Table of Contents

What is Engulfing Pattern?

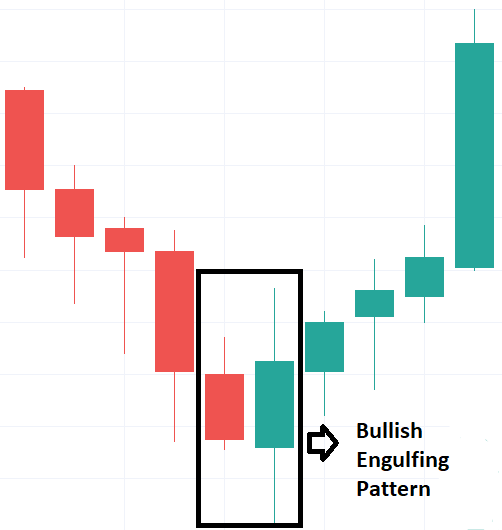

Bullish engulfing candlestick pattern is one of the two engulfing patterns. The engulfing candlesticks patterns can be used to identify trend reversals and form a part of technical analysis. engulfing pattern needs 2 trading sessions to develop. In an engulfing pattern, you will find a small candle on day 1 and an almost similar long candle on day 2 which appears as if it engulfs the candle on day 1. If the engulfing pattern develops at the bottom of the trend,then it is called the Bullish Engulfing Candlestick pattern.

What is a Bullish Engulfing Candlestick Pattern?

The bullish engulfing candle surfaces at the bottom of a downtrend and indicates a rush in buying pressure. The bullish engulfing pattern usually triggers a reversal in trend as more buyers enter the market to push prices up. The pattern includes two candlesticks where the second candle completely engulfes the body of the previous red candle.

Bullish engulfing patterns are described in different ways by stock market traders. While some traders assume that the tails of candlesticks must be included in the analysis of stock decisions, whereas others think that a bullish engulfing pattern is valid even when the tails are not engulfed.

Another important aspect you may find useful while interpreting bullish engulfing patterns is that it is possible for more than a single candle to engulf the preceding red candle in this arrangement.

This means that a single red candle may be followed by two, three, or even four green candlesticks of varying length, all forming a part of the bullish candlestick pattern. This combination of candlesticks is still considered to engulf the single preceding red candlestick as long as the body (and tails) is fully covered by its green counterparts

Also Read : Morning Star and Evening Star candlestick pattern

Characteristics of a bullish engulfing pattern

- A strong green candle that ‘engulfs’ the previous red candle body.

- Happens at the bottom of a downward trend.

- Stronger signals are given when the red candle is a Doji, or when subsequent candles close above the high of the bullish candle.

RULES for BULLISH ENGULFING PATTERN

There are a few primary rules that you need to know while placing a profitable trade using a bullish engulfing pattern, they are

- Before entering the trade, you must check whether the previous trend is a downtrend or not.

- The first session of the pattern must be a red candle, thereby, validating that the market is still in a bearish.

- In the second session, the market must be bullish enough to engulf the bearish trend set up in the last trading session.

- You may get a bit distracted in order to make some swift profits, you must strictly stick to the rules mentioned above to stay profitable in the trade.

How to use the Bullish Engulfing Pattern while Trading?

