Table of Contents

Morning Star Candlestick Pattern

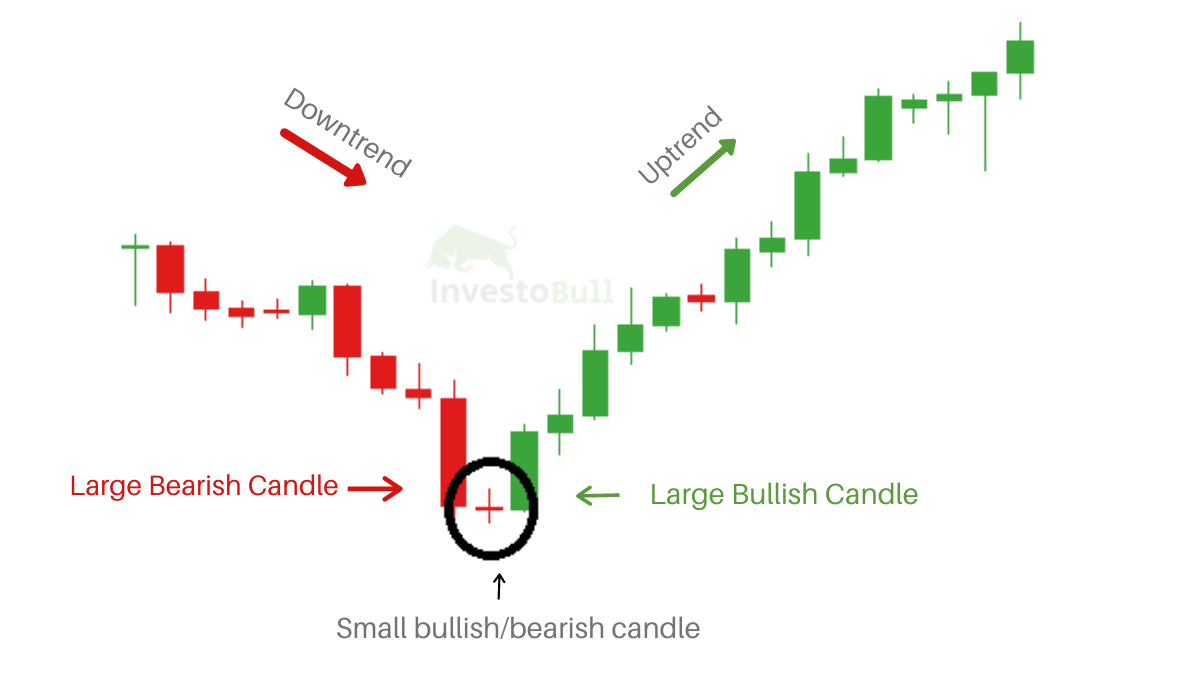

The Morning Star pattern is a three-candle, bullish reversal candlestick pattern that appears at the bottom of a downtrend. It reveals a slowing down of downward momentum before a large bullish move lays the foundation for a new uptrend.

Traders should analyze the formation of a morning star and then seek confirmation that a reversal is confirmed using technical indicators.

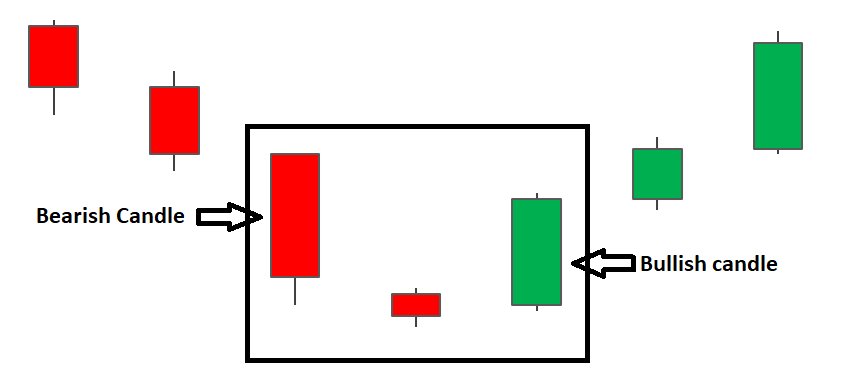

How to Identify a Morning Star Candlestick Pattern

Identifying the Morning Star on charts involves more than simply identifying the three main candles. What is required, is an understanding of previous price action and where the pattern appears within the existing trend.

