Table of Contents

What is the Expense Ratio?

The expense ratio is an efficiency ratio that calculates management charges as a percentage of funds in mutual fund investment. Mutual funds can be costly to create, manage, and maintain.

The Fund Manager must actively monitor the assets to invest in, research new investments, and make sure the fund is investing according to its goals.

If the assets are small, then the efficiency ratio in a mutual fund can be high to meet its expenses from a restricted or a smaller asset base. In this article, you can know the expense ratio in mutual funds.

If the net assets of the fund are more, then the expense percentage will come down.

On 18 September 2018, SEBI made an important change by reducing the total expense ratio (TER) of the mutual fund investment and changing the method of implementing a commission to the distributors. We will discuss them in detail later in this article.

The expense ratio can be calculated by dividing the fund’s operating expenses by the average value of the fund’s assets.

Expense Ratio Formula

Expense Ratio = Operating Expense /Average Value of Fund Asset

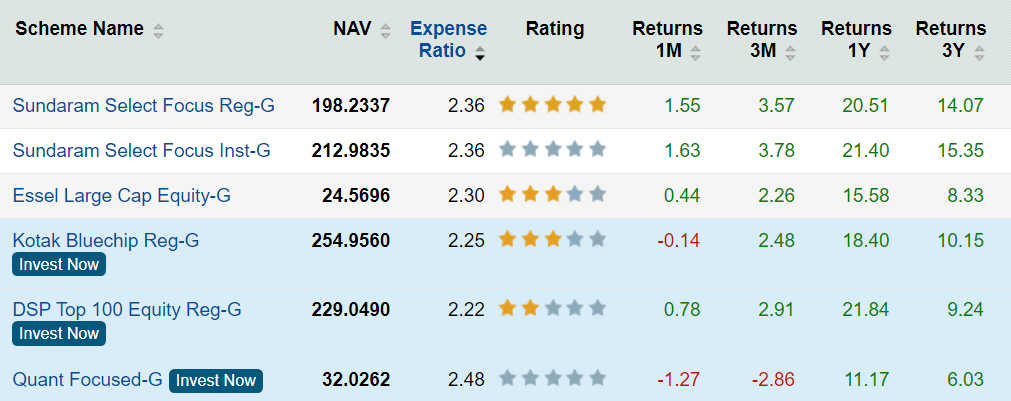

You can check the expense ratio of all mutual funds on moneycontrol Website or directly at the mutual fund’s website. The expense ratio keeps changing and is published every quarter by the mutual fund house.

Components of expense ratio

The expense ratio includes various charges to run the mutual fund plan easily. They have to recover this charge from the investor mutual funds on a day-to-day basis and ask the investors to pay once every six months.

This will have a real impact on your returns. There are three major types of the expense ratio, which are

1. Management Fees

Mutual funds demand the formulation of investment strategies before actually investing money in the underlying assets. Fund managers need to be well educated, relevant fund management experience, and expert credentials.

The investment advisory fee is compensation for these manager’s skills. This yearly fee is about 0.50% to 1% of the fund’s assets.

2. Administrative Costs

The administrative costs are the charges of running the fund. This would include keeping records, customer support, and service, and communications. They are unveiled as a percentage of fund assets.

3. Distribution Fees

Most of the mutual funds collect it for advertising and promotional purposes. They charge their shareholders to market and promote the fund to the investors. These fees combined are equal to the percentage of assets deducted from the fund.

Expense Ratio Limit Set by SEBI

As a market regulator , SEBI has prescribed guidelines under Regulation 52 of SEBI Mutual Fund Regulations the expenses as AMC of any mutual fund.

As per these regulations, the total expense ratio (TER) allowed is 2.5% for the first Rs.100 crore of average weekly total net assets, 2.25% for the next Rs.300 crore, 2% for the next Rs.300 crore and 1.75% for the rest of the AUM.

The limit for debt funds is 2.25%. ALso ,SEBI allows all the mutual funds to charge 30 additional basis points more if they are doing business in smaller towns (B15 Cities). These cities also enjoy an additional 20 basis points as exit load charges.

Impact of expense ratio on the fund returns

In the Expense ratio, the percentage of fund charges annually to manage your portfolio investment.

For example, if a fund earns returns up to 15% and has 2% of the total expense ratio, then you can make a return up to 13%. The Net Asset Value of a fund is reported after subtracting fees and expenses.

It is necessary to understand how much you are paying to the mutual fund company.

You must also note that if Funds Assets under management (AUM) decreases, the expense ratio will increase. This is also a red flag sometimes showing that many investors are exiting mutual funds . It may not always be true however it needs to be kept in mind.

You can use the expense ratio to separate between actively managed and passively managed funds. In the case of actively managed equity funds, the alpha generated by the fund manager is a convincing reason for the fee they charge.

If you find a broad difference between the returns of your fund and index funds, then you may think of making a switch.

Conclusion

A mutual fund scheme with a good track record may help you out to know about the total expense ratio in a different way. In some cases, the higher expense ratio can dominate the average returns.

Recommended Brokers

| No 1 STOCKBROKER IN INDIA Zerodha Free equity & mutual fund investments | Flat ₹20 intraday and F&O trades | Rating ★★★★★ | APPLY NOW |

| GET FREE DEMAT ACCOUNT Upstox Fix brokerage of Rs. 20 per trade | Rating ★★★★ | APPLY NOW |

| GET FREE DEMAT ACCOUNT Angel Broking 0 Brokerage on Equity Delivery | Rs 20 per order for Intraday and F&O trades | Rating ★★★★★ | APPLY NOW |

Leave a Reply