Table of Contents

What is a Straddle Options Strategy?

A straddle is one of the options trading strategies in which a trader buys or sells an at-the-money Call option and a Put option simultaneously for the same underlying asset at a specific point of time. Both the options will have the same strike price and expiry date.

For example, if NIFTY reads at 12000, you need to buy/sell an at-the-money call and put option (example buy/Sell 12000 CE and sell 12000 PE).

When the price movement is not clear, a trader uses such a neutral combination of trades. In some situations, the two opposite trades can balance losses if both the options fail.

Types of Straddle Options Strategy

There are two types of Straddle Options Strategy,

- Short Straddle strategy

- Long Straddle strategy

One can go either long (buy) on both options (long straddle) or short (sell) both (short straddle) . The outcome of the strategy depends on the degree of price movement, rather than the direction of price movement.

What is a short straddle?

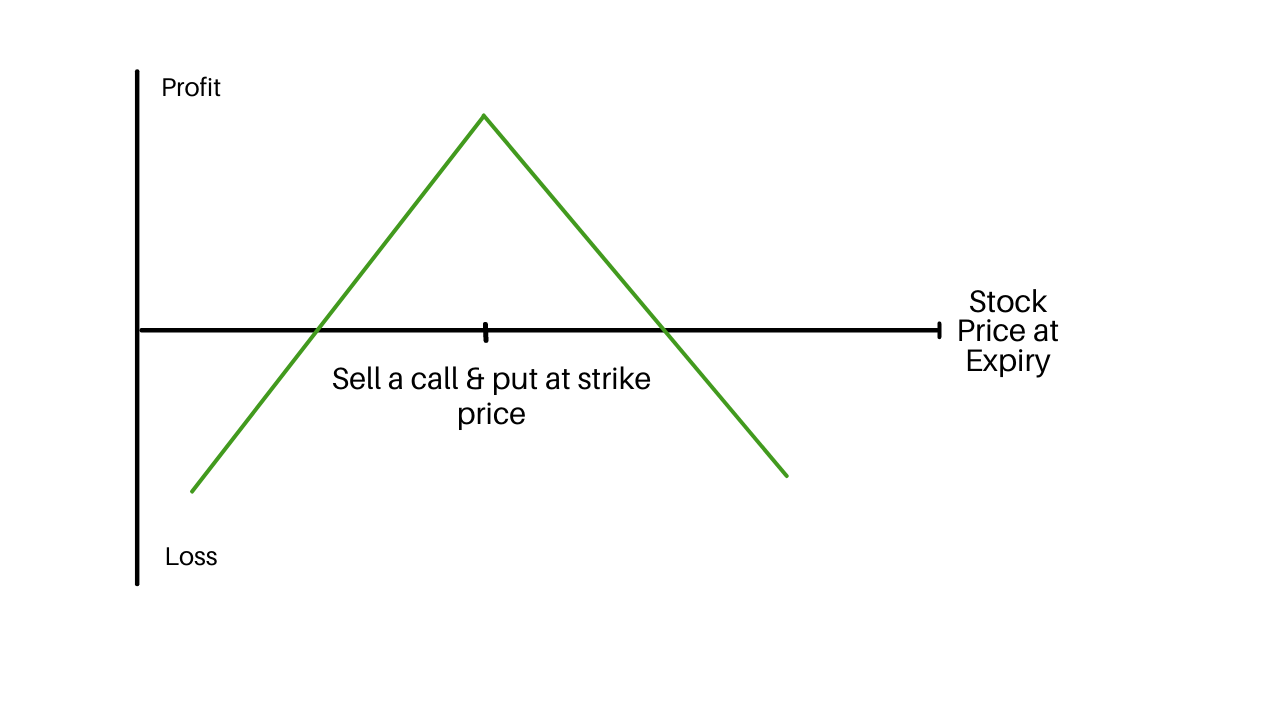

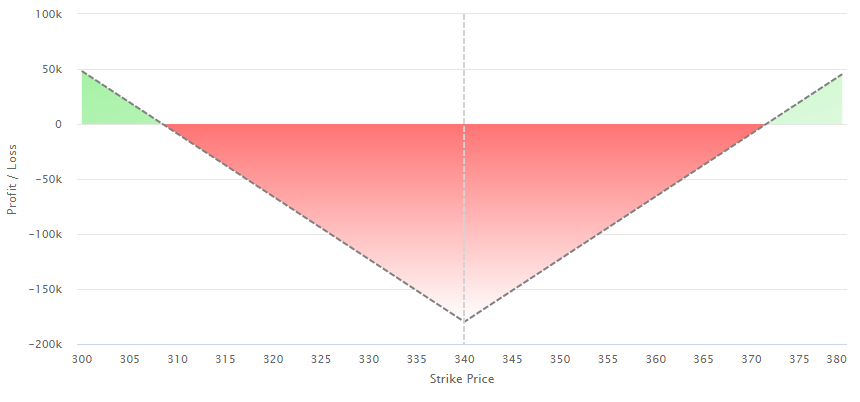

In a short straddle, both the at the money call and put options are sold with the same expiry date, the strike price of the underlying security. Short straddles are options strategies that are used in situations where we expect sideways to no movement in either direction.

The most suitable time to sell call/put options is when they are overrated irrespective of where the spot price of security moves and by how much.

It comprises unlimited risk, as one may lose up to the entire value in case of sale of both options. The profit will be limited to the premium received on both options.

The Breakeven points for short straddle strategy are

- The upper breakeven point for short straddle = Short Call option (strike price + premium received

- The lower breakeven point for short straddle = Short Put option (strike price – premium received

Margin requirement is the short call or short put requirement (whichever is great), plus the premium received from the other side.

When to trade short straddle strategy?

A short straddle option strategy works on the assumption that price can be range bound or not moving.

One should go for a short straddle strategy when Implied Volatility is medium to high but further move expected is range bound. A trader should enter at-the-money options or at least close to it at the time of selling.Short straddle works best when Theta Decay is high, so prefer weekly expiry.

How to make a short straddle Strategy?

