One of the most popular indicators used in modern-day trading to book more profits is RSI or Relative Strength Index. RSI is a leading indicator that is used to predict where to buy and sell the shares to get the maximum profit. By using this simple technical analysis tool, you can double your accuracy and get good results.

Table of Contents

What is RSI?

The Relative Strength Index is a momentum oscillator which helps to calculate the speed and price movements. The RSI is developed by J. Welles Wilder. It oscillates between zero and 100.

If the RSI is above 70 then it is considered as overbought and when it is below 30 then it is considered as oversold. As the stock moves up and down , its RSI values oscillates between 0 and 100 and indicated strength of movement

Know the detailed information on What is ADX indicator and how to use it in trading

What are the Uses of RSI?

RSI is one of the most widely used indicators which is used to gauge relative strength of markets or stocks. The Relative Strength Index can be applied to identify overbought shares and helps to book profits.

RSI can indicate oversold stocks where short positions should be booked or fresh entry for reversal move can be taken.

Remember RSI being oversold doesn’t necessarily mean that next day stock is going to reverse and move up. RSI being oversold means you should now look for opportunities for buying stocks at support.

Similarly, when RSI is overbought, it means that we should look to book profits, or look for fresh shorting opportunities rather than buying when RSI is at overbought levels.

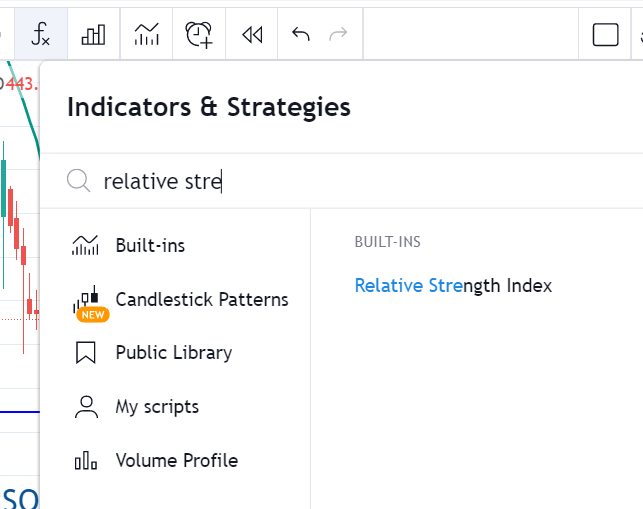

How to add RSI in charts

Most of the modern trading and charting platforms have RSI built in by default. You need to simply go to the indicators section and select Relative strength Index (RSI) and it will be plotted with default period value of 14. We should keep period value to default of 14, ie 14 period RSI

Know the detailed information on What is Moving Average Indicator and how to use it best for trading in Stock market

How to Interpret RSI on different timeframes

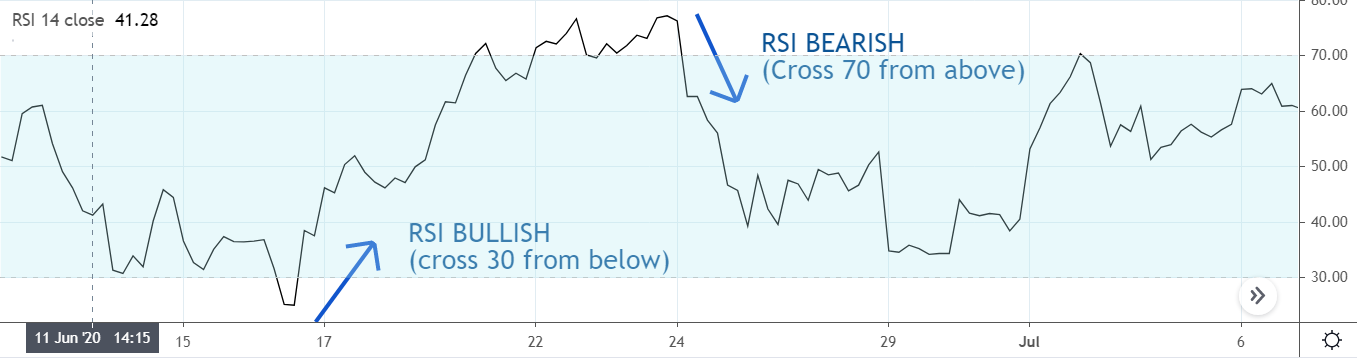

The first and foremost Rule to work with RSI is to understand the levels and zones and how RSI indicator is crossing those zones.Example in below chart, RSI is plotted and 30-70 levels are highlighted

Whenever RSI crosses from below and increases, it means RSI is getting bullish and relative strength of security is increasing. Stock will be gaining momentum whenever RSI crosses from above and decreases, it means RSI is getting bearish. Stock will be losing momentum then RSI will be falling.

