Table of Contents

What is Iron Condor Strategy?

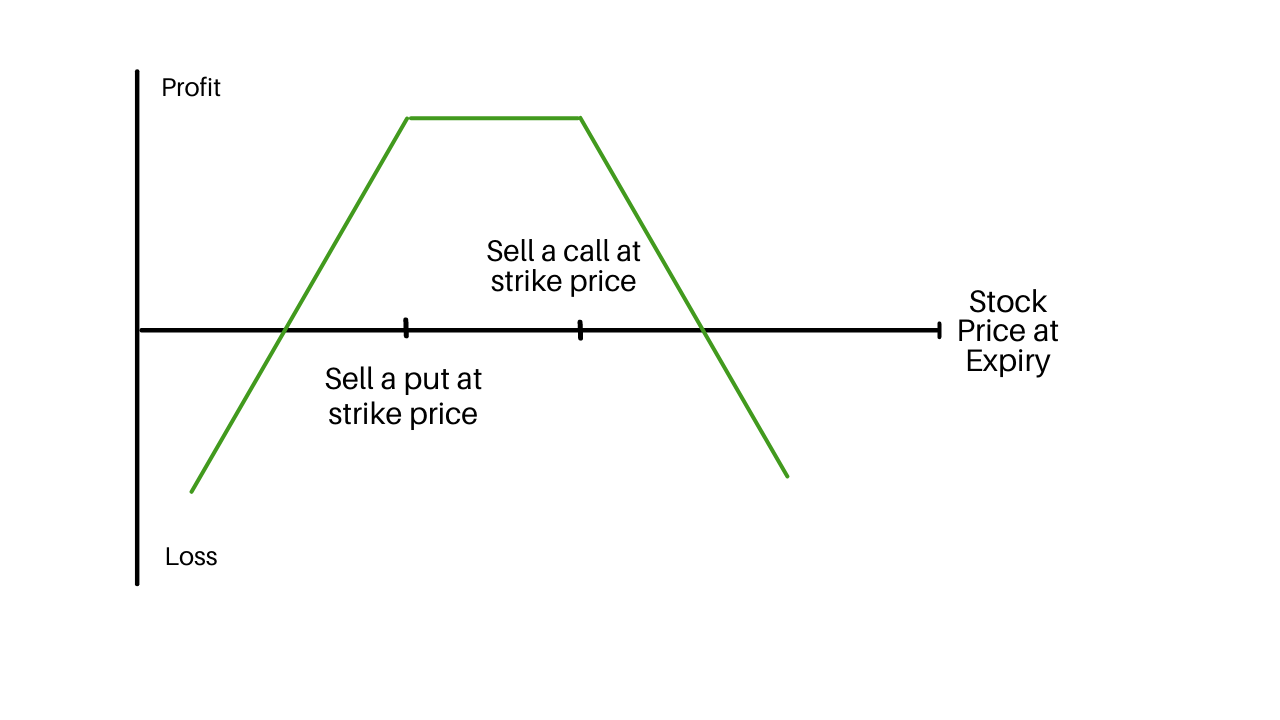

Iron Condor is an options trading strategy in which an options trader merges a Bull Put Spread and Bear Call spread to make a profit with a high chance of limited gain.

An options trader sticks to this strategy if he thinks that the market is going to be range-bound. The maximum profit in this strategy is equal to the net premium received settled for commissions.

The maximum loss that happens in this strategy is when the price of the underlying assets is higher than the strike price of the Long Call or when the price of the underlying assets is less than the strike price of the Long Put.

How does the Iron Condor Strategy work?

The iron condor strategy has limited upside and downside risk because the high and low strike options protect against significant moves in either direction.

Its potential to gain profit is also limited because of this limited risk. As there are four options involved in this strategy, the commission can be an important factor here.

There will be a nominal fee to close the trade if it is successful and if in case it is not successful, the loss is still limited. Buying an option gives the buyer a right, but not the obligation to acquire the security at a Strike Price within the expiry date.

