Table of Contents

Option Buying Vs Option Selling – Which is better.

Options are great tools for trading that helps you to play markets in any possible scenario. Options can be bought , Options can be sold or Combination of Buy and sell (option spreads) can be done in the markets. In this article let’s see whether we should prefer buying Options or whether we should prefer selling options.

Before we start this topic of Option Buying Vs Option Selling , we need to get a few things straight to help us understand this topic better.

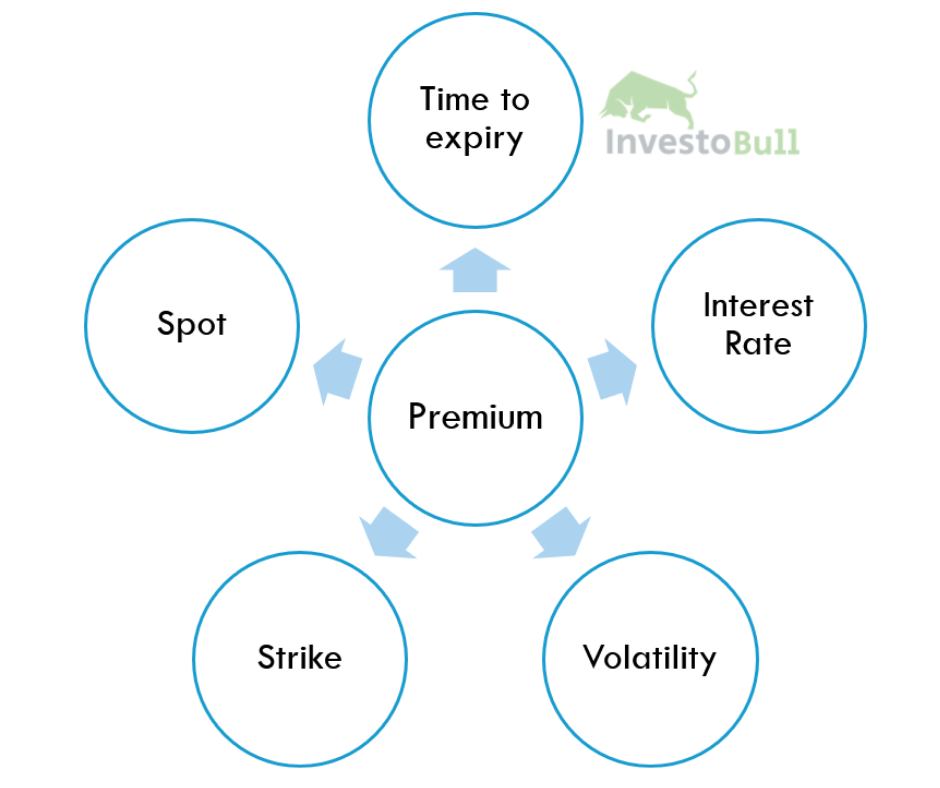

FACT 1 : Option Price changes with Direction , Volatility and Time.

FACT 2 : When you buy options, every passing day decreases your premium , hence hurting your profits . However , increase in Volatility helps to increase premium .

When you sell Options , Every Passing day will help you get more profit since premium decreases due to time. However Increase in Volatility will hurt you .

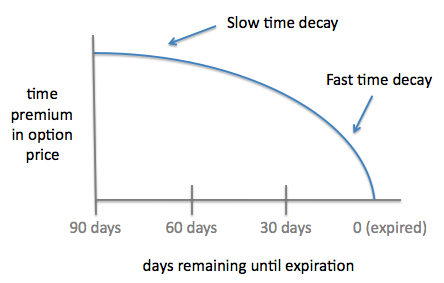

FACT 3 : Options premium decay over time – and decay is exponential as expiry approaches

When expiry has started and enough time is left , we can hold options for 2-3 days without much fall in premium due to time passing by if our directional view doesn’t go wrong .

80% of Options Expire Worthless – So Sellers make profits 80% of times!

FACT 4 : When Expiry is Near , we need a very fast and Impulsive Move to make profits .This is because Time value starts to falls very fast and unless we get premium benefit from directional move (delta) which is more than fall in premium due to time (theta decay) , we don’t get profits holding call.

Let’s take an example,Assuming Reliance is trading at 1940 rs and there are 2 days to expiry .

1950 call is trading at 10rs. Now we know that the whole 10rs is extrinsic value a (the value due to time) as this is Out the money call option and this will become zero on expiry day unless reliance moves above 1950.

So basically , if Reliance does not move at all and closes at same 1940, the next day Call option of 1950 will fall to something around 6rs . So basically 4 rs premium is reduced due to time. Now for it to open at 10rs itself, reliance needs to move to 1946may be so that the probability of it crossing above 1950 is high.

In short , we need big and fast directional moves to overcome loss due to time when near expiry. When expiry is far , we don’t need such a move as the decrease in premium due to time is less.

What happens when you Buy Options

When we buy Options , Decay in option premium always hurts us. So our Best case scenario to make profits should be

1> Buy Option at start of Expiry –

When we buy Options at the start of expiry , we can hold options for 5-6 days as Decay in premium due to time is very less. Main change in price will come due to Delta , which is a directional move. So unless our direction does wrong , we may not make loss. Example trading in monthly expiry.

2>Buy Options at End of Expiry –

When we buy Options near the expiry , Theta decay works against us. Hence unless we are not convinced of a strong directional move (highly bullish) that will overcome decrease in option premium due to time, we should not buy option.