RSI is an indicator which can be used on all timeframes. However , its importance increases significantly on higher time frames, like daily, weekly and monthly. Below is the RSI inference on daily charts

| RSI INFERENCE | Daily Chart |

| Short term bullish movement | Cross above 30 from bottom and rising |

| Bearish movement | Cross Below 70 from top and falling |

| Overbought zones | RSI above 70 |

| Oversold zones | RSI below 30 |

| Bullish movement | Between 50-100 rising upwards |

| Bearish movement | Between 50-0 falling downwards |

How does the RSI indicator work?

- The RSI Indicator admitted as overbought when above 70 and oversold when below 30. These levels can also be adjusted if necessary to better fit the share value. Few traders use 80 and 20 as overbought and oversold regions respectively

- In an uptrend, the Relative Strength Index tends to remain in the 40 to 90 range with the 40-50 zone as support. In a downtrend of the share price, it tends to stay between the 10 to 60 range with the 50-60 zone as resistance. These ranges depend on the RSI settings and the market’s underlying trend.

- During strong trends, the RSI might remain in overbought or oversold for long times. However, there is a high possibility that stock may correct from overbought and oversold zones so we need to be careful while trading in these zones.

- It often appears as RSI chart patterns that may not show on the price chart like double tops and bottoms and trend lines. You must also have a look for support or resistance on the RSI.

- If the RSI fails to confirm when the new underlying prices make a different high or low then this change can signal a price reversal. In RSI, it is considered as a Top Swing Failure has occurred when the RSI makes a lower high and then follows with a downside move below a previous low. It is considered as a Bottom Swing Failure has occurred when the RSI makes a higher low and then follows with an upside move above a previous high.

Also Read : What is Supertrend Indicator and how to use it for Trading

How to Calculate RSI?

The basic formula to calculate the RSI is:

Relative Strength Index = 100 – [100 / ( 1 + (Average of Upward Price Change in period / Average of Downward Price Change in period ) ) ]

Example, for a 14 period RSI, we will see how much the average market moves up when an up move is there (in the last 14 period) and how much the market moves down on average when there are downside days (in the last 14 period).

A higher value of RSI indicates markets on average move higher than when it corrects , thereby indicating strength of the market.

How to buy a stock using RSI in Intraday

Kindly note that using RSI alone in trading and coming up with trading conclusions is not recommended. RSI must be coupled with Trend of stock and everything must be concluded in relation to trend.

Before buying a stock, we must analyze the trend of the particular stock in a weekly and monthly RSI chart. If RSI is above 50 in both the charts and stock is trending upwards, then we must buy the particular stock in intraday and daily charts within a 15 minute timeframe.

We can look for buying opportunities in the stock when it is oversold (RSI below 30) and then RSI crosses 30 from below and heads up , especially when price action points to a support

So basically, what we are doing here is checking that a stock is strong and having good relative strength on a large timeframe, however when corrections come in a small time frame, we use those corrections to enter stock.

How to sell a stock using RSI in Intraday

Before selling a stock, we must analyze the trend of the particular stock in a weekly and monthly RSI chart. If RSI is decreasing and is below 50 in both the charts then we must sell the particular stock in intraday and daily charts.

We can sell on bounces and when RSI in a smaller time frame crosses 70 from above. It is advisable the difference between stop loss and support must be 2% of the risk-reward ratio.

