This comprehensive blog will provide you with detailed information on How to Find Positional Targets Using Fibonacci. But before that, let us know what a Fibonacci sequence is?

Table of Contents

What is Fibonacci Sequence?

The Fibonacci Sequence is a series of numbers where the sum of the previous two numbers is each number in the sequence. The first ten numbers Sequence are 0, 1, 1, 2, 3, 5, 8, 13, 21, 34.

This sequence has received huge demand in Financial markets. From the Fibonacci Sequence comes a series of ratios, and these ratios are of the key point to traders as they predict potential reversal or breakout.

The Fibonacci Ratios which are used by forex traders are 38.2% and 23.6%. These two ratios will have a low level of success but are still included for analysis. The 38.2% ratio is obtained by dividing any number in the sequence by the number which is two places to its right.

Let us take an example, if

- 8 is divided by 21 then it will be 0.380, which is 38.0%

- 144 is divided by 377 then it will be 0.381, which is 38.1%

Suggestions: Using the Intradayscreener app, you can easily find the best stock to trade in the stock market

How to Find Positional Targets Using Fibonacci

Sometimes, we find it difficult to know the targets for our positional trades or not able to take positional trades at the correct time. To master such a problem, we will apply a Fibonacci tool to know the suitable entry and exit points.

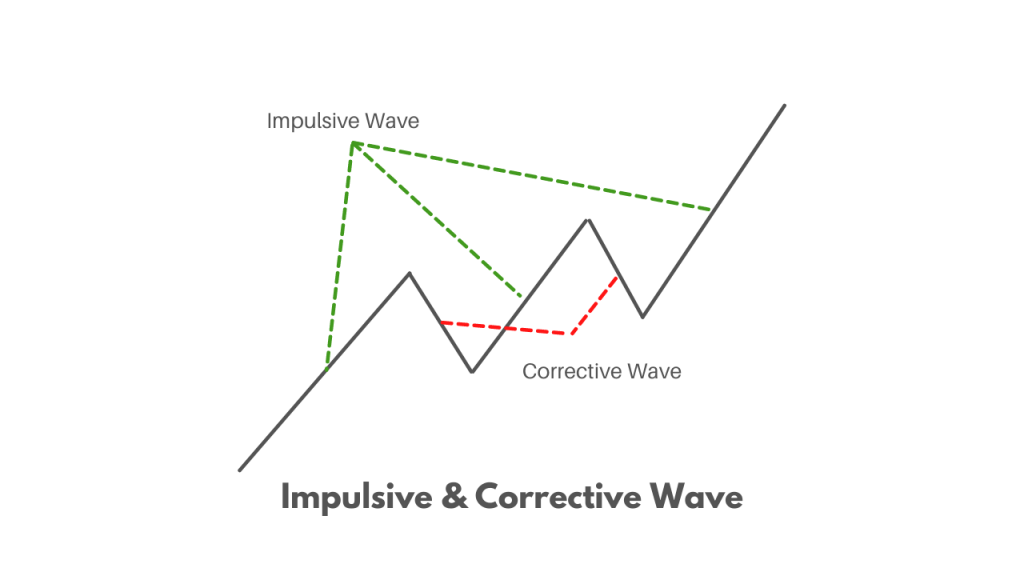

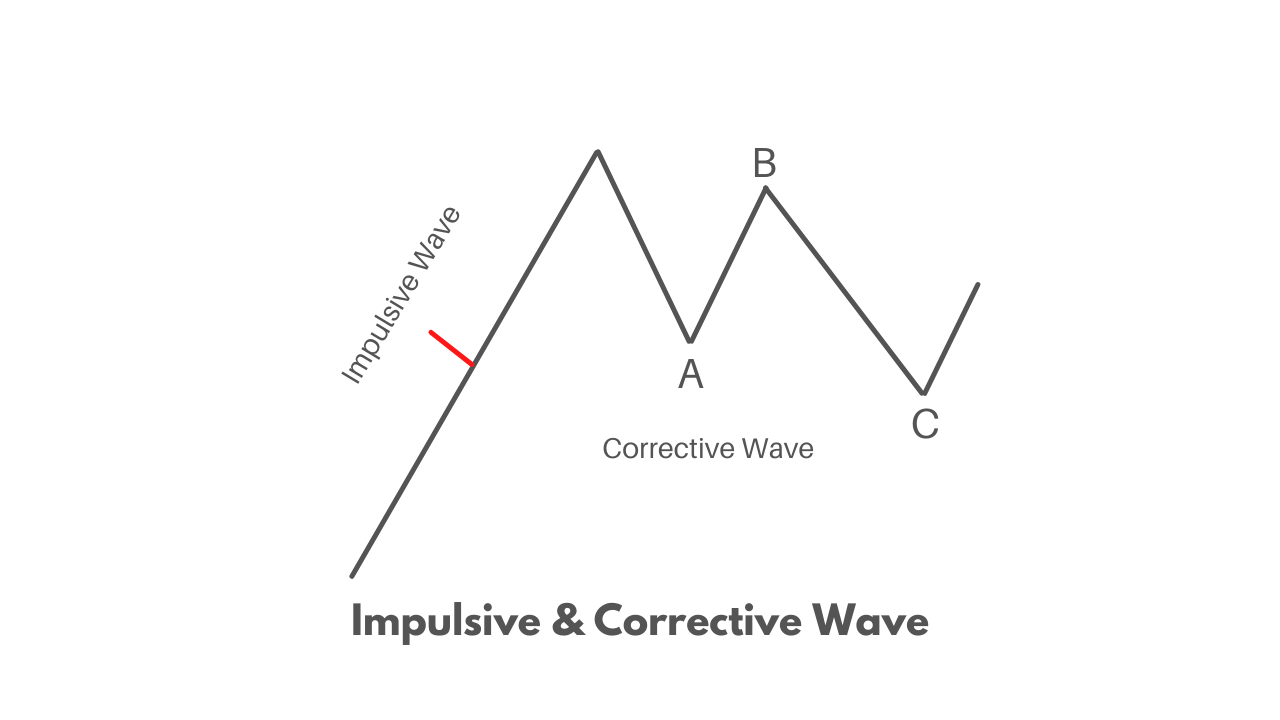

It is based on a simple wave concept that contains an impulsive wave and corrective where the corrective wave retraces back to 50% of its impulsive wave.

When a stock bounces back after the retracement, you may be clueless on whether it will go up or come down and when the retracement will start.

Check our recent post: What is face value and book value in the share market?

The corrective wave stock retraces back to the 50% Fibonacci level of its impulsive wave. We just require tracing out the impulsive wave and corrective waves and finding our entry points at 50% Fibonacci Level.

Sometimes one might know that after a big impulsive wave 3 corrective waves are 3 corrective waves that come after it.

As one can see in the above figure, after a big impulsive move, the stock retraces back to point C. We should always look for retracement till at least 50% Fibo level.

This strategy which is being explained here will work great only if the above conditions are met.

If you find any impulsive move i.e., higher high candles which makes a new high in a short time and its retracement. Apply Fibonacci tools on the stock to know its 50% retracement. If the script has not retracted to 50%, or if already retraced then spot it as confirmation of next up move if there is some good solid reversal candlestick pattern.

Leave a Reply