Table of Contents

What is a Bearish Engulfing Pattern?

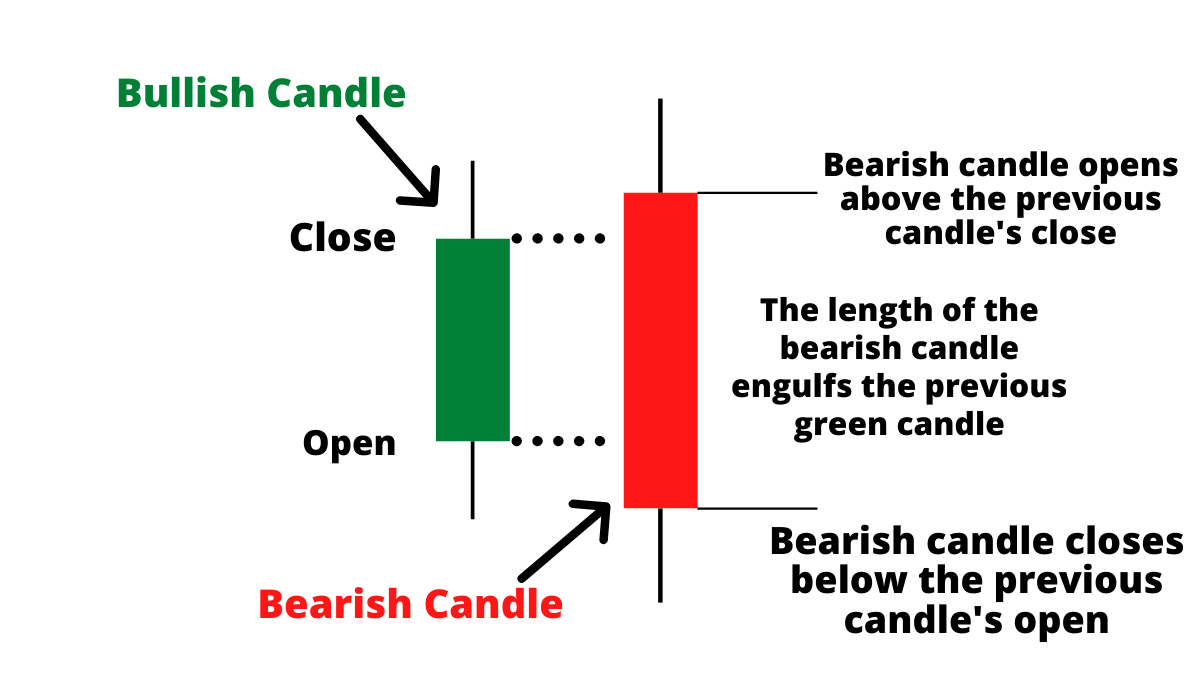

A bearish engulfing pattern happens in the candlestick chart of stocks when a large red candlestick fully engulfs the small green candlestick. This pattern usually happens during an uptrend and is supposed to signal the commencement of a bearish trend in a particular share. The bearish engulfing pattern develops at the top of the trend.

A bearish engulfing pattern is completely opposite of a bullish engulfing pattern. It contains a short green candle that is completely covered by the following red candle.

The primary candlestick indicates that the bulls were in charge of the market, while the second candlestick shows that the bearish pressure pushed the market price lower. The second period will tend to open higher than the previous day but finish significantly lower.

Why Does a Bearish Engulfing Pattern Matter?

The bearish engulfing pattern symbolises a possible reversal of investor sentiment and is indicative of a stock having reached the upper limits of its value. The stock may undergo a downward or bearish movement soon.

Rules to follow for Bearish Engulfing Pattern?

There are a few rules that you need to know while placing a profitable trade using a bearish engulfing pattern, they are

- Before entering the trade, you must check whether the previous trend is an uptrend or not.

- The first session of the pattern must be a green candle, thereby, validating that the market is still in a bearish state.

- In the second session, the market must be bearish enough to engulf the bullish trend set up in the last trading session.

- You may get a bit distracted in order to make some fast profits, you must strictly stick to the rules mentioned above to stay profitable in the trade.

Also Read : What is Bullish Engulfing Candlestick Pattern

How to trade a bearish engulfing pattern?

A trader should always be on the prospect for trade confirmation by using indicators, key levels of support and resistance, or any other technique that will support or invalidate a trade. Here are the details on how to trade a bearish engulfing candle.

When to Entry: a trader can wait for a close lower than the low of the bearish candle or simply place an order below the low of the bearish candle.

