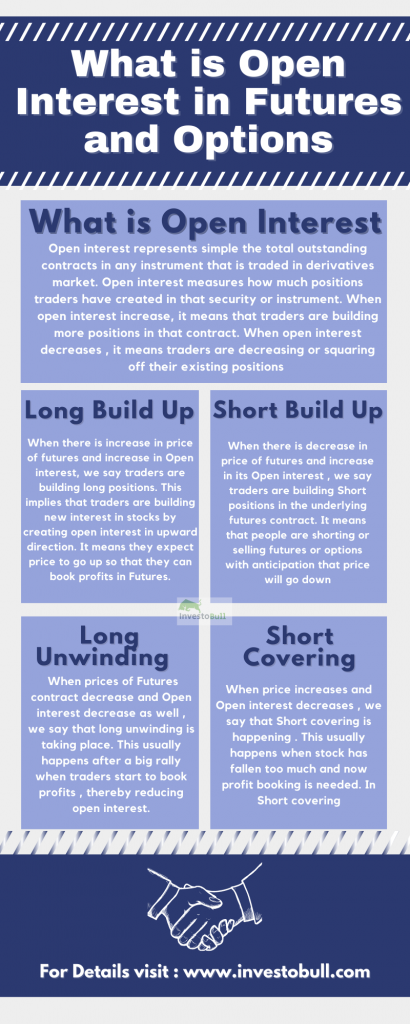

Open interest represents simple the total outstanding contracts in any instrument that is traded in derivatives market. Open interest measures how much positions traders have created in that security or instrument. When open interest increase , it means that traders are building more positions in that contract. When open interest decreases , it means traders are decreasing or squaring off their existing positions . We will also understand how to use Open interest along with price for trading.

Table of Contents

Does Futures and Options both have OI?

Every derivative contract of a symbol , example NIFTY will have its own open interest which will represent total outstanding contracts in that particular instrument. Example Nifty 12,000CE (call option) will have its own OI , Nifty current month Future will have its own OI , NIFTY next month Futures will have its own OI , Every strike Call or put will have its own OI.

How to Interpret OI increase or decrease?

Before we learn to interpret Open interest increase or decrease , we must understand how do we take directional view in market .

Example Lets assume Current NIFTY index price is 11800 rs and we want to go long in NIFTY (bullish view) .We can go Long in NIFTY in following ways

- Buy Nifty Call Option

- Sell Nifty Put Option

- Buy current month Nifty Futures

- Buy next Month Nifty Futures

Futures and its Open interest

Now traders who want to go long in Nifty and buy Nifty futures will cause increase in Open interest of Nifty Futures Contract of near month (current month) or next month(current month+1) or far month (current month+2). While 90% of traders will trade current month futures buy its highly likely that many traders can also buy next month futures depending on how close we are to current expiry. So if we add futures open interest of all 3 months and compare with sum all futures open interest of yesterday , we get and idea whether traders are building new positions or exiting positions.

Options open Interest

In case of Options , its a bit different explanation . Now we see Options positions with help of option sellers position instead of Option buyers position. You may ask why is it so – reason is that Option sellers have unlimited risk and Option selling requires high margin , so Option sellers are those people who have strong Idea on market , money to move markets or underlying hedged positions. So they basically can protect their positions.

Now when we want to sell open interest in Nifty Puts , we see if Open interest is increasing , Means more puts are getting Sold and put sellers don’t expect markets to go down . Similarly if Calls open interest are increasing , we interpret is at more calls are being sold and call sellers don’t expect market to go up.