What happens when you SELL Options

When we sell Options , Decay in option premium always benefits us. Option sellers mainly want to benefit from fall in extrinsic value than gain due to directional value . Let’s consider two scenarios and how does it impact premiums if we sell options in these scenarios

1> Sell Option at start of Expiry –

When we sell Options at the start of expiry , we can hold options for 5-6 days as Decay in premium due to time is very less. Main change in price will come due to Delta , which is a directional move. So unless the market remains range bound , Option sellers may not make profits due to fall in premium due to time decay . Example trading in monthly expiry. If you sell options on a monthly expiry start , negative side movement will hurt you.

2>Sell Options at End of Expiry –

When we sellOptions near the expiry , Theta decay works for us. Hence , decrease in option premium due to time will happen very fast and unless a big directional move comes against us (sellers position) , nothing will happen . Most option sellers get active very near to expiry and try to make benefits from fast decay in price.

Margin Requirements For Option Buying And Selling

For Naked option Selling , Margin requirement is very high. Around 1.2 lakh is required to sell 1 lot of Nifty and hold it . However Margin requirement comes down if you hedge positions with further OTM option buying as hedge. Example if you sell 10800 call and buy 11000 call , margin will be reduced to half.

Margin requirements can be further bought down by pledging your long term holding , Bonds etc as collateral .

For Option buying , margin requirement is just the premium of the option . Example if price of 10800Call option is 100rs , you need to pay lot size* 100 . Assuming lot size as 75rs , total premium is 7500 rs .

Risks in Options Buying and Options Selling vs Probability of profits

When you buy an option , your Profits and Unlimited while your loss is limited. Probability of profit depends on whether you buy In the Money , Out The Money or AT the Money Options. Deep In the money options have the highest probability of profits. At the Money has approx 50% probability and as we go further Out the money , probability decreases.

When you sell an Option , Your risks are unlimited. Probability of profit depends on whether you sell In the Money , Out The Money or AT the Money Options. When you sell OTM options( 99% sellers do this) you have a high probability of success. When you sell an ATM option ,you have approx 50% probability of success .

However whenever you have high probability , you have low profit potential . That why selling OTM options are high probability trades but profits are less.

Shall We Buy Or Sell Options ?

Statistically speaking , 80% of the options expire worthless. So ideally Option selling appears to have more probability of winning. However out of 10 trades , you may win in 7 trades by selling naked options and getting a small premium as profits. When one trade goes against you , you may lose all profits gained in the last many trades or even More. So though Selling options appears to be highly successful at first glance , however one loss may blow up whole account.

Payoff looks like below often unless Seller is Expert at adjusting options.

+10 , +12, +14,+18 ,+20, +10 , +14 , -200

Also margin requirements in Option selling is very high , since you have unlimited risk

Option Selling has Edge

When you sell an option near the expiry , you always will have an edge unless the market moves against you and volatility Increases. So We look to sell options when volatility in the Market is expected to remain the same or decrease, and markets are either neutral or going in the opposite direction than our position.

Example when Nifty is at 10700 and I have sold PUTS of 10600 strike with 2 days left to expiry, i will make money even if Nifty remains sideways and time passes or if Nifty goes up with time.

Now shall we buy or sell options then?

Well Answer depends on few conditions.

If Expiry is far and you have a Mild or Strong directional view, Buy Options

Example if Nifty is at 10700 and you feel nifty will go to 10800 above, you can buy 10800,10900 etc call options

If Expiry is near and you have directional view , Buy only ATM options that too when you expect markets to move fast in your direction

Example if Nifty is at 10700 and you expect nifty to fall to 10500 in next 2 days, you can buy 10700PE

If Expiry is near and you have Neutral view, sell options

Example if Nifty is 10700 and 2 days to expiry . You think Nifty will remain in 10680 to 10750 , sell 10600 Put

If expiry is near and you have a directional view , sell options which give profits in the reverse direction.

Example if nifty is 10700 and you expect Nifty to go up – sell 10600PUT .You will gain due to directional move as well as time decay.

Hope this article helps you in deciding when to buy and when to sell options. Lets summarize our learnings with help of an example

Summarizing with an Example

Let’s try to summarize our learnings with help of a table below representing a few scenarios.

Example when NIFTY is at 10700

| Expiry | Directional View | Volatility Expectation | Option Trade |

| Near | Very Strong Bullish | Increase | Buy 10700 Call Option |

| Near | Very Strong Bearish | Increase | Buy 10700 Put Option |

| Near | Neutral to Bullish | Decrease | Sell 10600 Put Option |

| Near | Neutral to Bearish | Decrease | Sell 10800 Call Option |

| Far | Mildly Bullish | Neutral to Increase | Buy 10800 Call Option |

| Far | Mildly Bearish | Neutral to Increase | Buy 10600 Put Option |

Recommended Brokers

| No 1 STOCKBROKER IN INDIA Zerodha Free equity & mutual fund investments | Flat ₹20 intraday and F&O trades | Rating ★★★★★ | APPLY NOW |

| GET FREE DEMAT ACCOUNT Upstox Fix brokerage of Rs. 20 per trade | Rating ★★★★ | APPLY NOW |

| GET FREE DEMAT ACCOUNT Angel Broking 0 Brokerage on Equity Delivery | Rs 20 per order for Intraday and F&O trades | Rating ★★★★★ | APPLY NOW |

This is the Best informative article i have seen on Options buying vs selling. Very insightful, thanks

Sir Which price should we select for Option Selling ?

Best documents for options.. Thanks..