Swing trading is a short term trading method that can be used to trade stocks and derivatives. In swing trading, positions are held for a duration of 2 days to a few weeks depending on the preference of the trader. Swing traders utilize technical analysis of stocks with short term price movement. These traders generally use the fundamental values of the stocks and combine it with the price trends and patterns.

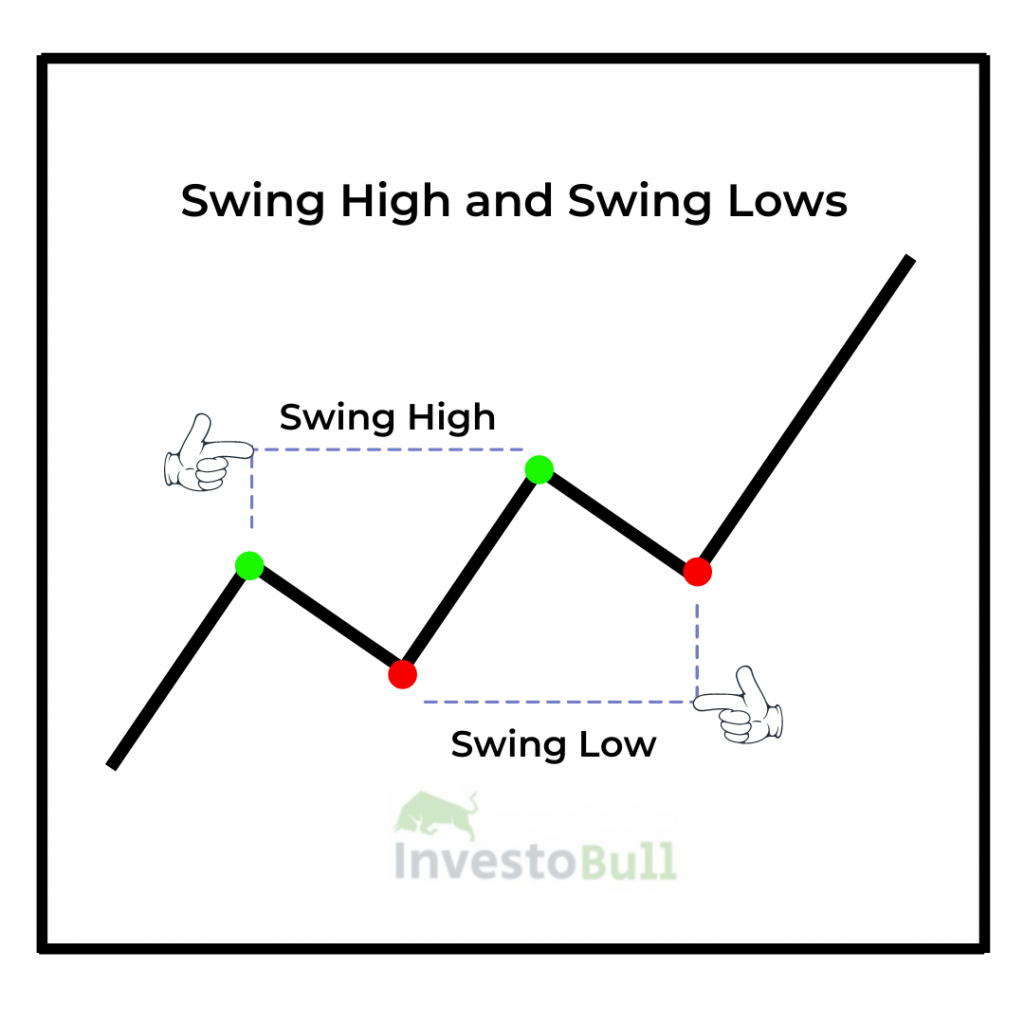

Swing traders can take the position in two ways

- Buy at swing lows and sell at swing highs

- Short sell at swing highs and cover at swing lows

Table of Contents

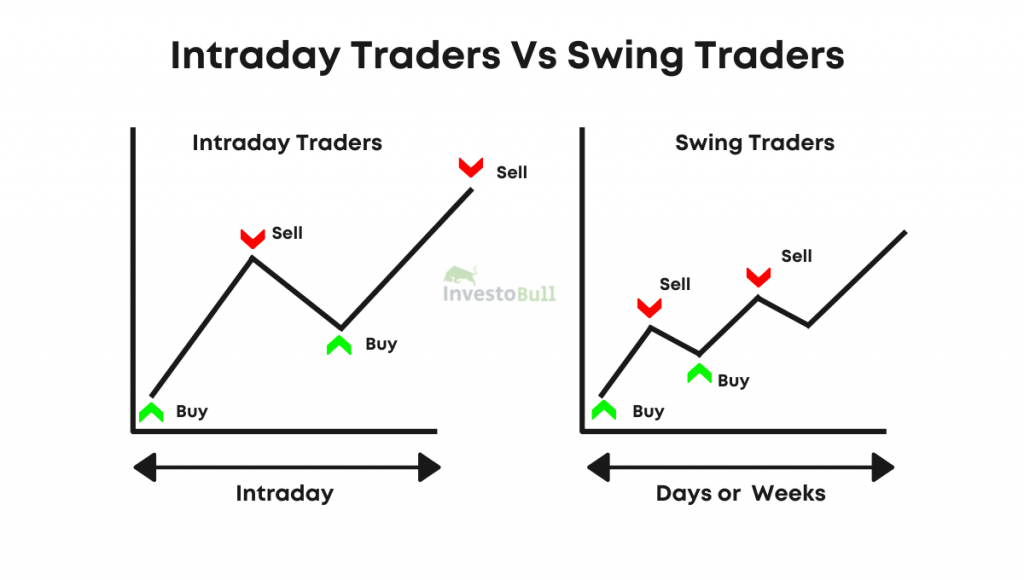

Difference between swing trading and intraday trading

Intraday trading refers to buying and selling on the same day. Intraday traders don’t carry positions overnight. While swing trading means capturing movement from swing lows to swing highs(and vice versa) . Swing trading can last from 2-3 days to 2-3 weeks as well. We buy and hold positions(in cash or futures options) till our targets achieved.

Swing trading is more of buy and hold stocks. The holding period is the main difference between swing trading and intraday trading. For day trading you have to square off the position on the same trading day but in swing trading the position can be held for two days to a few weeks.

Things to be considered in swing trading

Before you enter the world of swing trading, you need to have a plan that will give you success. This means you need to develop a well-balanced strategy and find a tool that allows you to perform your trading efficiently. Swing trading requires solid planning.