If the Strike Price is lesser than the current market price of the underlying security, then it is said to have an intrinsic value. This means that the option buyer will find it worthy to utilise his right.

Limited Profit for an Iron Condor Option Strategy

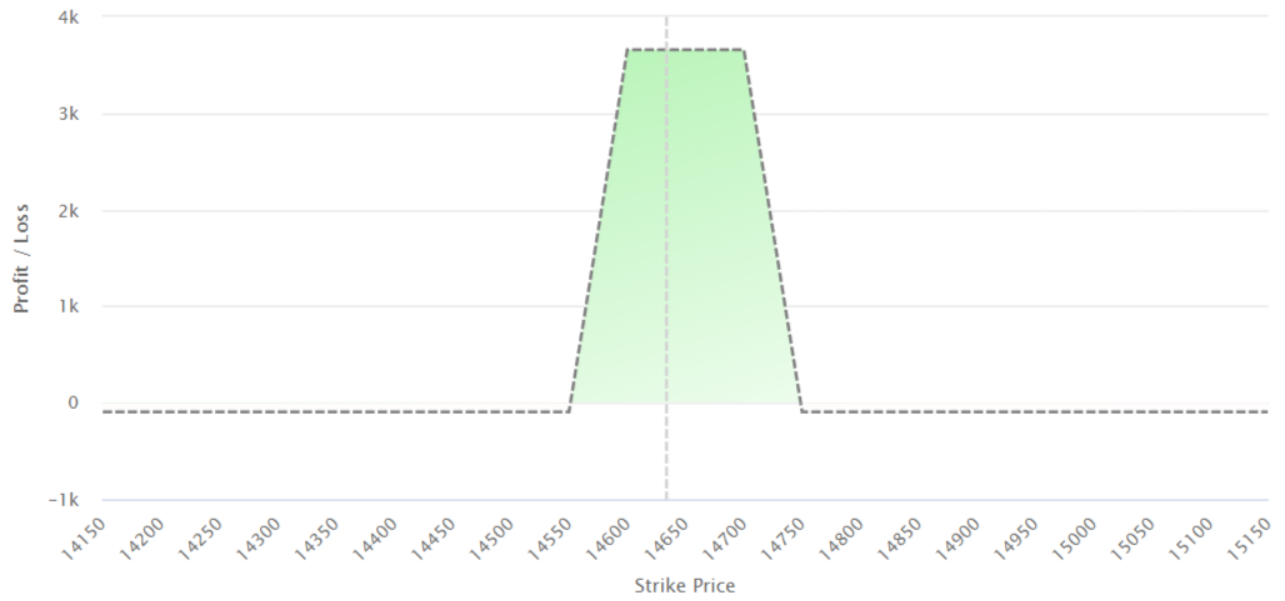

The maximum profit for this strategy is equal to the net premium received when entering the trade. Maximum profit is achieved when the underlying stock price at expiration is between the strike of the call and put sold.

The maximum profit can be calculated by using the formula given below:

- Maximum Profit for an Iron Condor Strategy = Net Premium Received – Commissions Paid

Limited Risk for an Iron Condor Strategy

The maximum loss for this spread is also limited but it is higher than the maximum profit. It happens when the stock price falls below or equal to the lower strike of the put purchased or rise above or equal to the higher strike of the call purchased.

The maximum loss occurs when the price of underlying is greater than or equal to the strike price of long call or price of underlying is lesser or equal to the strike price of the long put.

The maximum loss can be calculated by using the formula below

- Max Loss for an Iron Condor Strategy = Strike Price of Long Call – Strike Price of Short Call-Net Premium Received + Commissions Paid

Break Even Point for an Iron Condor Strategy

The break-even points for the iron condor position are 2. The breakeven points can be calculated by using the formula given below

- Upper Breakeven Point for an Iron Condor Strategy = Strike Price of Short Call + Net Premium Received

- Lower Breakeven Point for an Iron Condor Strategy = Strike Price of Short Put – Net Premium Received.