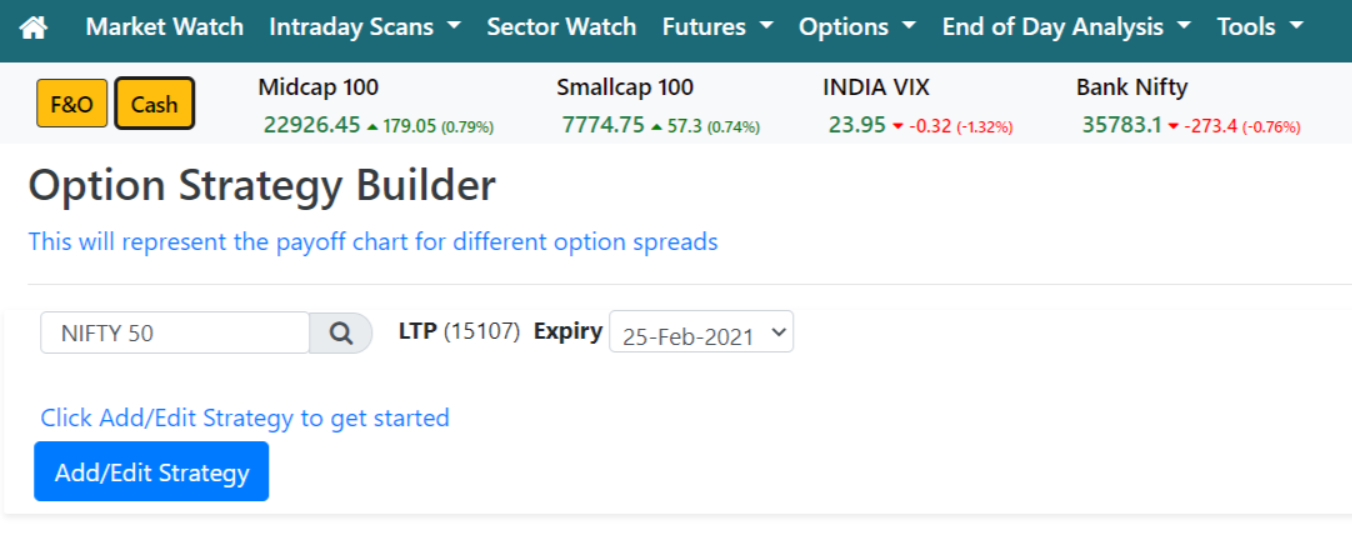

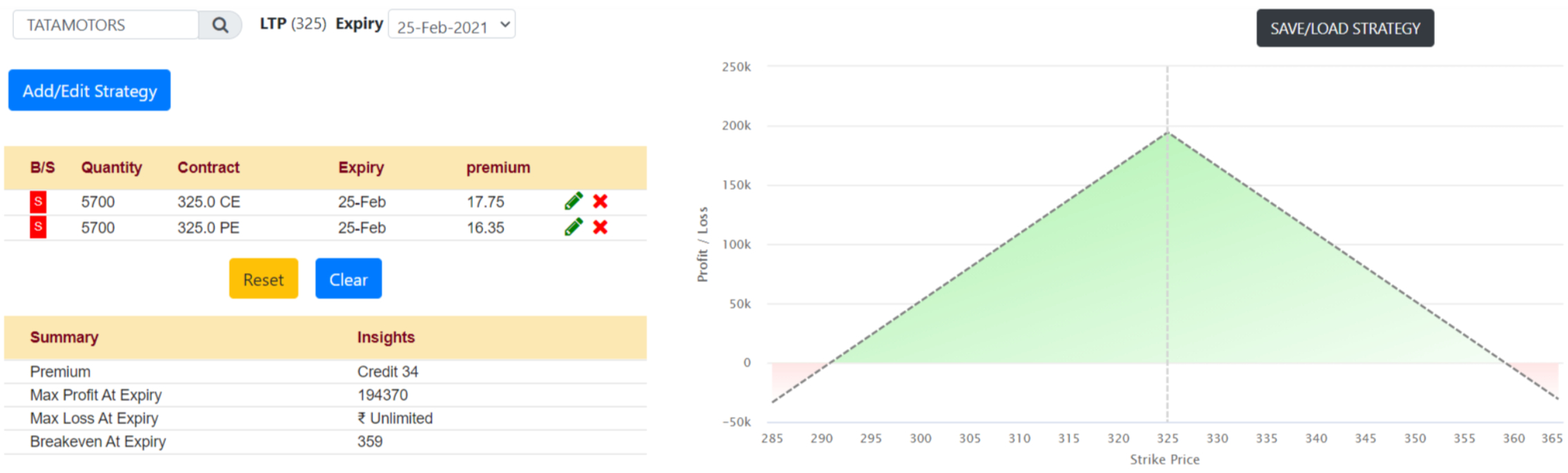

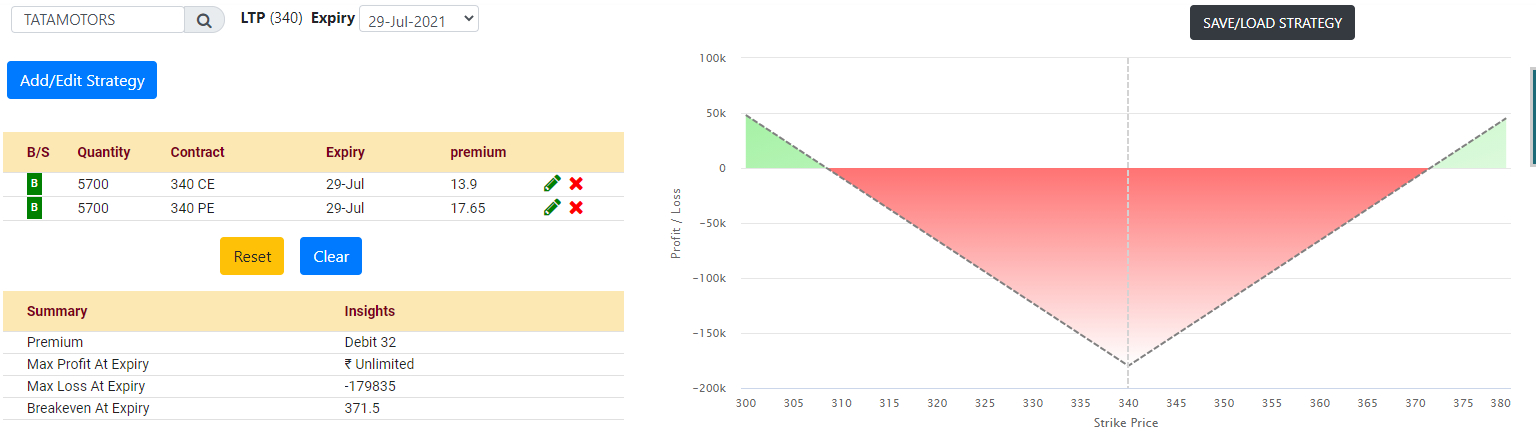

Using the Options strategy builder in intradayscreener.com, you can easily build an option strategy for a short straddle strategy.

Step 1: You just need to select the indices and expiry date (sell both call and put options) and click on add/edit to get started.

