Intraday Trading remains one of the most popular forms of trading to date. However many people are unsuccessful in intraday trading because they don’t follow any fixed strategy and take trades in their own mood.

Let’s understand some of the most popular Intraday Trading strategies for beginners which can help you successfully earn money from stock markets.

Before learning the strategies, let me tell you another very important factor that determines your success in intraday trading – Risk management and Money management. The strategy will only help you generate consistent returns if you are managing your risk and following trading rules

Table of Contents

Best Intraday trading strategies for beginners

Here is the 5 Best Intraday trading strategies for beginners

#1 Intraday Trading Strategies – Open High Low Strategy

Open high low strategy is one of the easiest and best intraday trading strategies for beginners to start with. Although the accuracy rate varies from 50-70%, if done with proper risk management and money management, this strategy can help you succeed in Intraday trading.

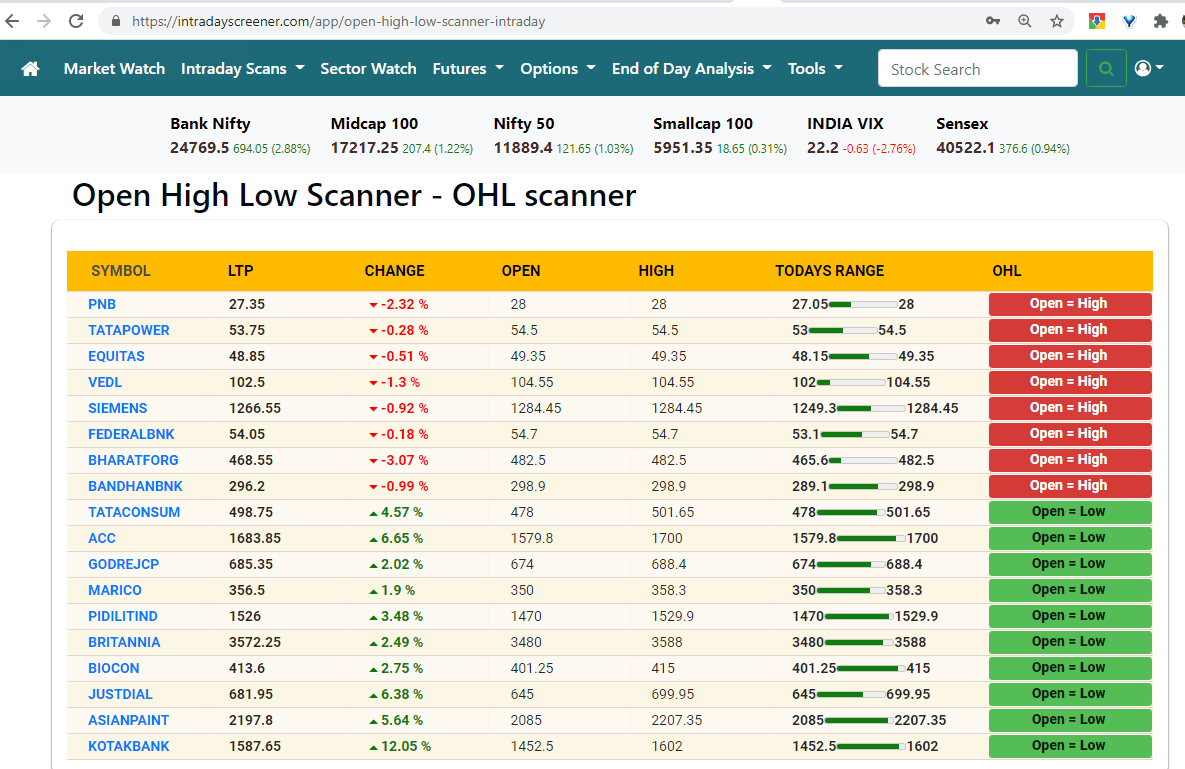

According to the OHL strategy, we wait for 10 minutes after the market opens and then check for stocks where open is equal to high or open is equal to low for the day. When open = high for the day after 10 minutes, this means that stocks started falling with high selling pressure as soon as the market opened.

Also stock has not crossed the highest point of the day after 10 minutes which will naturally act as resistance for it. Such stocks are candidates for short selling and should be shorted around VWAP (volume-weighted average price)

Similarly, when Open = low, this means that buyers started buying that stock as soon as it opened and if even after 15 minutes open is equal to low, it means that low point has not been breached for the day. Such stocks can be bought for the day keeping days low as to stop loss. However, make sure you buy it around VWAP and not very far away from VWAP.