Price direction And Change in Open Interest in Futures

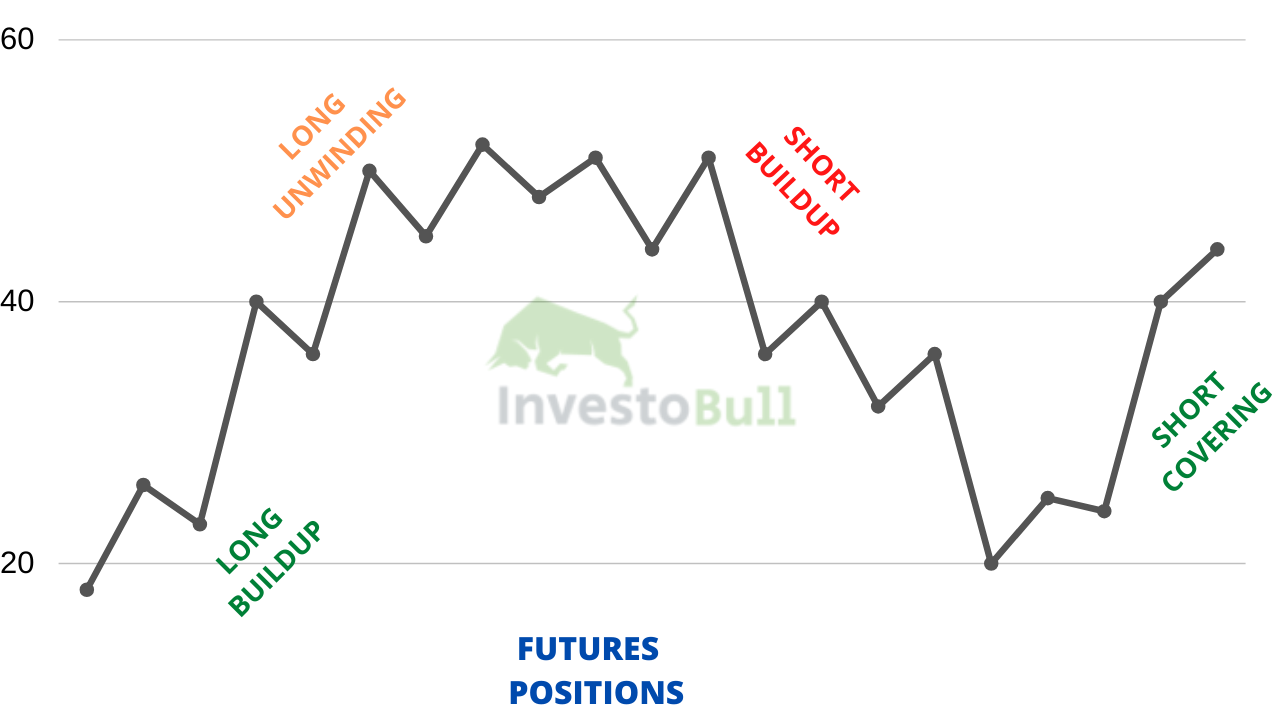

When we combine direction of underlying movement and how open interest is changing in futures contract , we get better idea on what type of positions are being build in market . There are below major types of positions that are build ususally

- LONG Build up : When there is increase in price of futures and increase in Open interest , we say traders are building long positions. This implies that traders are building new interest in stocks by creating open interest in upward direction. It means they expect price to go up so that they can book profits in Futures.

- Short Build Up : When there is decrease in price of futures and increase in its Open interest , we say traders are building Short positions in the underlying futures contract. It means that people are shorting or selling futures or options with anticipation that price will go down. Usually when some stock or index breaks support or reverses from a resistance , we see shorts being built up.

- Long unwinding : When prices of Futures contract decrease and Open interest decrease as well , we say that long unwinding is taking place. This usually happens after a big rally when traders start to book profits , thereby reducing open interest. it also means long positions are now getting exhausted and people are starting to book profits , assuming rally is about to over. It may be followd by fresh longs after consolidation or fresh shorts if reversal is to happen

- Short covering : When price increases and Open interest decreases , we say that Short covering is happening . This usually happens when stock has fallen too much and now profit booking is needed. In Short covering , the earlier built Short positions are getting decreased and people are booking profits and expecting reversal.

