Table of Contents

What is a Long Strangle Options strategy?

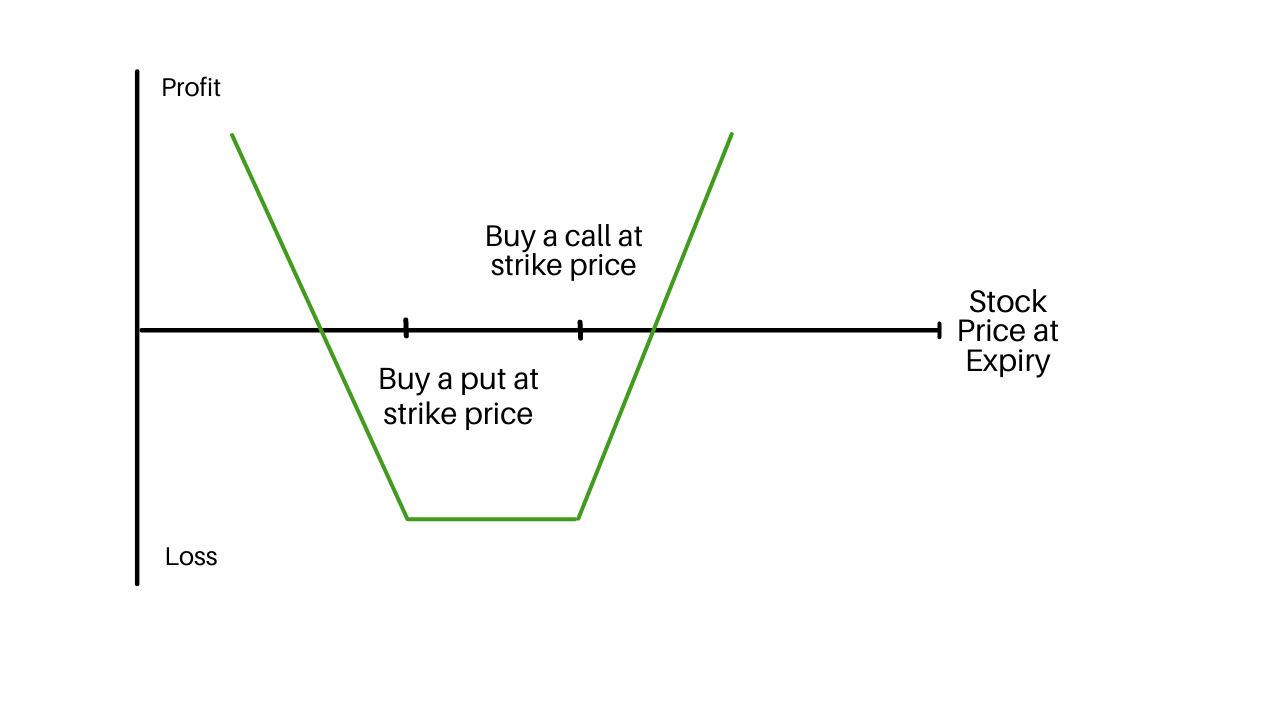

A long strangle is an options trading strategy in which a trader has to buy a Call option and a Put option of the same underlying asset at different strike prices but with the same expiry.

Long Strangle options strategies are used when we expect a big movement in either direction, but the price movement direction is not clear. However, chances of sharp movements are high.

One can go either with long (buy) on both options or short (sell) on both options but at different strike prices. Depending on whether he is buying call/but or selling call/put, it’s called long strangle and short strangle

When to trade in Long strangle

A strangle strategy works on the theory that prices can move violently in either direction. Hence this strategy of Long strangle options trading strategy.

A strangle gives a chance of unlimited profitability when prices move considerably in both directions. The trader bears a maximum loss when the cash price is between the strike prices of both the options.

It makes both the options worthless on expiry and the trader has to pay the value of premiums plus commissions on both option trades in long strangle. In the short strangle the loss can be manifold.