Here are a few things to be considered while creating a plan for swing trading.

Set up

Swing trading is based on Technical analysis. Therefore, a set up is described as a chart pattern that indicates a high risk/reward ratio. You can also include technical indicators into ideal setup. There is no perfect set up. You need to define setups that you understand and are comfortable with. If once you fix your unique setup, you have to create a plan for finding these setups.

Most common Swing trading set is pullback entry setup. Here we identify a trending stock and then wait for a pullback to enter into stock. Example , for an up trending stock , we wait for small correction to take entry at supports.

Time Frame

Choosing a time frame for your trades is very important. As it will help you to decide which type of setups to trade and which chart timeframes to analyze.Usually in Swing trading , we use hourly or daily timeframe. Unlike Intraday where smaller time frames like 5min,15min are used, we use larger time frames like hourly and daily.

Trade Management

Once you have planned your ideal setups and time frames, you need to start focusing on the actual trades.

Example:

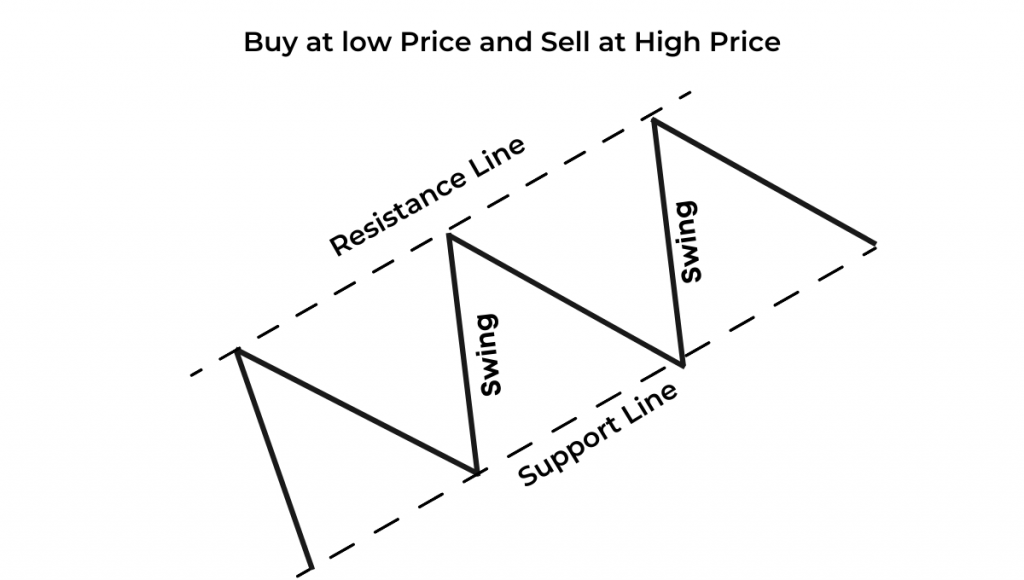

If you are willing to buy the stocks, you have to take the position when it reaches a swing low as well as on support levels. It is always better to Buy at low price and sell at high price. Stop loss is mandatory in order to reduce risks.

