In this article, lets try to understand two common terminologies associated with stocks , i.e. Face Value of share and Book Value of a share. Face value and book value are important to know for stocks as they convey totally different information but are often confused with each other

Table of Contents

What is Face value of share?

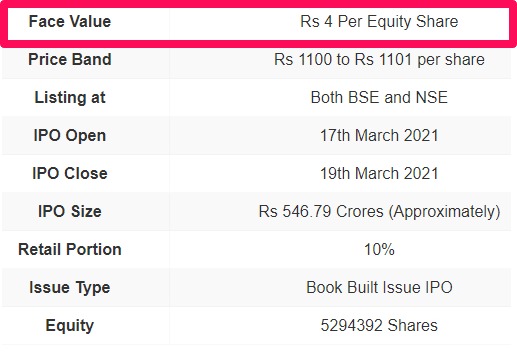

Face value of share is the value that appears on the face of security and the share is listed in the stock market. Face value is also known as par value or nominal value which is the legal capital of each share of stock held by an individual trader or investor.

Face value of share is not calculated; rather it reflects the face value in the form of shares depending upon the capital that a company wishes to raise from the market.

Why is Face Value important?

Face value of share has a key role in a company. It is generally used for the purpose of calculating interest in shares and bonds. The value of a share is taken into consideration for computing the market value, discounts, premiums and returns, etc.

One of the key importance of face value is that dividends distributed to shareholders by any company are declared as a percentage of its face value. Example when a company of FV 10rs declares 200% dividend, it means it issued dividend of 20rs.

Understanding the face value of share is important to invest or trade easily in the stock market. Face value has no relation to market price. Bond prices are mostly affected by their face value.

What is Book Value?

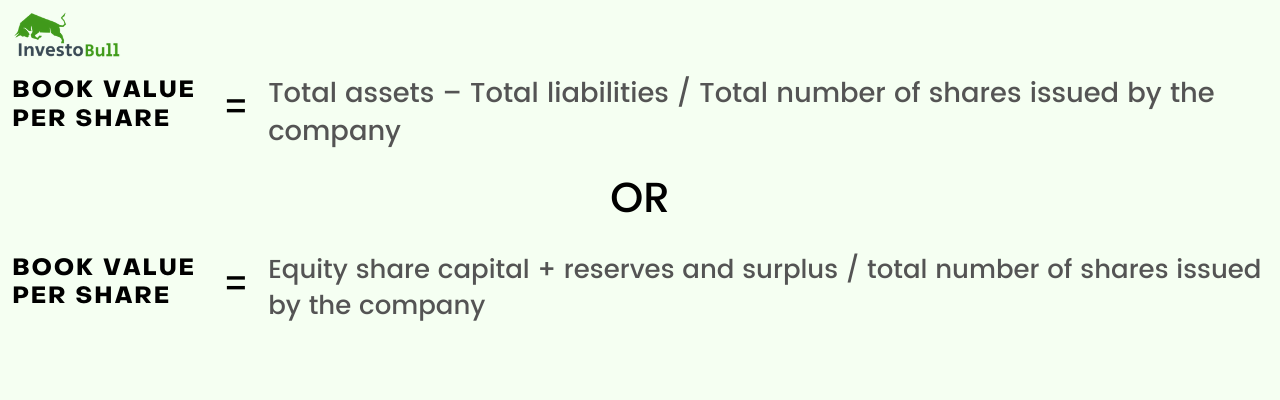

Book value is the value of the share in the company’s books. It illustrates the amount per share the shareholders can get if the company is liquidated and its assets are sold off to pay the liabilities.

Here are the two formulas to calculate Book value

Check our Product Intradayscreener

Why is Book Value Important?

You get (P/B) price to book value ratio when you split the current price of the share of a company with its book value per share. The P/B ratio is the most beneficial comparison tool while taking an investment decision based on different variables.

Book value is important for investors using an investing strategy because it can enable them to find bargain deals on stocks if they feel that the company is underrated, and the stocks are going to rise up in price.

Conclusion

All these three terms are different in each term and one should not get confused among them while studying any company in detail.

Face value is the value of a company that is listed in its books and share certificate. And, the book value of a company is the total value of the company’s assets that shareholders will receive in case the company gets liquidated.

FAQs

Recommended Brokers

| No 1 STOCKBROKER IN INDIA Zerodha Free equity & mutual fund investments | Flat ₹20 intraday and F&O trades | Rating ★★★★★ | APPLY NOW |

| GET FREE DEMAT ACCOUNT Upstox Fix brokerage of Rs. 20 per trade | Rating ★★★★ | APPLY NOW |

| GET FREE DEMAT ACCOUNT Angel Broking 0 Brokerage on Equity Delivery | Rs 20 per order for Intraday and F&O trades | Rating ★★★★★ | APPLY NOW |

Leave a Reply