Table of Contents

What is Bear Call Spread?

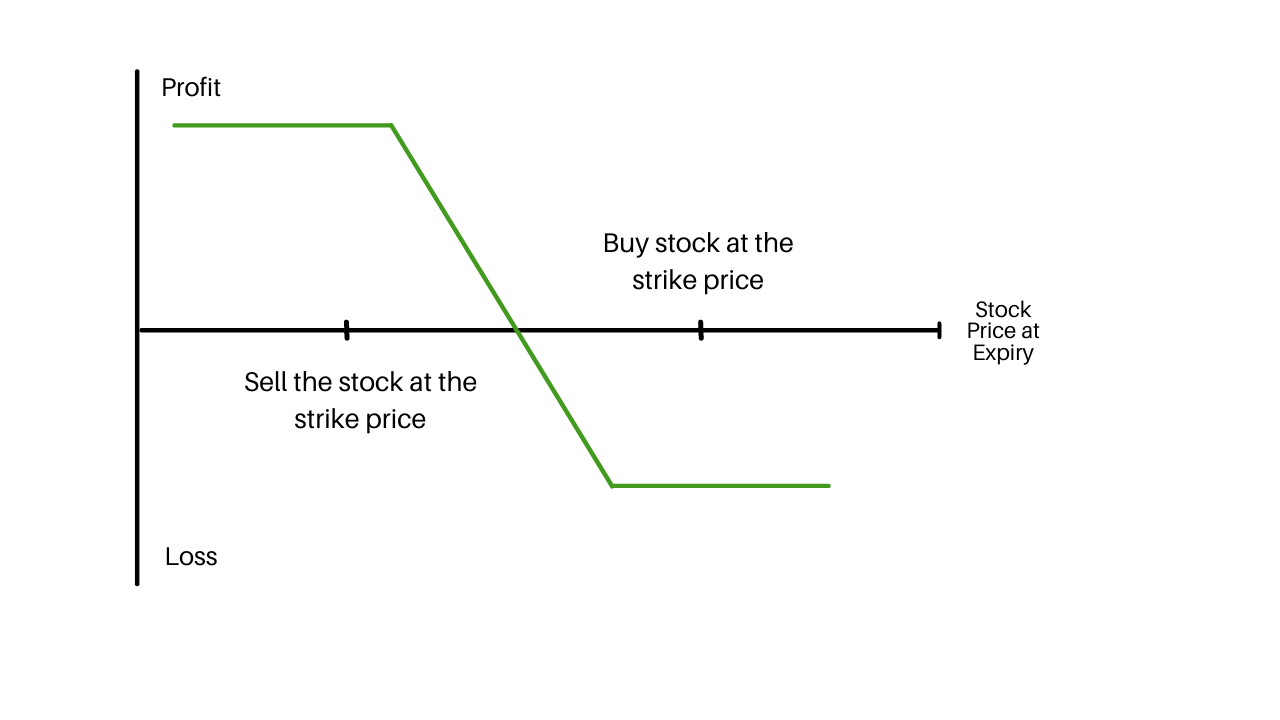

The bear call spread option trading strategy is applied when the options trader assumes that the price of the underlying asset will fall down slightly in the near term.

Bear call spread can be achieved by buying out the money call options of a specific strike price and selling the same number of in the money call options of lower strike price on the same underlying security expiring in the same month.

The bear call spread strategy is also known as the bear call credit spread as a premium is received upon entering the trade.

Related Post: Bull Call Spread – Option trading strategy

Profit in the bear call spread

The maximum profit achievable using the bear call spread options strategy is the premium received upon entering the trade.

The stock price needs to close below the strike price of the lower striking call sold at the expiration date where both options would expire worthlessly to reach the maximum profit.

You can calculate the maximum profit in the bear call spread by using the formula below

- Maximum Profit in the bear call spread= Net Premium Received – Commissions Paid

- Maximum Profit obtained When Price of Underlying <= Strike Price of Short Call

Related Post: Bear Put Spread – Options trading strategy

Risk in the bear call spread

The bear call spread strategy bears a maximum loss if the stock price moves above the strike price of the higher strike call at the expiration date.

It is equal to the difference in strike price between the two options minus the net premium taken in when entering the position.

You can calculate the maximum loss in the bear call spread strategy by using the formula below

- Maximum Loss in the bear call spread = Strike Price of Long Call – Strike Price of Short Call-Net Premium Received + Commissions Paid

- Maximum Loss happens When Price of Underlying >= Strike Price of Long Call

Breakeven Point for the bear call spread

The price at which break-even is obtained for the bear call spread position can be calculated by using the formula below.