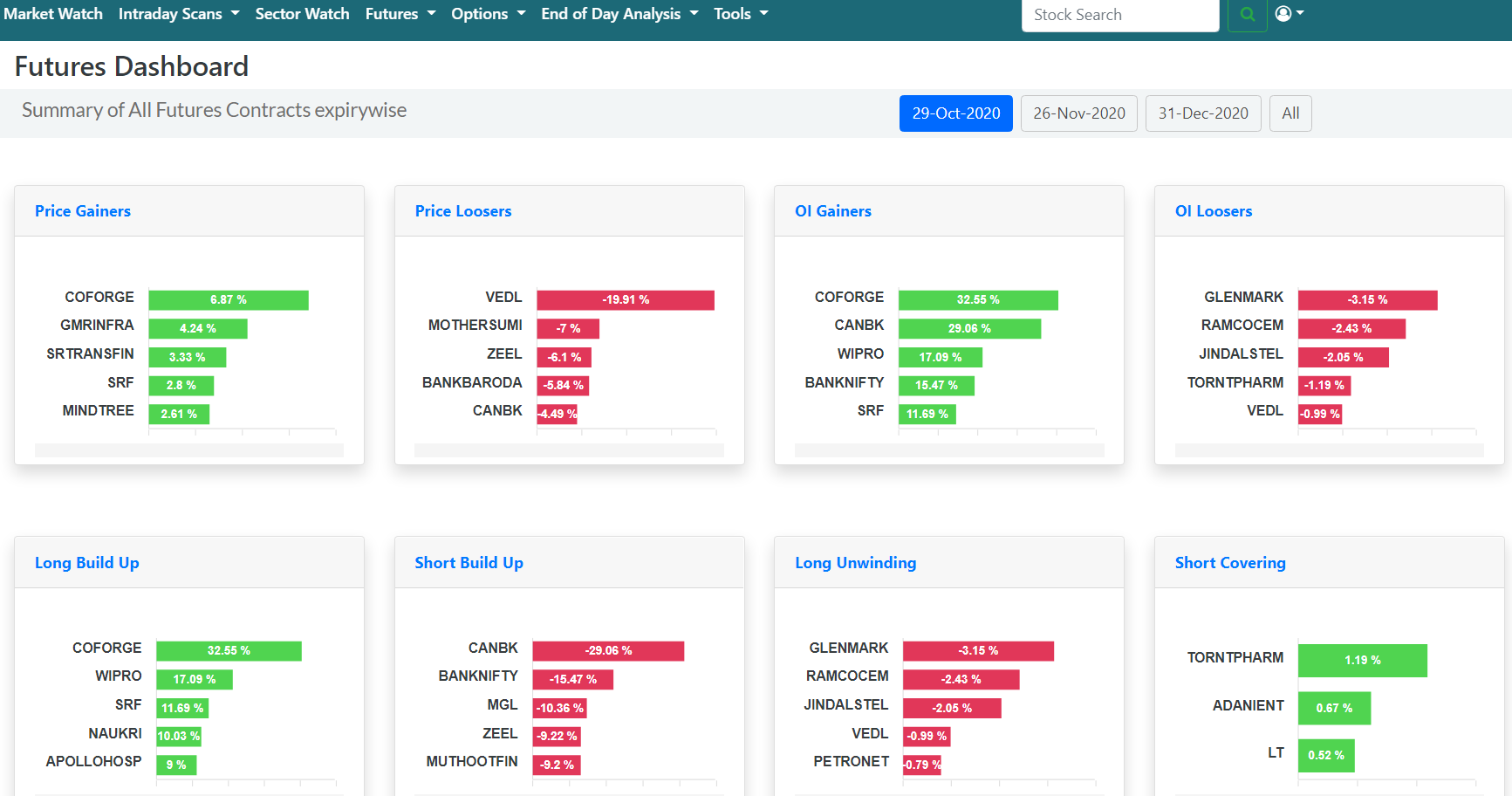

Open Interest Screener and Dashboard

You can check open interest of all Futures and Options strike of NSE listed India stocks at Intradayscreener.com Futures Dashboard. You can get a summary of different positions being build in all futures expiry wise as well as combined.

Using this screener , it very easy to see where traders are building long positions or short positions , or doing profit booking.

Recommended Brokers

| No 1 STOCKBROKER IN INDIA Zerodha Free equity & mutual fund investments | Flat ₹20 intraday and F&O trades | Rating ★★★★★ | APPLY NOW |

| GET FREE DEMAT ACCOUNT Upstox Fix brokerage of Rs. 20 per trade | Rating ★★★★ | APPLY NOW |

| GET FREE DEMAT ACCOUNT Angel Broking 0 Brokerage on Equity Delivery | Rs 20 per order for Intraday and F&O trades | Rating ★★★★★ | APPLY NOW |

Leave a Reply