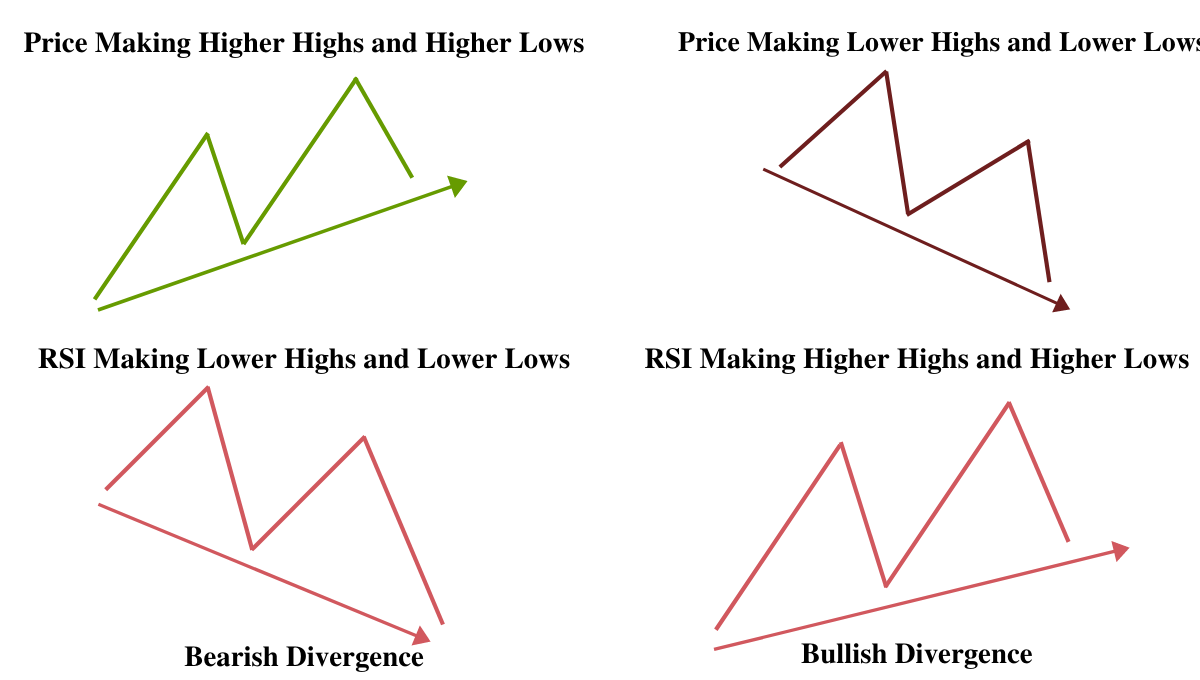

What is RSI Divergence

Many times, we see that RSI indicator moves opposite to direction of price on charts. Example , we can see stocks making higher highs and higher lows but RSI indicators will be making lower highs and lower lows. Such phenomenon is called Divergence and indicates that the trend of price may reverse.

Types of RSI divergence

There are two types of RSI divergence – Bullish and Bearish

Bullish RSI Divergence

In Bullish RSI divergence , we can see price making lower highs and lower lows (downtrend) while RSI will be making higher highs and higher lows. Such a pattern is usually followed by a bullish move and the price starts moving up.

BEARISH RSI Divergence

In Bearish RSI divergence , we can see price making higher highs and higher lows (Uptrend) while RSI will be making lower highs and lower lows (Downtrend). Such a pattern is usually followed by a bullish move and the price starts moving up.

RSI Double top and Double bottom?

When the market trend makes a double trend above the 70 lines then there is a possibility of a strong bearish trend reversal, it is known as RSI double top.

When the market trend makes a double trend below the 30 lines then there is a possibility of a strong bullish trend reversal, it is known as RSI double bottom.

Conclusion

The Relative Strength Index is the most popular and simple to use in trading. The RSI has the ability to indicate whether prices are trending when a market is overbought or oversold, and the best price to enter or exit a trade.

Recommended Brokers

| No 1 STOCKBROKER IN INDIA Zerodha Free equity & mutual fund investments | Flat ₹20 intraday and F&O trades | Rating ★★★★★ | APPLY NOW |

| GET FREE DEMAT ACCOUNT Upstox Fix brokerage of Rs. 20 per trade | Rating ★★★★ | APPLY NOW |

| GET FREE DEMAT ACCOUNT Angel Broking 0 Brokerage on Equity Delivery | Rs 20 per order for Intraday and F&O trades | Rating ★★★★★ | APPLY NOW |

Leave a Reply