It refers to implied volatility whether it’s the best time to buy or sell options.

a) Low implied volatility provides buy/entry signal for long strangle

b) High implied volatility provides sell/entry signal for short strangle

Long strangle strategy

We need to buy both call options in the long strangle and put options with the same expiry date and same security but at different strike prices.

The most suitable time to buy Call/Put options is when they are out-the-money irrespective of where the spot price moves.

The long strangle strategy involves limited risk as the cost of the options is the maximum loss that the trader can acquire and that will happen when the price of the underlying security is between the strike prices of the Call & Put option on expiry.

When both options are in-the-money on expiry then there will be a chance to get maximum profits.

The breakeven points for a long strangle strategy are:

- Upper Breakeven Point for a long strangle strategy= Long Call Option (Strike Price + Premium paid

- Lower Breakeven Point for a long strangle strategy = Long Put Option (Strike Price – Premium paid.

How to Make a Long strangle Strategy

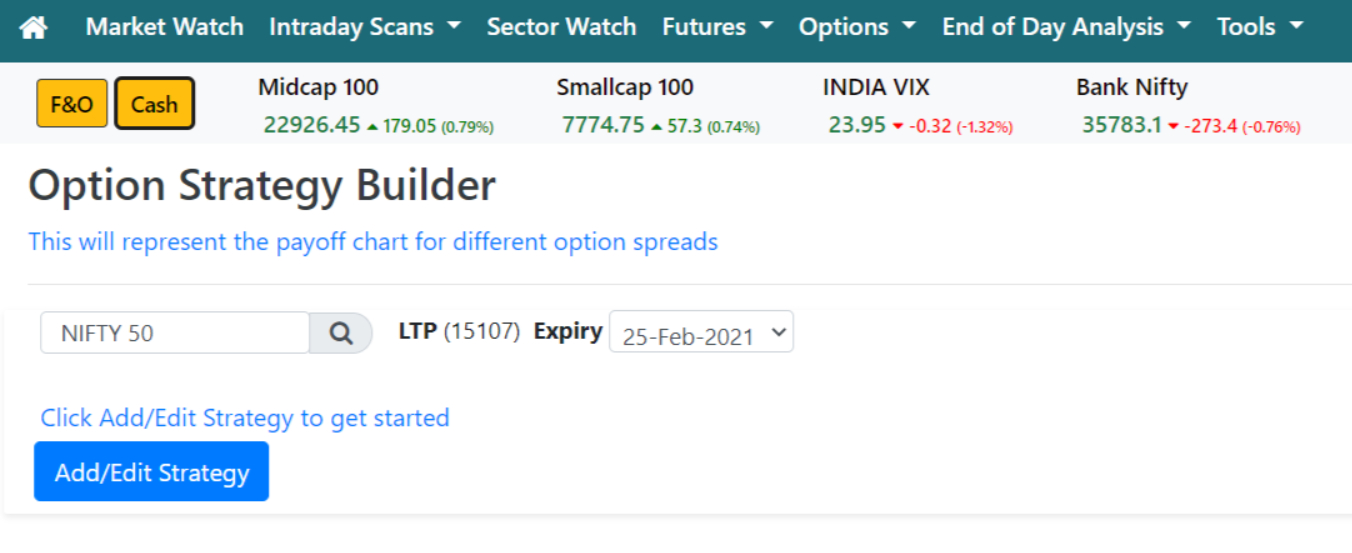

Using the Options strategy builder in intradayscreener.com, you can easily build an option strategy for a long strangle strategy.

Step 1: You just need to select the indices and expiry date (buy both call and put options) and click on add/edit to get started.

Step 2: Click on the strangle strategy below.