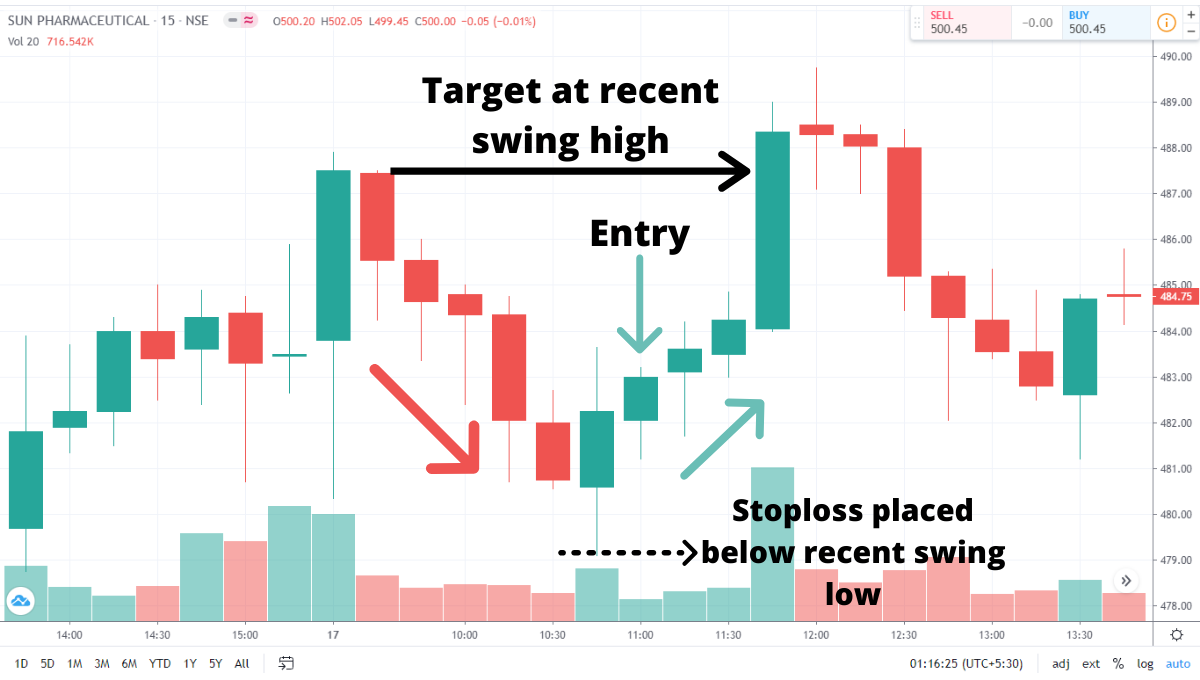

The bullish engulfing candle pattern can be witnessed in action in the daily chart. In the bullish Engulfing pattern, the trend is shown in a downtrend. We must take the trade at the Subsequent candles validating the signal as they closed above the high of the bullish candle.

The Stop Loss can be set below the low of the bullish engulfing pattern with a target set at a key level that price has jumped off previously this is the recent swing high and provides a positive risk to reward ratio.

Advantages of using Bullish Engulfing Candlestick?

- The bullish engulfing pattern is an essential indicator of the reversal of the stock market.

- It provides you with a viable indication for your stock trading decisions irrespective of your stock trading style.

- Can combine bullish patterns with statistical analysis to accurately make a judgment of complete reversal in investor sentiments.

- Witnessing specific signs with respect to trends increases the significance of the bullish engulfing trading pattern.