You can find many screeners for open high low strategy but our favorite is IntradayScreener.com ‘s Open high low scanner that can be accessed here. It gives you open high low stocks with dats range as well as volume-weighted average price (VWAP).

#2 Intraday Trading Strategies – Moving Average Crossover Strategy

Moving average crossover strategy is another great beginner intraday trading strategy. A moving average crossover occurs when two different moving average lines cross over one another.

Moving average crossover strategy is based on the simple fact that smaller moving average will follow price faster than big moving average (for example 5 SMA will follow price faster than 20 SMA) and when crossover happens, we can have a small trend formation till reverse crossover happens.

Since we understand that moving averages are a lagging indicator, the crossover strategy will exactly not capture exact tops and bottoms. But it can help you identify the formation of trend and take trade-in that direction

Let’s understand this by example. on 15 minutes timeframe of Nifty below, we can see 5 SMA (red line) and 20 SMA (blue line). When 5MA crosses 20MA from above (negative cross), we have a sell signal. We initiate a sell trade with let’s say .5% as Stop loss and 1% as a target. Exit can also be done if 5 MA crosses 20 MA from below (positive cross).

This is a very basic strategy that works well with trending stocks. So to make the signals accurate, we can have small filters like ADX more than 25.

If you don’t know what ADX is, you can read this article on What is ADX indicator and how to use ADX

The most common moving average combinations that are used by traders are below

5,20 for 15 minute and 5-minute time frame

50, 200 SMA for 1 day timeframe

#3 Intraday Trading Strategies – Breakout Trading Strategy

Breakout trading strategy is one of the most popular day trading strategies which can help to select good intraday stocks. In this strategy, we focus on stocks that move above or below specified levels with an increase in volumes.

These levels are called support and resistance levels and once the price moves above resistance levels, it continues to go up. Similarly, if the price falls below support levels, then you can take a short position in the stocks assuming the price will move downwards.

Another easy day trading strategy based on breakout trading strategy is the range breakout trading strategy. Example stocks that are breaking the 30-day range with high volumes can show good movement in intraday and positional trading.

Once the stock price starts trading and sustaining above 30 days or 90-day highs and low with volume additions, volatility expansion stakes place and further buying or selling will happen to cause stocks to move up and down.

How to select stocks for Breakout Trading Strategy?

You can use Intradayscreener.com for selecting stocks that are breaking out of a range in markets. When such stocks which are breaking out of range occurs with an increase in open interest and increase in volumes, a further move can happen. Click here to visit Intradayscreener.com and access range breakout scanner

#4 Intraday Trading Strategies – Momentum trading strategy – trend trading

Momentum trading strategy is one of the best intraday trading strategies that should be followed by beginner’s intraday trading strategies. This is one of the best intraday trading strategy which has a high chance of success.

Momentum trading means finding out stocks that are moving for the past few days or weeks. Such stocks keep on moving unless clear reversal signs happen. If we catch such stocks early, we can ride the trend and make profits out of these stocks.

In the above example, you can see when the bank nifty broke a resistance level and took momentum, it went much higher. Such trades are called momentum trade where we catch such moves and ride these movements. You can also use a 50 period simple moving average to make sure that the momentum or trend is intact .

#5 Intraday Trading Strategies – Pullback trading strategy

Pull back trading refers to a trading style in which we enter stocks on correction or pullbacks. When a stock is moving in an Uptrend or downtrend, it will have small moves which will be opposite to the direction of the major trend.

For example, if a stock is moving in an uptrend, it may occasionally pull back and show some correction before resuming its major trend. Similarly is a stock is falling, it may show some bounce back and then resume its downtrend move.

Pull back trading refers to a trading style in which we catch the stocks on correction (in an uptrend) or bounce back (in a downtrend).

Let’s understand it with the help of an example

Recommended Brokers

| No 1 STOCKBROKER IN INDIA Zerodha Free equity & mutual fund investments | Flat ₹20 intraday and F&O trades | Rating ★★★★★ | APPLY NOW |

| GET FREE DEMAT ACCOUNT Upstox Fix brokerage of Rs. 20 per trade | Rating ★★★★ | APPLY NOW |

| GET FREE DEMAT ACCOUNT Angel Broking 0 Brokerage on Equity Delivery | Rs 20 per order for Intraday and F&O trades | Rating ★★★★★ | APPLY NOW |

Leave a Reply