You have to consider how you are going to handle the trade once you open a position. The most important part of this process is setting your risk and exit plan. When you are going to sell, if the trade goes against you, create this plan before you enter the trade. Having a plan for entries and exit can help you to take a more systematic approach to trade, which will minimize stress and add structure to your trading.

Swing Trading tools

Like any type of trader, a swing trader also requires tools. These tools are used for identifying and analyzing setups. Here is the list of tools which are mostly used.

- Charts – A candlestick chart is just a chart composed of different candles. Many traders use charts for the understanding of stock price movement. Candlestick charts show where the stock price is opened and closed for a period. It also shows the highs and lows of the stock price for a particular period.

- Trend Lines – Many traders frequently use the trendline to find the direction of the market trend. The trendline can be used in multiple for trading. Few people use it for drawing vertical support patterns. Trendline provides them with proper entry points to get in a trade. The market is bullish if the trendline is upwards and the market is bearish if the trendline is downwards.

- Support and resistance – Support is the point where stock will find buyers and will start going up. Resistance is a point where there will be more sellers than buyers and stock may start to go down.

How does Swing Trading work?

The goal of swing trading is to capture big price movements , also called swing moves . Swing traders use technical analysis to decide whether the swing price will move upwards or downwards. By analyzing technical indicators, intraday traders follow the stocks whose price actions have momentum and intimate the best times to purchase or sell.

For instance, other traders may wait ten months to get a 40% profit, while swing traders will earn 10% profits every week and beat the other trader’s earnings in the long term. Many swing traders use daily charts for entry and exit positions, and few more people will use short time frames such as hourly, 4 hours, etc.

Pros and Cons of swing trading

| Advantages | Disadvantages |

| Swing trading is a more comfortable style of trading that needs, less entering/exiting of positions. | Swing trading accompanies the risk of holding a position overnight. This means you have the risk if unexpected news can affect your position. |

| You allow traders to work out over a period of several days to several weeks. | You should attempt to decrease this risk by choosing appropriate position size and avoiding overnight holds when a news event is expected. |

| Swing trading is a great option for small traders who are new to market and want to trade with low risk than intraday trading | Swing traders let their positions ride out for days or weeks, it can be easy to get impatient and consistently monitor your position |

| Swing trading doesn’t require traders to sit behind a computer every day. | |

| Swing trading can allow you to profit from the market without constant monitoring. |

Swing trading can be implemented in two ways

System Trading: This trading is related to the automatic set of entry and exit rules

Discretionary Trading: In this trading, the traders take a set of technical tools and decide when to enter and exit based on market conditions.

Bullish and Bearish Swing trading

Bullish swing trade – Buy low and sell high in up trending stocks:

Market often goes into the Uptrend where it tends to form higher highs and lower lows. At the time of the bullish market, the buyers will be more when compared to sellers. So the share price will move up .

Bullish swing trade is done is such uptrending markets when stocks rise and then fall to support levels.Its here when swing traders get into stock at support levels and wait for stocks to move up again

Bearish swing trade- short sell on every rise for down trending stock:

Like an upward trend, Stock could be moving downward for various days, followed by an uptrend for a few days and then started moving downwards. In bearish swing trading, we find weak stocks and try to sell it every rise (at resistance) . We want to sell first and then buy back at a lower price to make profits.

FAQs

Which is the best timeframe to use for swing trading?

We cannot specify the best time frame in swing trading. It is always better to select the timeframe which you can trade continuously.

Which is the best way for entry and exit – support resistance, moving average?

We cannot specify, and everything depends on the market condition

If the market is in a bearish trend, then you can prefer support resistance.

If the market is in a bullish trend, then you can use the moving average.

So everything depends on the market condition.

What chart should I use for swing trading?

Swing trader, who concentrates on daily charts for stock selection, should use weekly charts to determine the primary trend and 60-minute charts to determine the short-term direction.

Can I short in swing trading?

Yes, Swing traders follow the market direction. If the market is in the uptrend, they will take a long position, and if the market is in a downtrend, they will take a short position.

What is a swing trading strategy?

Swing Trading is a strategy that concentrates on getting small profits in short term trends. Normally, swing traders hold their position from a few days to weeks, and they can hold their position for the long term.

Here are the few swing trading strategies which can create good returns

Trade with trends.

Make profits when market movement is upwards.

Identify how to enter your trade.

Recommended Brokers

| No 1 STOCKBROKER IN INDIA Zerodha Free equity & mutual fund investments | Flat ₹20 intraday and F&O trades | Rating ★★★★★ | APPLY NOW |

| GET FREE DEMAT ACCOUNT Upstox Fix brokerage of Rs. 20 per trade | Rating ★★★★ | APPLY NOW |

| GET FREE DEMAT ACCOUNT Angel Broking 0 Brokerage on Equity Delivery | Rs 20 per order for Intraday and F&O trades | Rating ★★★★★ | APPLY NOW |

Leave a Reply