- Establish an existing downtrend: The market should be exhibiting lower highs and lower lows.

- Large bearish candle: The large bearish candle is the result of large selling pressure and a continuation of the existing downtrend. At this point, traders should only be looking for short trades as there is no evidence of a reversal yet.

- Small bearish/bullish candle: The second candle is a small candle – sometimes a Doji candle – that presents the first sign of a fatigued downtrend. Often this candle gaps lower as it makes a lower low. It does not matter if the candle is bearish or bullish as the main takeaway here is that the market is somewhat undecided.

- Large bullish candle: The first real sign of new buying pressure is revealed in this candle. This candle gaps up from the close of the previous candle and signals the start of a new uptrend.

- Subsequent price action: After a successful reversal, traders will observe higher highs and higher lows but should always manage the risk of a failed move through the use of well-placed stops.

Related Post: Introduction to Candlestick Patterns

How to trade using Morning Star Pattern

Entry levels, targets and stop loss can be clearly recognised when taking a look at the chart below.

The entry can be placed at the open of the next candle after the morning star pattern has developed. Stoploss can be placed below the recent low and the initial target level can be set at key levels or recent areas of support/resistance.

Related Post: What is Doji Candlestick Pattern?

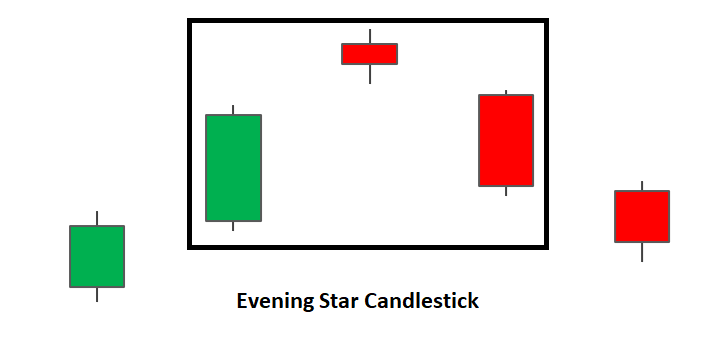

What is Evening Star Candlestick Pattern

The Evening Star candlestick is a three-candle pattern that signals a reversal in the market and is commonly used to trade in the stock market.

The Evening Star pattern is a bearish reversal candlestick pattern that appears at the top of an uptrend. It signals the slowing down of upward momentum before a bearish move lays the foundation for a new downtrend.