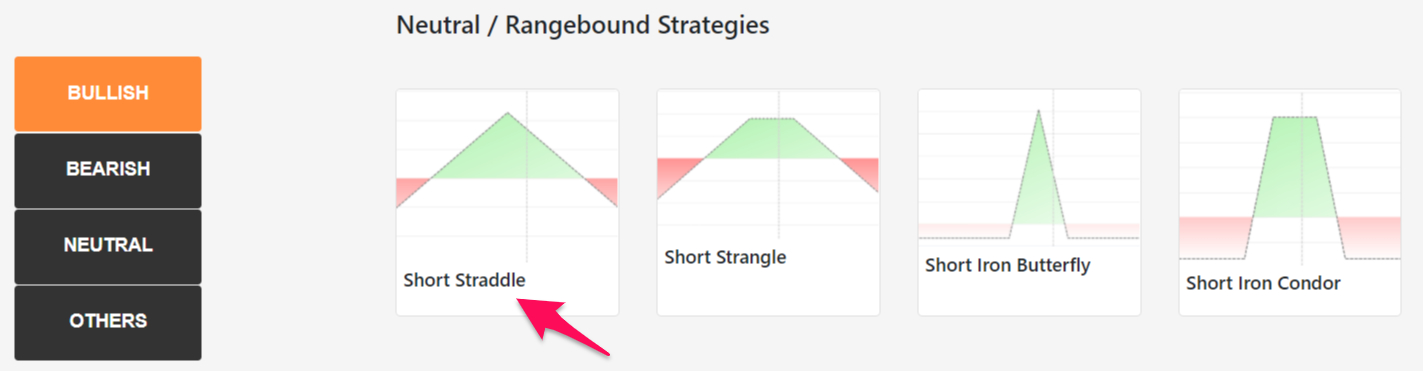

Step 2: Click on the short straddle strategy below.

Step 3: You will get detailed information on the option strategy like Premium, Max profit at expiry, Max losses at expiry, Breakeven at expiry and a short straddle graph.

Advantages of the Short Straddle Options Strategy

- The trader can gain profits even if the market is not volatile.

- This strategy suits most risk-prone traders.

Disadvantages of the Short Straddle Options Strategy

- The risks and losses involved in this strategy are infinite.

- The maximum profit gained is equal to the premiums received.

- The trader will incur huge losses if the price movements are opposite to the anticipated price movements.

Short Straddle Options Strategy – Example

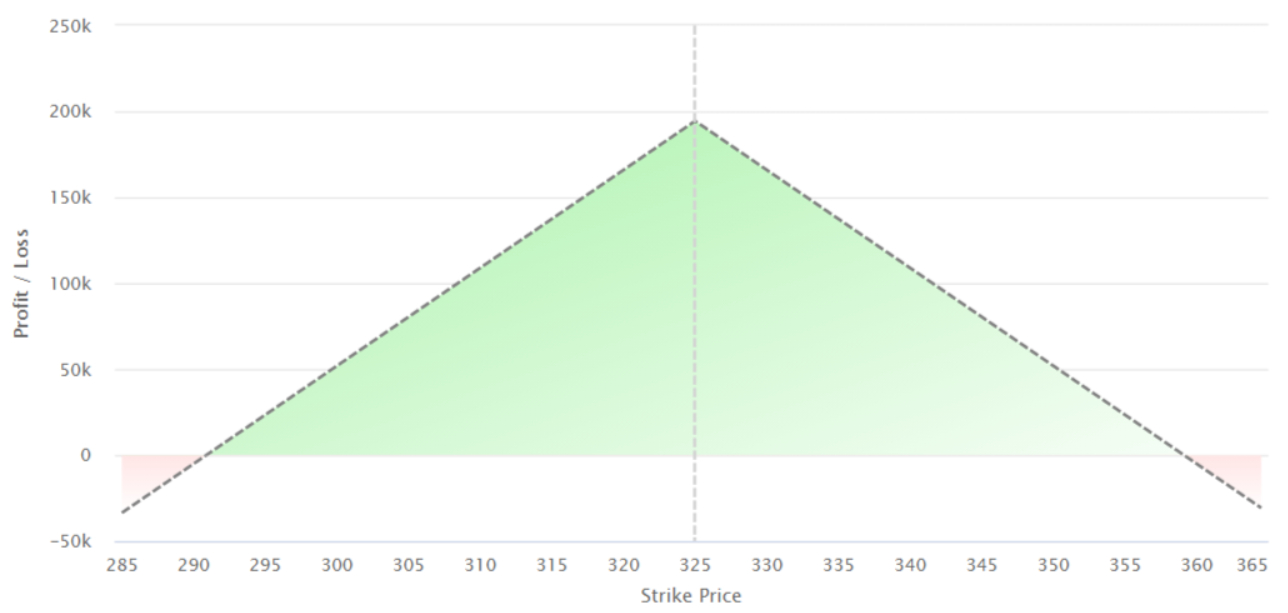

Let us take an example of TATA motors with the strike price given in the table below