- Breakeven Point for the bear call spread= Strike Price of Short Call + Net Premium Received.

The margin requirement is the difference between the strike prices.

How to make Bear Call Spread Strategy?

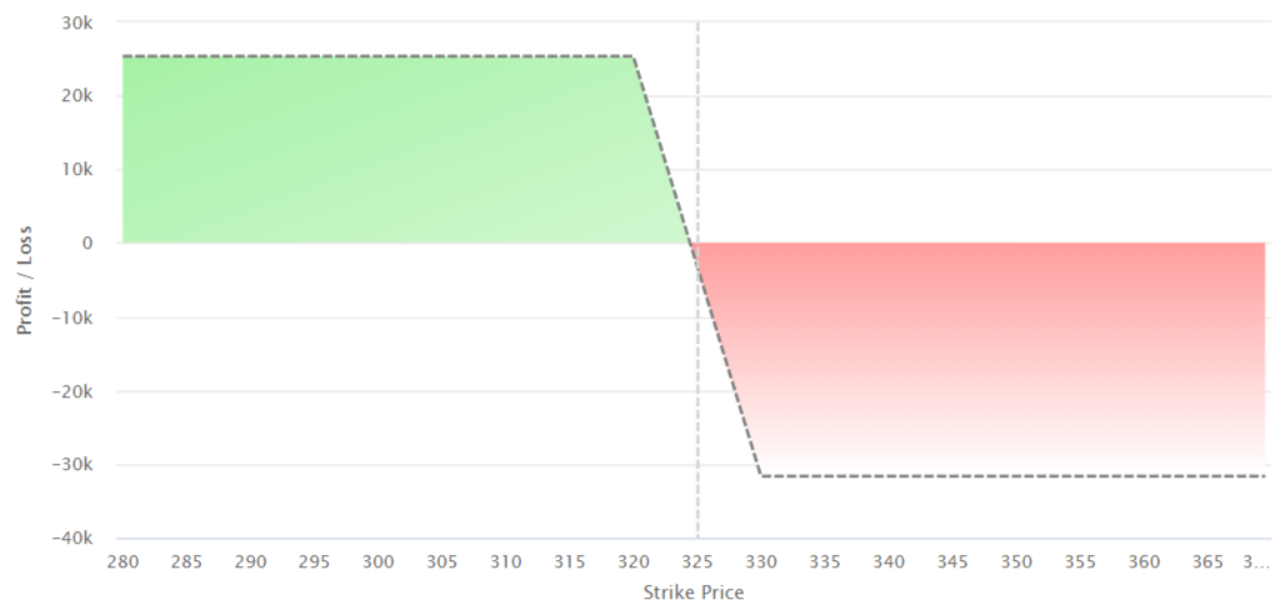

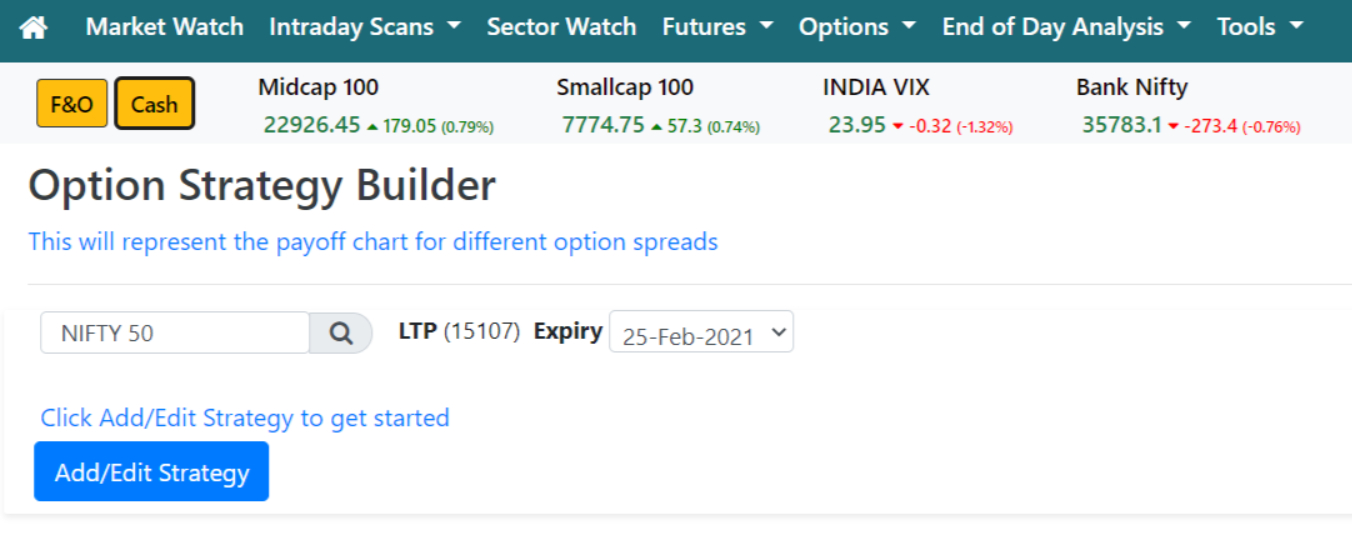

