In this comprehensive blog, let us understand how does Exchange-traded funds works but before that let us know what is ETF.

Table of Contents

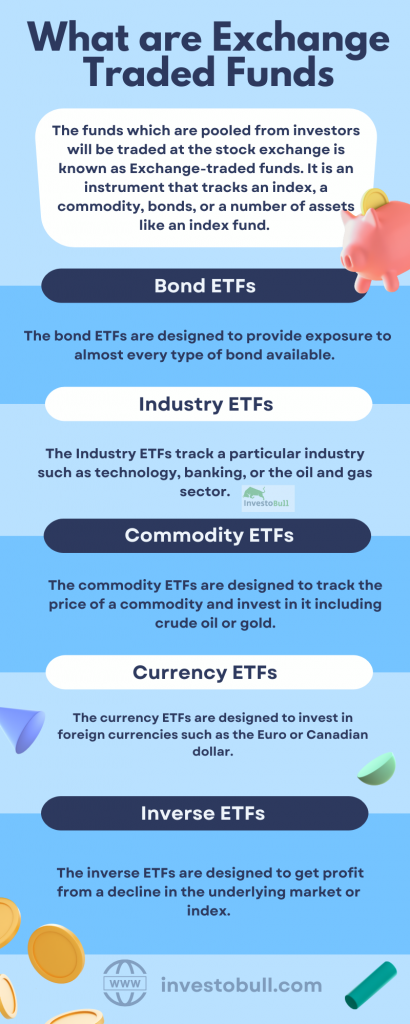

What is an Exchange-traded funds or ETFs

The funds which are pooled from investors will be traded at the stock exchange is known as Exchange-traded funds. It is an instrument that tracks an index, a commodity, bonds, or a number of assets like an index fund.

Exchange-traded funds are one of the most valuable and important products created for individual investors in recent years. ETFs offer many benefits and are an excellent opportunity to achieve an investor’s investment goals.

In Exchange-traded funds, you can enter at any point in time, to time the market and buy the units. This is the biggest positive in the ETFs. In Exchange-traded funds to buy a specific stock, you must have a Demat account and Broker account.

Suggestions: Using the Intradayscreener app, you can easily find the best stock to trade in the stock market

How does ETFs work

An ETF is bought and sold like a company stock when the stock exchanges are open. An ETFs has a symbol and intraday price data can be obtained easily while trading.

The company which manages these funds is known as an asset management company. They appoint a fund manager to invest the funds according to their objectives and goals.

The profits will be shared with the investors and asset management companies charge some expense ratio (fees) to maintain it.

In the cash market, you cannot trade on Nifty, Bank Nifty, Sensex, and other indices because they are not stock or funds. It is an index that shows the value of the market. Nifty shows the performance of 50 companies that are well established in the market.

An exchange-traded funds is a fund that replicates an index. The fund manager invests directly in stocks in Nifty ETFs. If the Nifty increases, Nifty ETFs increase. If the Nifty share price decreases Nifty ETFs will also decrease. The returns of Nifty Exchange-traded funds may not match with Nifty’s returns.

There might be a slightly up or down which is known as a tracking error. There are two types which are

- Actively managed fund: In an actively managed fund, the fund manager does research on the stocks and picks a stock on their own. Their ultimate goal is to get high returns on the basis of stock objectives.

- Passively managed fund: In a passively managed fund, the fund manager will buy the funds which replicate indexes of the funds. The fund manager doesn’t need to research and pick the stocks. The passively managed fund’s expense ratio is lower than the actively managed fund.

Also Check: Recent post on What is face value and book value in the share market?

Types of Exchange-traded funds

There are five types of ETFs available to investors that can be used to generate income, speculation, price increases, and to hedge or partly offset risk in an investor’s portfolio.

Below are the types of ETFs.

- Bond ETFs: the bond ETFs are designed to provide exposure to almost every type of bond available. It might include government bonds, corporate bonds, and state and local bonds which are called municipal bonds.

- Industry ETFs: The Industry ETFs track a particular industry such as technology, banking, or the oil and gas sector.

- Commodity ETFs: The commodity ETFs are designed to track the price of a commodity and invest in it including crude oil or gold.

- Currency ETFs: The currency ETFs are designed to invest in foreign currencies such as the Euro or Canadian dollar.

- Inverse ETFs: The inverse ETFs are designed to get profit from a decline in the underlying market or index.

Exchange-traded funds – Pros and cons

Here are the pros and cons of ETFs

Pros of ETFs

- You can buy and sell any time of the day

- Low expense ratios and less broker commissions.

- Tax-efficient is more

- Risk management

Cons of ETFs

- Trading costs too high

- Tracking error

- Lack of liquidity in transactions

Leave a Reply