This comprehensive blog lets us know about some terminologies on what is a Face Value and book value of the share market. For a second we should understand what these terms mean.

Table of Contents

What is the Face Value of shares?

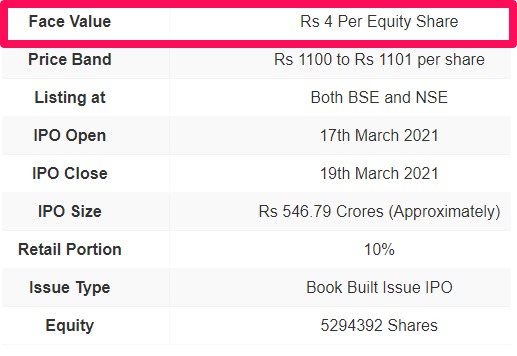

Face value of shares is the value that appears on the face of security and the share is listed in the stock market. Face value is also known as par value or nominal value which is the legal capital of each share of stock held by an individual trader or investor.

Face value is not calculated; rather it reflects the face value in the form of shares depending upon the capital that a company wishes to raise from the market.

Why is Face Value important?

Face value has a key role in a company. It is generally used for the purpose of calculating interest in shares and bonds. The value of a share is taken into consideration for computing the market value, discounts, premiums and returns, etc.

Understanding the face value of shares is important to invest or trade easily in the stock market. Face value has no relation to market price. Bond prices are mostly affected by their face value.

Related Post: Upcoming IPOs List 2021

What is Book Value?

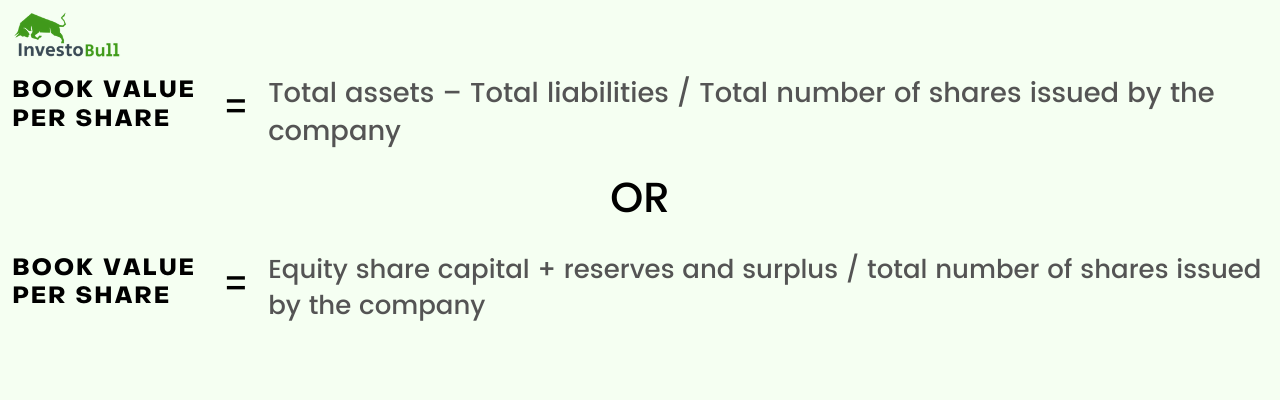

Book value is the value of the share in the company’s books. It illustrates the amount per share the shareholders can get if the company is liquidated and its assets are sold off to pay the liabilities.

Here are the two formulas to calculate Book value

Why is Book Value Important?

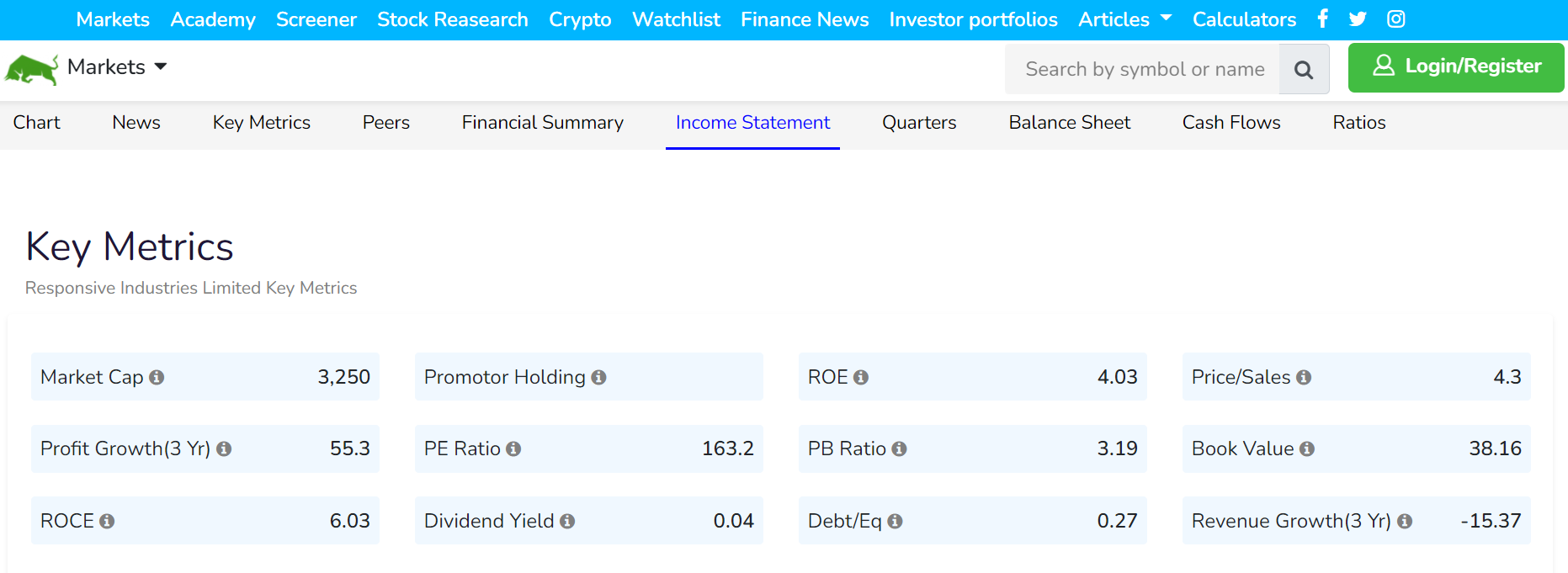

You get (P/B) price to book value ratio when you split the current price of the share of a company with its book value per share. The P/B ratio is the most beneficial comparison tool while taking an investment decision based on different variables.

Book value is important for investors using an investing strategy because it can enable them to find bargain deals on stocks if they feel that the company is underrated, and the stocks are going to rise up in price.

Suggestions: Using the Intradayscreener app, you can easily find the best stock to trade in the stock market

Where to find the face value and book value

The face value and book value of a company can be found on more or less all financial websites.

Whenever you open the stock page on the investobull website, the first thing that you’ll notice is its market value per share. However, just by scrolling a little down, you can easily find book value per share of the company.

Conclusion

All these two terms are different in each term and one should not get confused among them while studying any company in detail.

Face value is the value of a company that is listed in its books and share certificate. And, the book value of a company is the total value of the company’s assets that shareholders will receive in case the company gets liquidated.

Leave a Reply