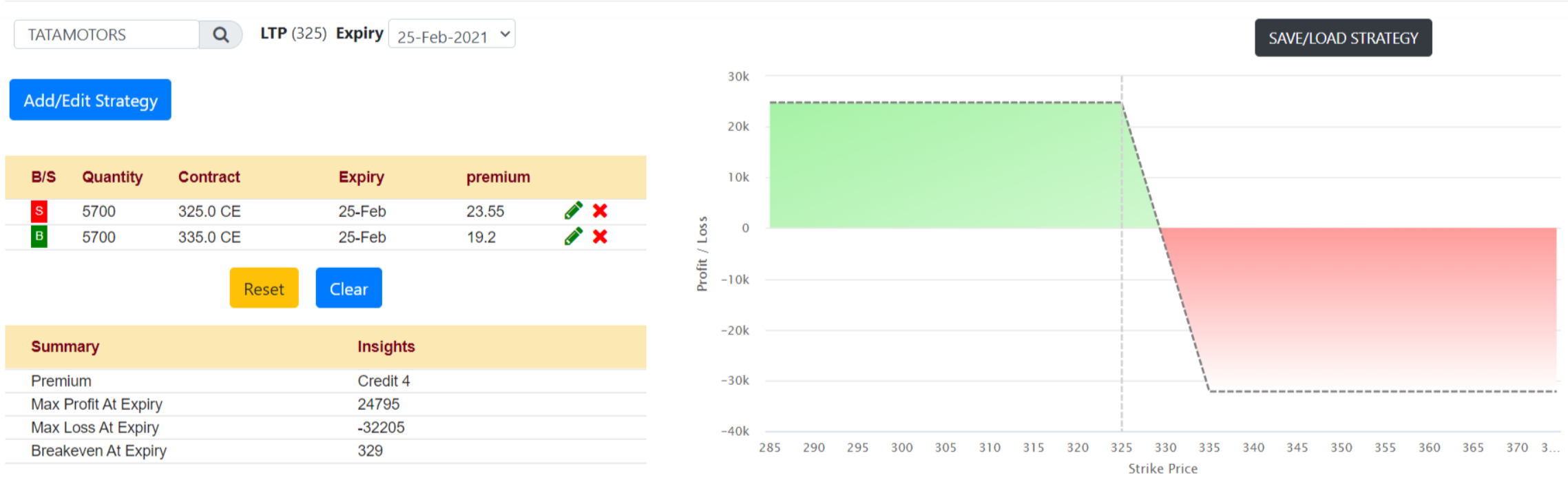

Using Options strategy builder in intradayscreener.com, you can easily build an option strategy for a bear call spread.

Step 1: You just need to select the indices and expiry date (one sell call option and one buy call option) and click on add/edit to get started.

