In this article, we will understand why do stock prices go up and down but before that let us know what is the stock price?

Table of Contents

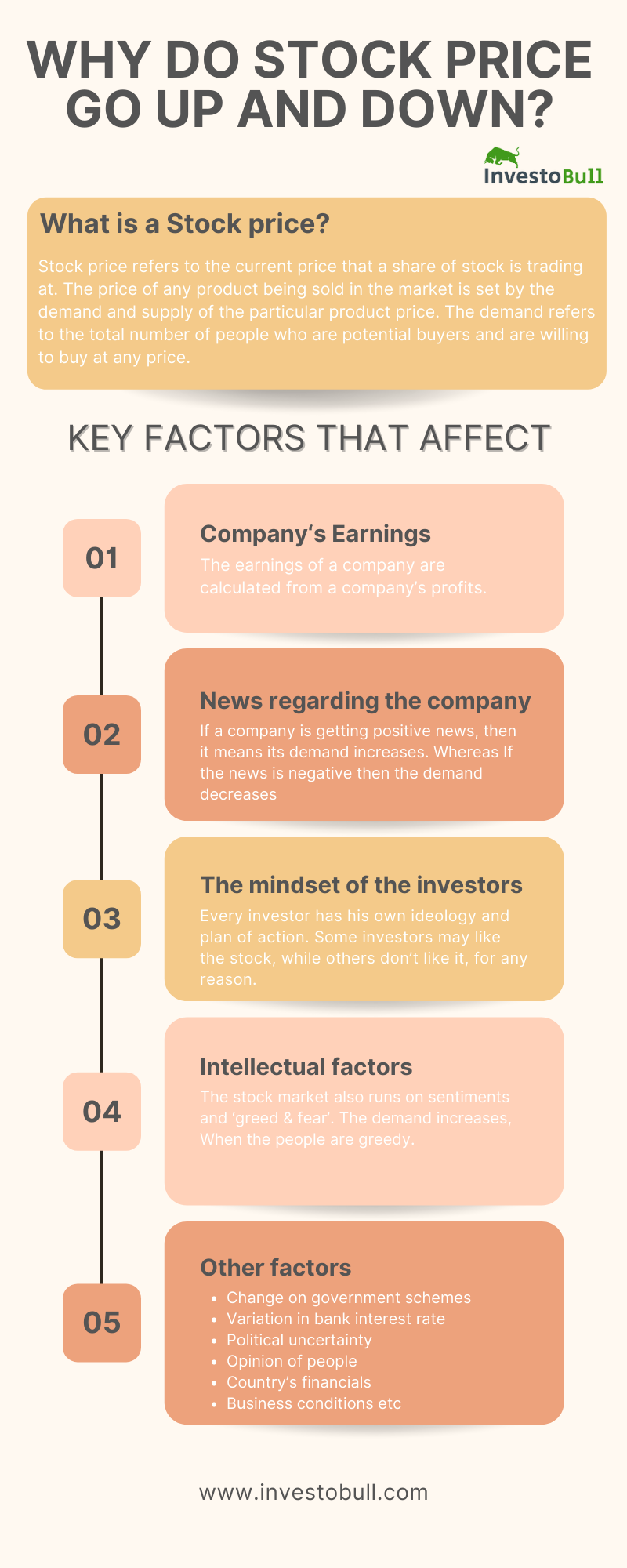

What is Stock Price?

Stock price refers to the current price that a share of stock is trading at.

Why do stock prices go up and down?

The price of any product being sold in the market is set by the demand and supply of the particular product.

Let us take an example, most people purchase products that help them fight the heat during summer in which lemons are a huge favourite. As summer approaches, the price of lemon increases two/three-times.

This sudden increase in the price happens because the demand for lemons increases and the supply cannot match up. Lemons become inadequate in the market.

Hence, the retailers purchase lemons at a higher price. As the demand is higher than supply. This results in the price of lemons increasing from Rs 2 per piece to Rs.5 per lemon.

Now let us understand supply and demand in terms of the stock market.

- Supply – The supply refers to the total number of people willing to sell their shares at any price.

- Demand – The demand refers to the total number of people who are potential buyers and are willing to buy at any price.

The stock price increases when the number of people who are willing to buy the stock (demand) is greater than the number of people who are willing to sell the stock (supply).

The stock price decreases when the number of people who are willing to sell the stock (supply) is greater than the number of people who are willing to buy the stock (demand).

It’s simple to say that the price fluctuations are due to demand and supply, but, what causes the demand and supply is a fascinating subject to understand.

Investor, as well as market sentiment, drives the demand. That is, the perceived risk-return reward of investing in stock along with some external conditions drive the stock prices. Here are the key factors that influence stock prices.

Related Post: Also check What are the Different types of stocks to invest?

Why do stock prices go up and down – Key factors that affect

The key factors that affect stock prices are

Company‘s Earnings

The earnings of a company are calculated from a company’s profits. Almost all the investors are unable to invest in a profitable company. The Stock prices show the actual value of the future earnings expectations of the company.

News regarding the company

If a company is getting positive news, then it means its demand increases. Whereas If the news is negative then the demand decreases and people will try to sell their stocks. And if the news is neutral, then people can be uncertain, either buy or sell the stock.

The mindset of the investors

Every investor has his own ideology and plan of action. Some investors may like the stock, while others don’t like it, for any reason. This difference in the ideologies and plan of action of the investors also plays a major role to influence the demand for a stock.

Intellectual factors

The stock market also runs on sentiments and ‘greed & fear’. The demand increases, When the people are greedy. They try to sell all their stocks and exit when the people are fearful, which causes an increase in supply. The fluctuations in the stock price happen because of greed and fear of the people.

Suggestions: Using the Intradayscreener app, you can easily find the best stock to trade in the stock market

Other factors

There are a number of other variables also that govern the fluctuations in the share market. They are-

- Change on government schemes,

- Variation in bank interest rate,

- Involvement of domestic and international institutional investors,

- Variation in international Stock exchanges,

- Opinion of people,

- Political uncertainty,

- Country’s financials,

- Business conditions etc

Reasons that cause an increase in demand

Here are a few reasons that cause an increase in the demand

- Positive news regarding the company (like new tender, decrease in tax in the industry etc)

- Strong financial results for the company (like increase in sales, earnings etc)

- Healthy news from the management (like new plant set-up, new acquisition, etc)

- Stock Split or When Bonus is Issued

(Price gets adjusted with the Face Value ~ Decreasing the Stock Price)

Example: MRF Share (CMP: 75,939)

For Retailers, buying such High Price Stocks is somewhat Difficult. If the Stock Split or Company is issuing the Bonus Shares, Price Gets automatically adjusted, and the price gets reduced.

Note: Value of the Share is not reducing, just Price is reducing.

When Such a Thing Happens, Retailers can Buy the Share with more ease, This Automatically Increases the Volume, i.e., Demand Increases.

- Company Buying Back the Shares at a price, Higher than the Current Market Price.

- Debt Rejection, and Un Pledging the Shares

Reasons that cause a decrease in demand

Here are the few reasons that cause a decrease in demand

- Negative news about the company

- Increase in debts

- Poor financial results/performance in a quarter/year, etc

- Company Buying Back the Shares at a price, Lower than the Current Market Price

- Pledging the Shares

Leave a Reply