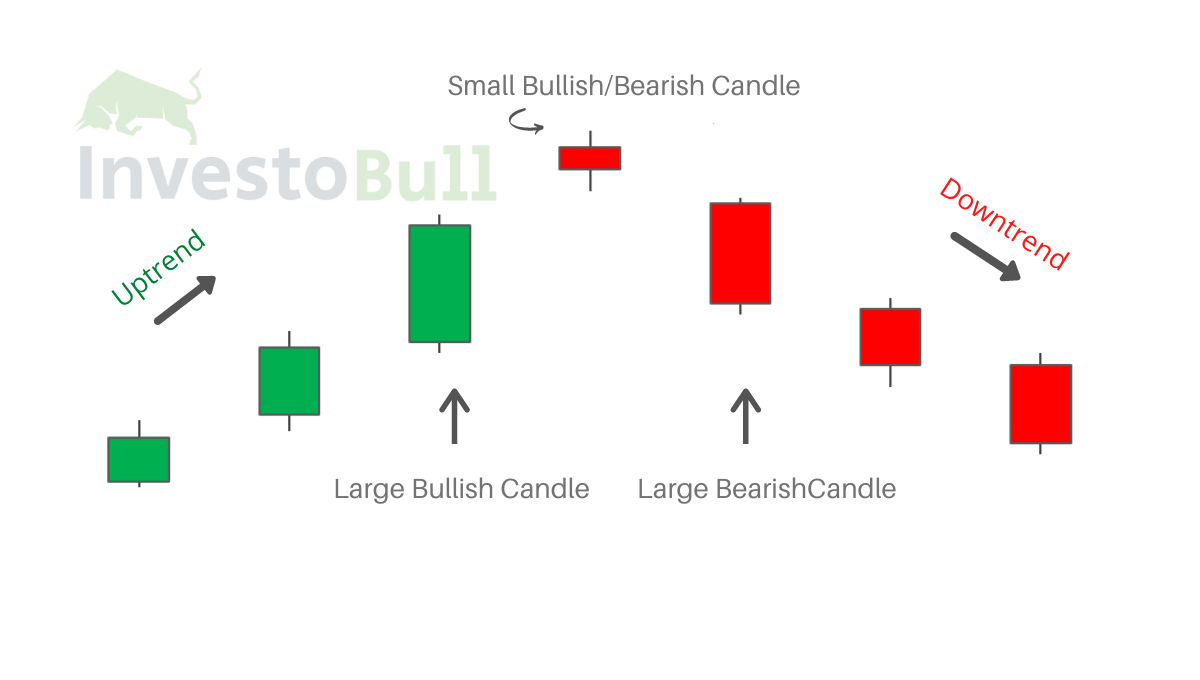

How to Recognize an Evening Star Pattern

Recognizing the Evening Star on charts involves more than simply identifying the three main candles. You need to understand the previous price action and where the pattern emerges within the existing trend.

- Establish an existing uptrend: The market should be exhibiting higher highs and higher lows.

- Large bullish candle: The large bullish candle is the result of large buying pressure and a continuation of the existing uptrend. At this point, traders should only be looking for long trades as there is no evidence of a reversal yet.

- Small bearish/bullish candle: The second candle is a small candle – sometimes a Doji candle – that presents the first sign of a fatigued uptrend. Often this candle gaps higher as it makes a higher high. It does not matter if the candle is bearish or bullish as the main takeaway here is that the market is somewhat undecided.

- Large bearish candle: The first real sign of new selling pressure is revealed in this candle. In non-forex markets, this candle gaps down from the close of the previous candle and signals the start of a new downtrend.

- Subsequent price action: After a successful reversal, traders will observe lower highs and lower lows but should always manage the risk of a failed move through the use of well-placed stops.

Related Post: What is Dark Cloud Cover Candlestick Pattern

How to trade using Evening Star Candlestick Pattern?

Entry levels, targets and stop loss can be clearly recognised when taking a look at the chart below.

The entry can be placed at the open of the next candle after the morning star pattern has developed. Stoploss can be placed above the recent high and the initial target level can be set at key levels or recent areas of support/resistance.

Pros and cons of Morning Star & Evening Star Candlestick Pattern

- Both Morning Star & Evening Star occurs frequently in the charts and it also presents well-defined entry as well as exit levels.

- This candlestick pattern is also easy to identify as they happen frequently in the charts.

- One should note that if it signals a failed reversal, then the price could move further up.

- When these candlestick patterns are backed up by volume and other technical indicators like resistance level, then it confirms the signal.

FAQs

Recommended Brokers

| No 1 STOCKBROKER IN INDIA Zerodha Free equity & mutual fund investments | Flat ₹20 intraday and F&O trades | Rating ★★★★★ | APPLY NOW |

| GET FREE DEMAT ACCOUNT Upstox Fix brokerage of Rs. 20 per trade | Rating ★★★★ | APPLY NOW |

| GET FREE DEMAT ACCOUNT Angel Broking 0 Brokerage on Equity Delivery | Rs 20 per order for Intraday and F&O trades | Rating ★★★★★ | APPLY NOW |

1 Comment