Margin requirement is the short call spread requirement or short put spread requirement (whichever is greater).

How to make an Iron Condor Strategy?

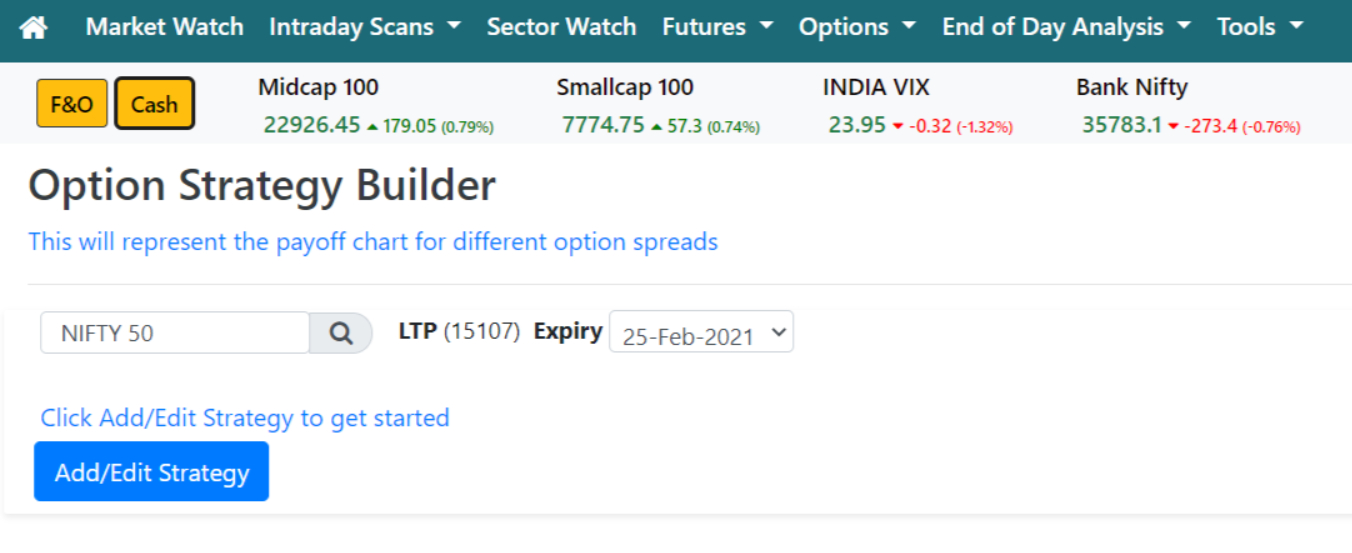

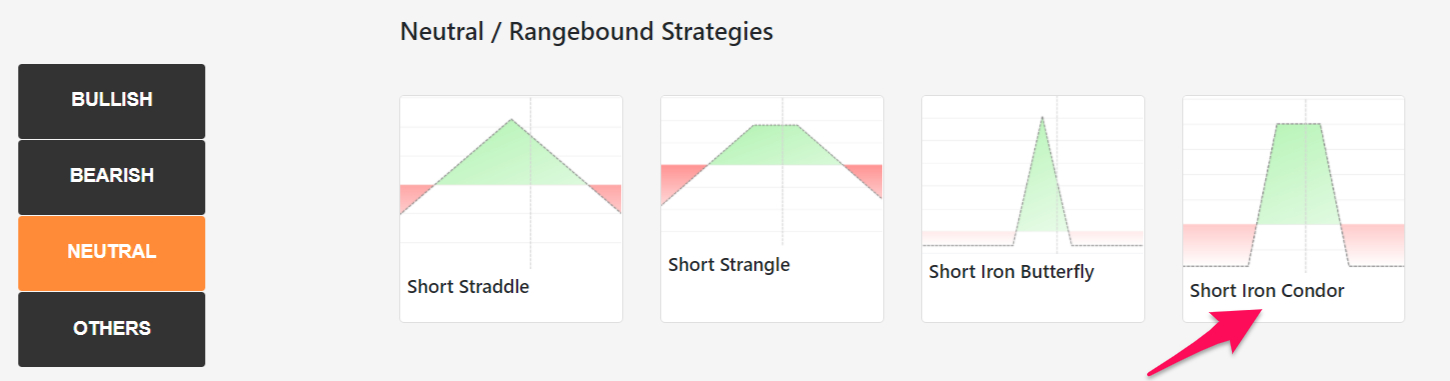

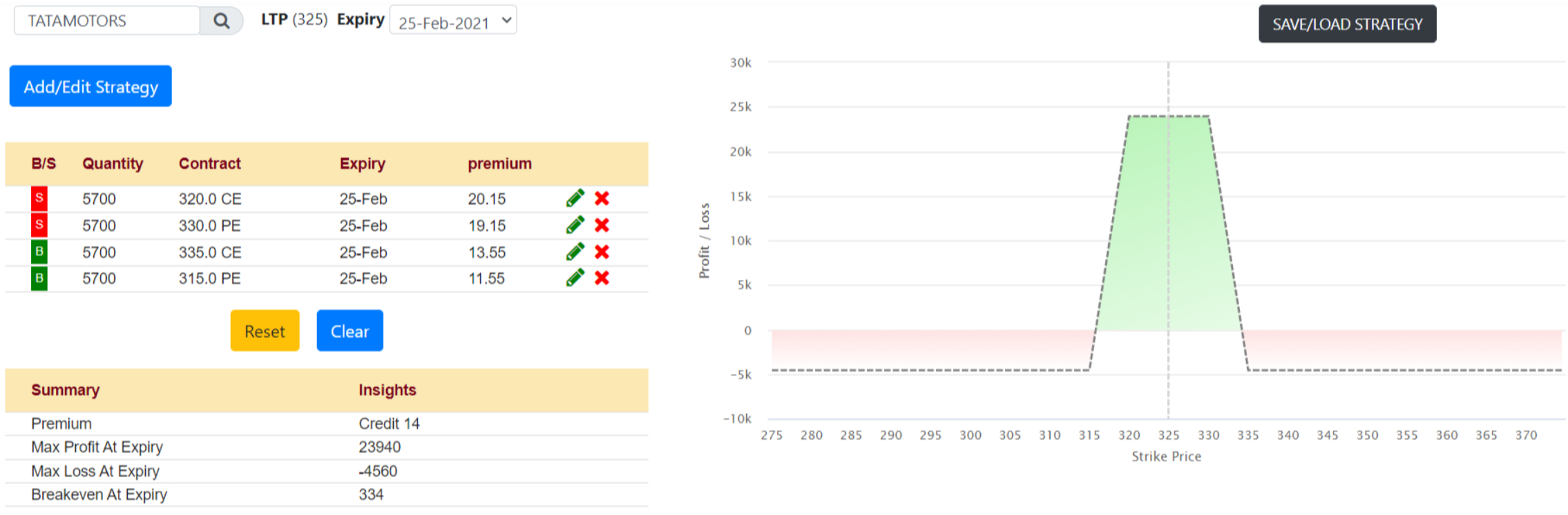

Using Options strategy builder in intradayscreener.com, you can easily build an option strategy for Iron Condor.

Step 1: You just need to select the indices and expiry date and click on add/edit to get started.

Step 2: Click on the Iron Condor strategy below.

Step 3: You will get detailed information on the option strategy like Premium, Max profit at expiry, Max losses at expiry, Breakeven at expiry, and an Iron Condor graph.