Placing Stop-loss: A stop loss can be placed above the recent swing high as this would cancel the movement and provides a sensible risk to reward ratio.

Target to make a profit: As bearish engulfing candles can indicate the beginning of a continued downtrend, it is helpful to acknowledge an initial take-profit level while remaining open to further downward movement. You can adjust the stop-loss accordingly or it is better to use a trailing stop.

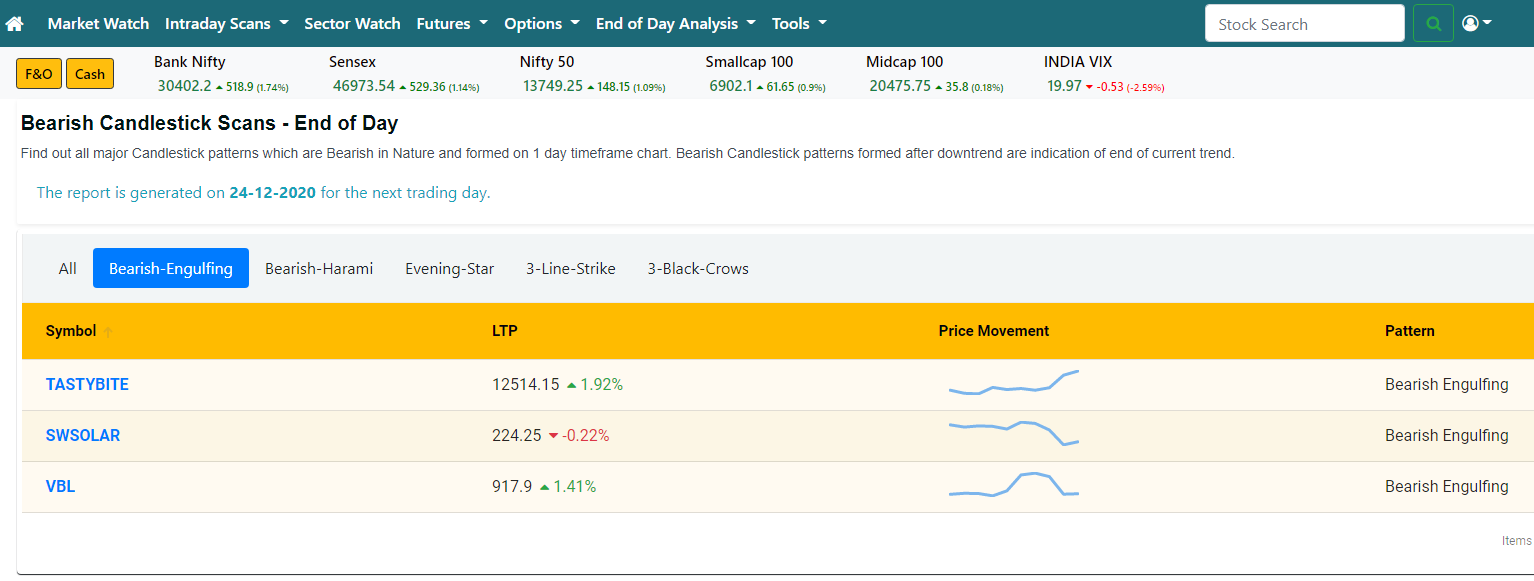

How to find Bearish Engulfing pattern – Candlestick pattern screener

You can find candlestick pattern screener online very easily by using Intradayscreener.com EOD analysis Candlestick screener. However make sure you use this screener along with price trend since bearish engulfing works only after an up move for few days

Conclusion

Engulfing candlestick patterns are composed of two bars on a price chart. They are used to indicate a market reversal. It is not recommended to trade the Bearish Engulfing pattern in isolation as you must consider the trend, market structure, etc. You can combine the Bearish Engulfing pattern with the market structure to recognize high probability trading setups.

Recommended Brokers

| No 1 STOCKBROKER IN INDIA Zerodha Free equity & mutual fund investments | Flat ₹20 intraday and F&O trades | Rating ★★★★★ | APPLY NOW |

| GET FREE DEMAT ACCOUNT Upstox Fix brokerage of Rs. 20 per trade | Rating ★★★★ | APPLY NOW |

| GET FREE DEMAT ACCOUNT Angel Broking 0 Brokerage on Equity Delivery | Rs 20 per order for Intraday and F&O trades | Rating ★★★★★ | APPLY NOW |

Leave a Reply