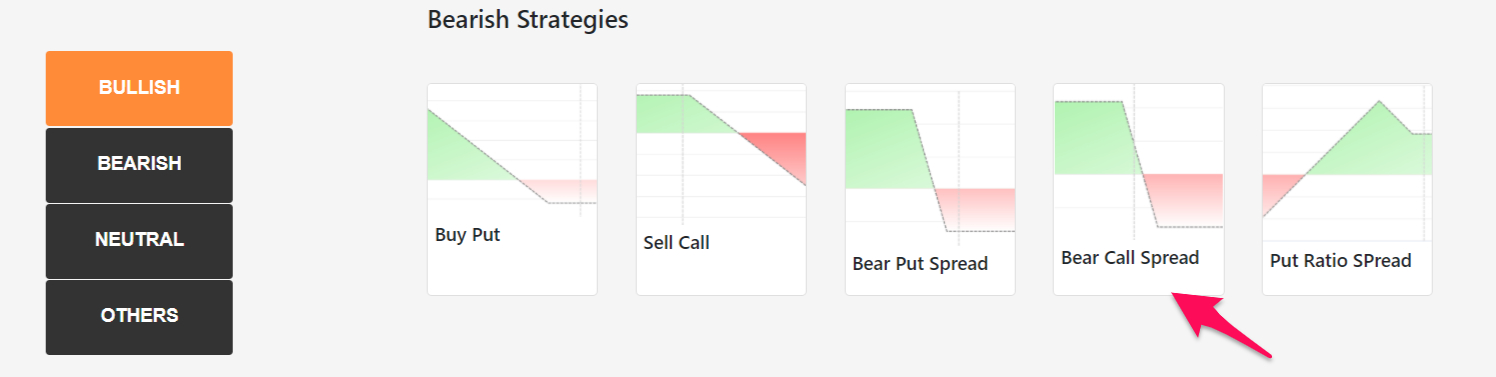

Step 2: Click on the Bear call spread strategy below.

Step 3: You will get detailed information on the option strategy like Premium, Max profit at expiry, Max losses at expiry, Breakeven at expiry, and a Bear call spread graph.

Bear Call Spread – Example

Let us take an example of Tata motors with the strike price of 325, sell a call option, and buy a call option given in the table below

| Action | Type | Strike price | Premium |

| BUY | CE | 335 | -19.2 |

| SELL | CE | 325 | 23.55 |

In bear call spread, you need to sell one In-the-money call option which is 325 and the premium received is 23.55 and buy one out-the-money call option which is at 335 with a premium paid is 19.2.

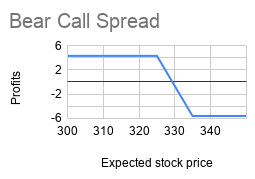

| Expected stock price | 335 CE BUY | 335 CE Prem Paid | 335 CE BUY Net Profit | 325 CE SELL | 325 CE premium received | 325 NET CE SELL | Expected stock price | BEAR CALL PAYOFF |

| 300 | 0 | -19.2 | -19.2 | 0 | 23.55 | 23.55 | 300 | 4.35 |

| 305 | 0 | -19.2 | -19.2 | 0 | 23.55 | 23.55 | 305 | 4.35 |

| 310 | 0 | -19.2 | -19.2 | 0 | 23.55 | 23.55 | 310 | 4.35 |

| 315 | 0 | -19.2 | -19.2 | 0 | 23.55 | 23.55 | 315 | 4.35 |

| 320 | 0 | -19.2 | -19.2 | 0 | 23.55 | 23.55 | 320 | 4.35 |

| 325 | 0 | -19.2 | -19.2 | 0 | 23.55 | 23.55 | 325 | 4.35 |

| 330 | 0 | -19.2 | -19.2 | -5 | 23.55 | 18.55 | 330 | -0.65 |

| 335 | 0 | -19.2 | -19.2 | -10 | 23.55 | 13.55 | 335 | -5.65 |

| 340 | 5 | -19.2 | -14.2 | -15 | 23.55 | 8.55 | 340 | -5.65 |

| 345 | 10 | -19.2 | -9.2 | -20 | 23.55 | 3.55 | 345 | -5.65 |

| 350 | 15 | -19.2 | -4.2 | -25 | 23.55 | -1.45 | 350 | -5.65 |

By using the above calculation in the table, we can plot the payoff diagram for the bear call spread.

Bear Call Spread – FAQs

How do you adjust a bear call spread?

The first adjustment is to turn the bearish call spread into an iron condor. Sell the corresponding put spread below the market, also $3 wide and the same number of contracts. When you mirror the bearish call credit spread it adds no additional margin or risk to the position.

How does call spread work?

A call spread is an option spread strategy that is created when equal number of call options are bought and sold simultaneously

Recommended Brokers

| No 1 STOCKBROKER IN INDIA Zerodha Free equity & mutual fund investments | Flat ₹20 intraday and F&O trades | Rating ★★★★★ | APPLY NOW |

| GET FREE DEMAT ACCOUNT Upstox Fix brokerage of Rs. 20 per trade | Rating ★★★★ | APPLY NOW |

| GET FREE DEMAT ACCOUNT Angel Broking 0 Brokerage on Equity Delivery | Rs 20 per order for Intraday and F&O trades | Rating ★★★★★ | APPLY NOW |

Leave a Reply