Example

Let us take an example of Tata motors with the strike price of 325, buy and sell prices given in the table below

| Action | Type | Strike price | Premium |

| BUY | CE | 335 | -19.2 |

| SELL | CE | 320 | 26.15 |

| BUY | PE | 315 | -13.6 |

| SELL | PE | 330 | 20.85 |

In the Iron Condor strategy, you need to buy one in the money put option which is 315 and premium paid is 13.6. Sell one at the money put option which is 325 and premium received is 18.25.

Sell one at the money call option which is 325 and premium paid is 23.55. Buy one over the money call option which is 335 and premium paid is 19.2.

| Expected stock price | 335 CE BUY | 335 CE Prem Paid | 335 CE Buy Net Profits | 320 CE SELL | 320 CE Prem recvd. | 320 CE Sell Net Profits |

| 300 | 0 | -19.2 | -19.2 | 0 | 26.15 | 26.15 |

| 305 | 0 | -19.2 | -19.2 | 0 | 26.15 | 26.15 |

| 310 | 0 | -19.2 | -19.2 | 0 | 26.15 | 26.15 |

| 315 | 0 | -19.2 | -19.2 | 0 | 26.15 | 26.15 |

| 320 | 0 | -19.2 | -19.2 | 0 | 26.15 | 26.15 |

| 325 | 0 | -19.2 | -19.2 | -5 | 26.15 | 21.15 |

| 330 | 0 | -19.2 | -19.2 | -10 | 26.15 | 16.15 |

| 335 | 0 | -19.2 | -19.2 | -15 | 26.15 | 11.15 |

| 340 | 5 | -19.2 | -14.2 | -20 | 26.15 | 6.15 |

| 345 | 10 | -19.2 | -9.2 | -25 | 26.15 | 1.15 |

| 350 | 15 | -19.2 | -4.2 | -30 | 26.15 | -3.85 |

| 315 PE BUY | 315 PE Prem Paid | 315 Net PE buy | 330 PE SELL | 330 PE prem recvd | 330 Net PE Sell | Expected stock price | Iron Condor Payoff |

| 15 | -13.6 | 1.4 | -30 | 20.85 | -9.15 | 300 | -0.8 |

| 10 | -13.6 | -3.6 | -25 | 20.85 | -4.15 | 305 | -0.8 |

| 5 | -13.6 | -8.6 | -20 | 20.85 | 0.85 | 310 | -0.8 |

| 0 | -13.6 | -13.6 | -15 | 20.85 | 5.85 | 315 | -0.8 |

| 0 | -13.6 | -13.6 | -10 | 20.85 | 10.85 | 320 | 4.2 |

| 0 | -13.6 | -13.6 | -5 | 20.85 | 15.85 | 325 | 4.2 |

| 0 | -13.6 | -13.6 | 0 | 20.85 | 20.85 | 330 | 4.2 |

| 0 | -13.6 | -13.6 | 0 | 20.85 | 20.85 | 335 | -0.8 |

| 0 | -13.6 | -13.6 | 0 | 20.85 | 20.85 | 340 | -0.8 |

| 0 | -13.6 | -13.6 | 0 | 20.85 | 20.85 | 345 | -0.8 |

| 0 | -13.6 | -13.6 | 0 | 20.85 | 20.85 | 350 | -0.8 |

By using the above calculation in the table, we can plot the payoff diagram for the bear put spread.

FAQs

Recommended Brokers

| No 1 STOCKBROKER IN INDIA Zerodha Free equity & mutual fund investments | Flat ₹20 intraday and F&O trades | Rating ★★★★★ | APPLY NOW |

| GET FREE DEMAT ACCOUNT Upstox Fix brokerage of Rs. 20 per trade | Rating ★★★★ | APPLY NOW |

| GET FREE DEMAT ACCOUNT Angel Broking 0 Brokerage on Equity Delivery | Rs 20 per order for Intraday and F&O trades | Rating ★★★★★ | APPLY NOW |

Leave a Reply