not always judge the size of the company by its market cap. A small company here means it has a smaller percentage share in the total industry. Suppose an industry has a total business size of 2000 cr and a company in the same business has captured the business of 200-300cr, then that company can be called as small in size.

It reflects that the company is currently a small player in the industry and has a good potential to grow and capture a bigger share in that business.

When a small size company aspires to become a medium-sized company in a business, then there may be turned around in that company and in that transformation phase share can give multi-bagger returns.

MI means medium in experience

Medium inexperience means the company should have around 10-15 years of experience in the business. Because if a company does not have seen the ups and downs of the business then it is not matured enough to be invested.

If a company has a small experience of 5-7 years then it has not seen enough cycles of ups and downs and we can’t judge its capability to overcome the bad times and retain in the business. So if you are a smart investor, then always choose a company that have good experience in business maybe 15-20 yrs.

L means large in aspiration

Aspiration is a very important characteristic that is required in the company’s management. If management aspiration is high, they are not satisfied and happy with small achievements and are always driven to take the company to the next level.

But mostly it is seen that when a company goes through a major transformation like it is able to grow from small to medium or medium to large, then they somehow lose their aspiration and get complacent with their achievements. That is where the decline starts.

Management quality and vision have the capability to take a company to a completely different level. If you are holding stocks of such company’s then definitely it will give you a handsome return in the long term.

E means extra-large in market potential

Another very important aspect is that the market potential of the company should be very good. In small words, in an ocean, it should be a small lake. A company in a sector which is growing at 10%, and having 10-15% of total market share, has a good potential to grow and capture the rest of the market. Such potential is important for a multi-bagger stock.

. So these are the principles that Vijay Kedia strictly adheres to before investing in a company. If you are able to find a few stocks with these characteristics, then hold it with patience and have the courage to allocate a significant amount to such stocks.

Recommended Brokers

| No 1 STOCKBROKER IN INDIA Zerodha Free equity & mutual fund investments | Flat ₹20 intraday and F&O trades | Rating ★★★★★ | APPLY NOW |

| GET FREE DEMAT ACCOUNT Upstox Fix brokerage of Rs. 20 per trade | Rating ★★★★ | APPLY NOW |

| GET FREE DEMAT ACCOUNT Angel Broking 0 Brokerage on Equity Delivery | Rs 20 per order for Intraday and F&O trades | Rating ★★★★★ | APPLY NOW |

Leave a Reply