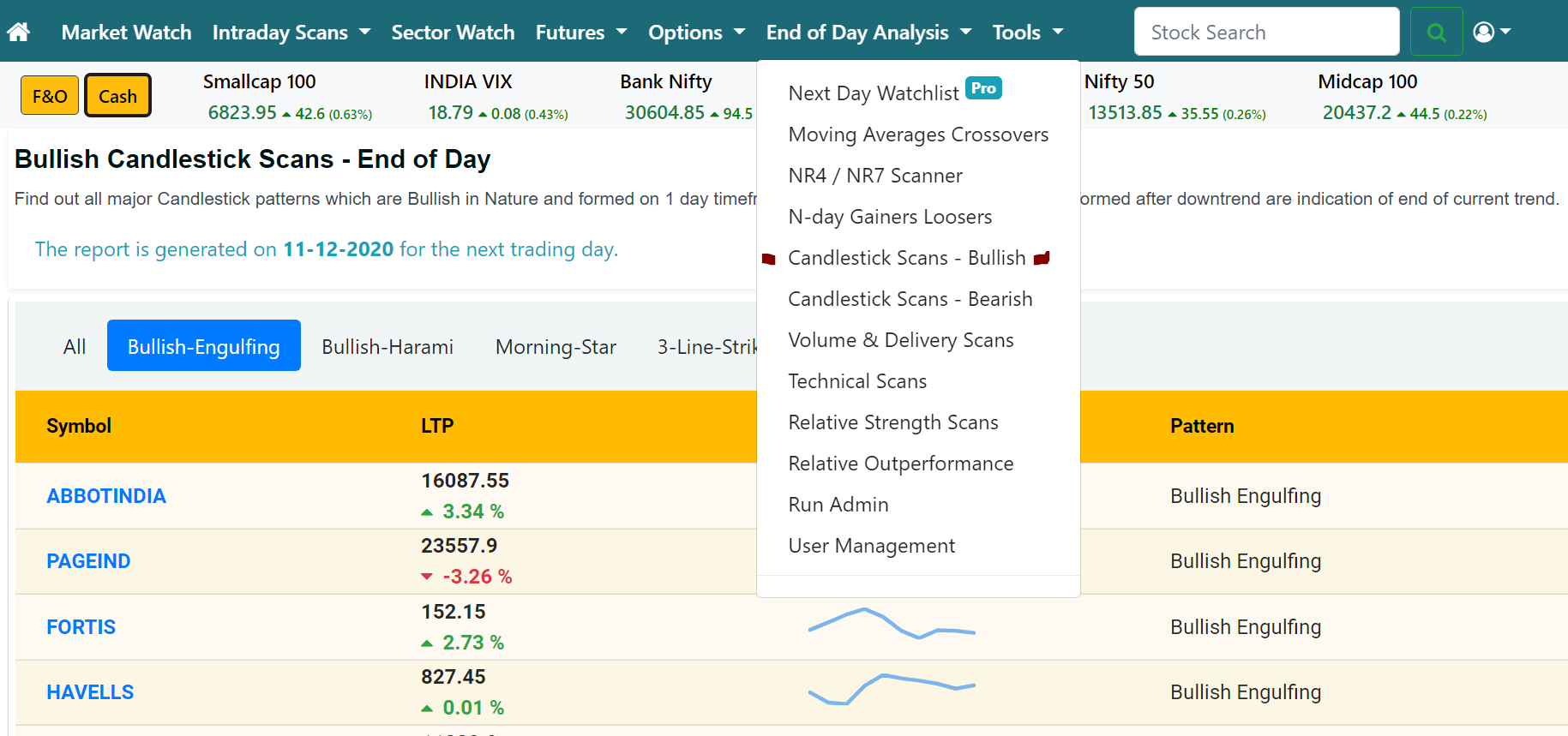

Bullish Engulfing candlestick pattern screener

With over 1500 stocks traded in NSE, it may be tough to find out so many candlestick formations instantly . Its always recommended to use stock screener for finding out such patterns. We recommend using Intradayscreener.com ‘s Bullish Candlestick patterns and Bearish candlestick patterns screener to find out the same.

Conclusion

The bullish engulfing pattern presents useful signals for stock traders. It helps you to choose to buy stocks immediately, or at the end of the second day, which is right after the reversal of market sentiment. The bullish engulfing patterns can be used in the form of fundamental signs for successful stock trading.

Recommended Brokers

| No 1 STOCKBROKER IN INDIA Zerodha Free equity & mutual fund investments | Flat ₹20 intraday and F&O trades | Rating ★★★★★ | APPLY NOW |

| GET FREE DEMAT ACCOUNT Upstox Fix brokerage of Rs. 20 per trade | Rating ★★★★ | APPLY NOW |

| GET FREE DEMAT ACCOUNT Angel Broking 0 Brokerage on Equity Delivery | Rs 20 per order for Intraday and F&O trades | Rating ★★★★★ | APPLY NOW |

Leave a Reply