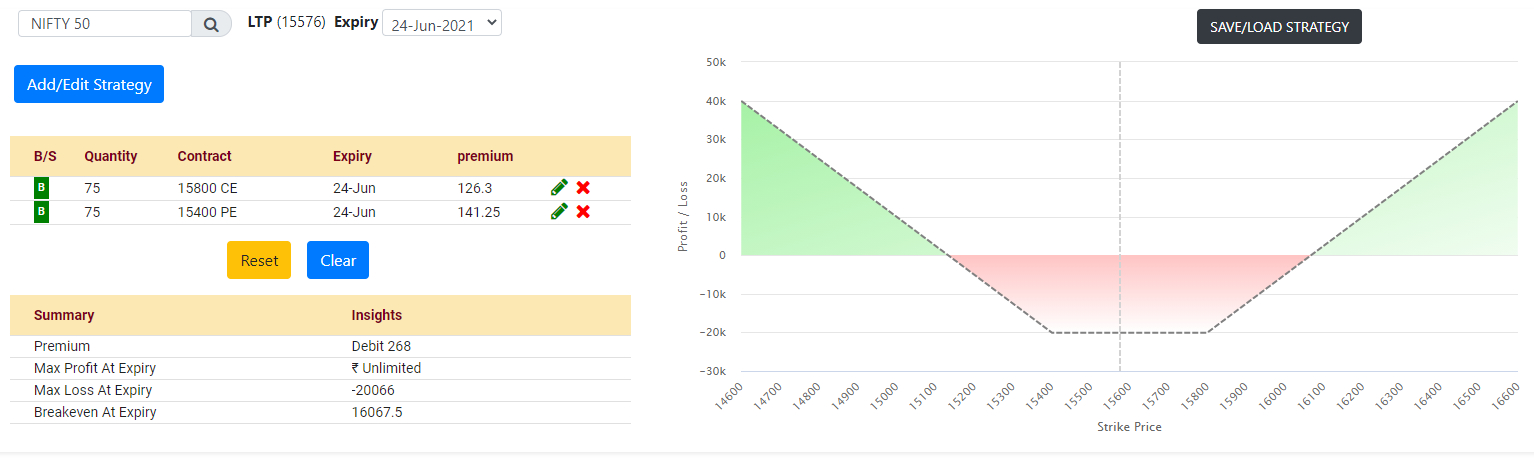

Step 3: You will get detailed information on the option strategy like Premium, Max profit at expiry, Max losses at expiry, Breakeven at expiry and a short strangle graph.

Long Strangle Option Trading Strategy Example

Let us take an example of nifty futures with the strike price given in the table below

| CE PREMIUM | Strike price | PE PREMIUM |

| 100 | 11900 | 55 |

| 70 | 12000 | 105 |

| 35 | 12100 | 145 |

Assuming the market moves in either direction. When we do a long strangle, we buy out-of-the-money put and call. In the above trade, if the nifty is at 12000 we will buy 12100 call which is 145 and buy 11900 put which is 100.

| LEG 1 | LEG 2 | Final Net | |

| EXPIRY PRICE | NET CE BUY@11900 | NET PE BUY @12100 | LONG STRANGLE |

| 11500 | -100 | 455 | 355 |

| 11600 | -100 | 355 | 255 |

| 11700 | -100 | 255 | 155 |

| 11800 | -100 | 155 | 55 |

| 11900 | -100 | 55 | -45 |

| 12000 | 0 | -45 | -45 |

| 12100 | 100 | -145 | -45 |

| 12200 | 200 | -145 | 55 |

| 12300 | 300 | -145 | 155 |

| 12400 | 400 | -145 | 255 |

| 12500 | 500 | -145 | 355 |

By using the calculation in the table above, we can plot the payoff diagram for a long strangle.

Recommended Brokers

| No 1 STOCKBROKER IN INDIA Zerodha Free equity & mutual fund investments | Flat ₹20 intraday and F&O trades | Rating ★★★★★ | APPLY NOW |

| GET FREE DEMAT ACCOUNT Upstox Fix brokerage of Rs. 20 per trade | Rating ★★★★ | APPLY NOW |

| GET FREE DEMAT ACCOUNT Angel Broking 0 Brokerage on Equity Delivery | Rs 20 per order for Intraday and F&O trades | Rating ★★★★★ | APPLY NOW |

Leave a Reply