| Action | Type | Strike price | Premium |

| SELL | CE | 325 | 23.55 |

| SELL | PE | 325 | 18.25 |

When we do a short straddle, we sell at-the-money put and call. In the above trade, if TATA motors is at 325 we will sell a call option which is 325 and premium received is 23.55 and sell put option which is 325 and premium received is 18.25.

| Expected stock price | 325 CE SELL | 325 CE Prem recvd. | 325 CE Sell Net Profits | 325 PE SELL | 325 PE prem recvd | 325 Net PE Sell | Expected stock price | Short Straddle Payoff |

| 300 | 0 | 23.55 | 23.55 | -25 | 18.25 | -6.75 | 300 | 16.8 |

| 305 | 0 | 23.55 | 23.55 | -20 | 18.25 | -1.75 | 305 | 21.8 |

| 310 | 0 | 23.55 | 23.55 | -15 | 18.25 | 3.25 | 310 | 26.8 |

| 315 | 0 | 23.55 | 23.55 | -10 | 18.25 | 8.25 | 315 | 31.8 |

| 320 | 0 | 23.55 | 23.55 | -5 | 18.25 | 13.25 | 320 | 36.8 |

| 325 | 0 | 23.55 | 23.55 | 0 | 18.25 | 18.25 | 325 | 41.8 |

| 330 | -5 | 23.55 | 18.55 | 0 | 18.25 | 18.25 | 330 | 36.8 |

| 335 | -10 | 23.55 | 13.55 | 0 | 18.25 | 18.25 | 335 | 31.8 |

| 340 | -15 | 23.55 | 8.55 | 0 | 18.25 | 18.25 | 340 | 26.8 |

| 345 | -20 | 23.55 | 3.55 | 0 | 18.25 | 18.25 | 345 | 21.8 |

| 350 | -25 | 23.55 | -1.45 | 0 | 18.25 | 18.25 | 350 | 16.8 |

By using the calculation in the table above, we can plot the payoff diagram for a long strangle.

