Borosil Renewables Ltd – Case Study and Detailed Analysis

Borosil Renewables Ltd. is a subsidiary of Borosil Group and is the leading player in the manufacturing of Solar glass used in solar panels. Its share price has increased from Rs 33 (June 2020) to Rs 270 (as of date). Mind Boggling right?

Let’s try to see why it happened as there must be a strong reason behind this rally.

Table of Contents

Background of Borosil Renewables Ltd

- It is a subsidiary of Borosil Group popular for its kitchenware glass products.

- The company started venturing into solar glass manufacturing in 2010 and turned profitable in 2016.

- The initial 6 years were not easy at all as they faced stiff competition from china due to the dumping off their cheap products.

Solar Industry: Overview And Future Growth

- Total installed power generation capacity in India(as in Jan 21) = 382 GW. Renewables form around 25% = 94 GW .Solar power = 40 GW about 40% of the renewable capacity.

- Govt. has a target to install 100 GW of Solar Energy by 2022, which is jump of 1.5 times.

- Future Target to install 300GW of solar energy by 2030.

- Emergence of Electrical Vehicles along with viable battery storage expected to increase the demand considerably.

- Solarization of railways – 500 MW of Rooftop Generation Capacity by 2022

Recommended Brokers

| No 1 STOCKBROKER IN INDIA Zerodha Free equity & mutual fund investments | Flat ₹20 intraday and F&O trades | Rating ★★★★★ | APPLY NOW |

| GET FREE DEMAT ACCOUNT Upstox Fix brokerage of Rs. 20 per trade | Rating ★★★★ | APPLY NOW |

| GET FREE DEMAT ACCOUNT Angel Broking 0 Brokerage on Equity Delivery | Rs 20 per order for Intraday and F&O trades | Rating ★★★★★ | APPLY NOW |

Key Drivers for Solar Glass Industry

- India imposes Anti-Dumping Duty on Chinese imports since 2017

- Imposition of Countervailing Duty of 9.71% on solar glass imports from Malaysia in 2021

- Basic Customs Duty on imports of solar cells (25%) & modules (40%) and Performance Linked Incentives (PLI) scheme worth Rs. 4,500 Cr. in 2021

- Bifacial Solar glass panels are on rising demand.

Risks in Solar Glass Industry

- China and Malaysia are the leaders and govern the price of solar glass as their products are very cheap.

- Demand for Solar glass in India is at 650TPD. 60% is still met with imports (Malaysia+China)

- It’s a capital intensive industry and capacity expansion is very costly.

- 15- 18 months of time to do capacity expansion.

- China + Malaysia captures 80% of the global market share in terms of solar panel production. China has a total solar power capacity of 240GW and it added 40GW in the CY2020

Borosil Renewables Growth in Past 3 years and future capacity expansion plan

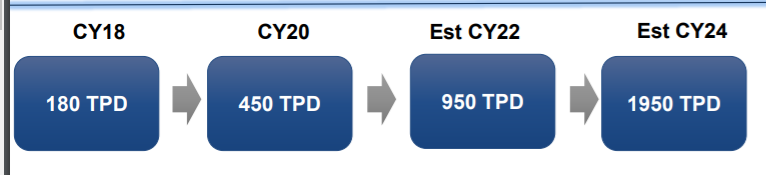

Borosil Renewables did show an excellent growth in terms of capacity expansion to keep pace with market growth.

- In 2020, rebuilt 1st furnace with enhanced capacity of 210 tons/day.

- In 2020, added 2nd furnace with 240 tons/day capacity.

- The company has started utilising 100% of their capacity

- In 2021, announced capacity addition of 500 tones/ day using 3rd furnace. The expansion will be complete by CY2022.

- Proposed capacity addition of 1000 tones/ day by adding 2 more furnaces for 2023 and 2024.

- The reason for above capacity expansion is that domestic demand for solar glass is very high and even with 100% capacity utilization supply from our side is less. The demand currently is met by imports. So once the expansion will be done, those orders can be absorbed by Borosil Renewables.

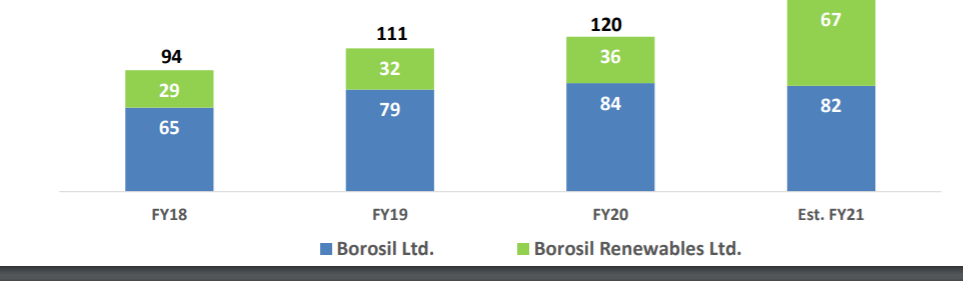

- Sales distribution and growth over the years is mentioned below. As you can see the growth borosil renewables is highly encouraging.

Why Stock price surged in the last few quarters?

As a lot of you have noticed, the stock price has increased a lot in the last few quarters. So what has supported the company’s profit. If you see the details, the Operating profit margin of the company has increased from 28% to 53% in the last 2 quarters.

The reason is the supply demand equation. As we mentioned above, China domates the solar panel industry globally, capturing almost 80% of the market. So they have the pricing power control and can determine at what price solar glass is sold.

For many years the solar glass price has been in the range of 98-100 rs/ sq meter. But in the last few months the price of solar glass has increased to 160-170 rs/ sq meter which is around 60-70% jump. This price increase benefitted Borosil Renewables as well but it looks temporary and price can stabilize from here to its original value.

What are the drivers for this sudden increase

- Chinese has announced its own program of installation of solar power, which is about 40 GW. Also the modules being used for this is Bifacial solar glass (both sides of glass in solar panel). So sudden spike of demand.

- There is a lack of supply side in china due to anti pollution measures. So some glass manufacturing plants have been shut down and due to lack of supply, prices surged to 60-70%, which looks temporary.

- The production of glass will be increased in China but it can take an year or so.

Borosil Renewables Ltd , definitely has the future to grow due to the industry dynamics and its quality products. It is also going to a higher margin business like it is a leader in production of 2mm glass whose end price is higher than 3.2 mm glass but production cost is not that high. But there are definitely risks from foreign players like China, Malaysia, Vietnam. So definitely a good company to track as the industry looks quite promising.

Leave a Reply