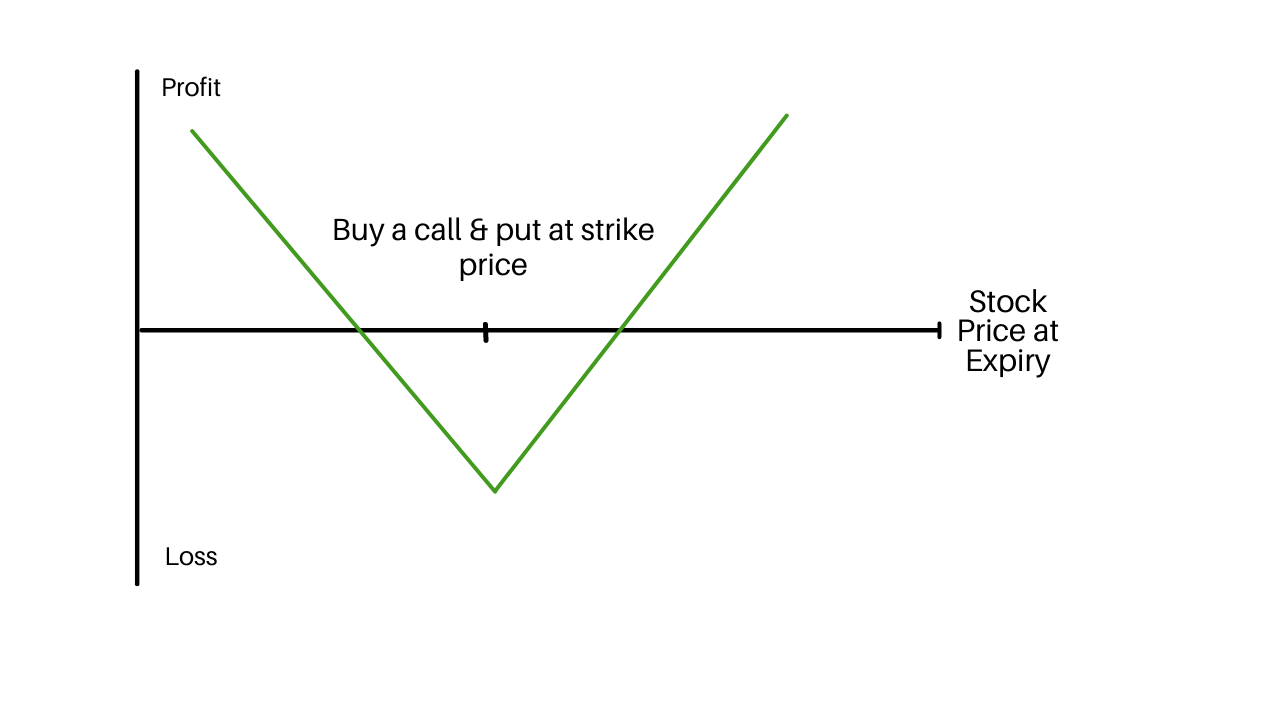

What is a long straddle?

In the long straddle, both at the money Call and Put options are bought with the same expiry date, strike price and underlying security. The most suitable time to create long straddle options is when the premium is low.

The cost of both options is the maximum value that the trader can lose. This trading strategy involves very limited risk.

The Breakeven points for a long straddle are

The upper breakeven point for long straddle = Long Call option (strike price + premium paid)

The lower breakeven point for long straddle= Long Put option (strike price – premium paid)

When to trade long straddle strategy?

A long straddle option works on the assumption that price can move in both directions, but the movement should be volatile.

One should go for a long straddle strategy when Implied Volatility is low. A trader should enter at-the-money options or at least close to it at the time of buying. When Theta Decay is low, so prefer monthly expiry.

How to make a long straddle Strategy?

Using the Options strategy builder in intradayscreener.com, you can easily build an option strategy for the long straddle strategy.

Step 1: You just need to select the indices and expiry date (buy both call and put options) and click on add/edit to get started.

Step 2: Click on the short straddle strategy below.

Step 3: You will get detailed information on the option strategy like Premium, Max profit at expiry, Max losses at expiry, Breakeven at expiry and a long straddle graph.

Advantages of a Long Straddle Options Strategy

- This strategy has limited risks and unlimited profit

- If the trader predicts the market volatility right, he need not worry about the direction of the price movement

Disadvantages of a Long Straddle Options Strategy

- Traders are required to pay high premiums

- The price movements should be much high to gain maximum profits after the premium is paid

Long Straddle Options Strategy – Example

Let us take an example of nifty futures with the strike price given in the table below

| CE PREMIUM | Strike price | PE PREMIUM |

| 70 | 12000 | 105 |

When we do a long straddle, we buy at-the-money put and call. In the above trade, if nifty is at 12000 we will buy a call which is 70 and buy put which is 105. By using the calculation in the table below, we can plot the payoff diagram for a long strangle.

| EXPIRY PRICE | NET CE BUY @12000 | NET PE BUY @12000 | LONG STRADDLE |

| 11500 | -70 | 395 | 325 |

| 11600 | -70 | 295 | 225 |

| 11700 | -70 | 195 | 125 |

| 11800 | -70 | 95 | 25 |

| 11900 | -70 | -5 | -75 |

| 12000 | -70 | -105 | -175 |

| 12100 | 30 | -105 | -75 |

| 12200 | 130 | -105 | 25 |

| 12300 | 230 | -105 | 125 |

| 12400 | 330 | -105 | 225 |

| 12500 | 430 | -105 | 325 |

Straddle Options Strategy – Conclusion

As compared to the long straddle, the short straddle option strategy is complex and is suitable for specific traders only. Whereas the long straddle trading strategy is for everyone and is one of the simplest strategies. Identify your skill in straddle strategies and trade accordingly.

Straddle Options Strategy – FAQs

Recommended Brokers

| No 1 STOCKBROKER IN INDIA Zerodha Free equity & mutual fund investments | Flat ₹20 intraday and F&O trades | Rating ★★★★★ | APPLY NOW |

| GET FREE DEMAT ACCOUNT Upstox Fix brokerage of Rs. 20 per trade | Rating ★★★★ | APPLY NOW |

| GET FREE DEMAT ACCOUNT Angel Broking 0 Brokerage on Equity Delivery | Rs 20 per order for Intraday and F&O trades | Rating ★★★★★ | APPLY NOW |

1 Comment